Coventry Building Society cuts interest rate on savings account - but it's now best easy access option

Coventry Building Society offers 5.15 per cent AER/gross (variable) via the Triple Access Saver Online (2)

|COVENTRY BUILDING SOCIETY | GETTY

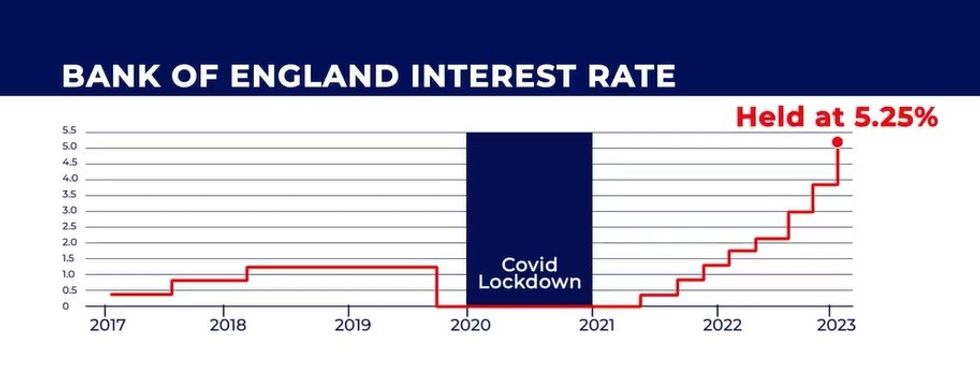

Savings providers have been withdrawing their more competitive options of late after the Bank of England ceased its consecutive base rate hikes

Don't Miss

Most Read

Coventry Building Society is currently offering the highest-paying interest rate for easy access savings, despite a recent cut to the rate.

The Triple Access Saver (Online) (2) pays 5.15 per cent AER/gross (variable) on deposits starting from £1, up to £250,000.

The building society launched the first Issue of the Triple Access Saver (Online) in September last year with an interest rate of 5.2 per cent, and the latest Issue is believed to have been launched last month.

There is a limit on withdrawals with this account - savers can only take money out of the account up to three times each year without facing a charge.

The Bank of England has held the base rate at 5.25 per cent

|GB NEWS

Close Brothers Savings comes in just behind Coventry, according to Moneyfactscompare, with its Easy Access Account (Issue 2) paying 5.1 per cent. There aren't withdrawal limits on this account.

Ulster Bank's Loyalty Saver is an instant access account which pays a slightly higher interest rate than Coventry Building Society, at 5.2 per cent AER/gross per annum (variable).

However, this rate only applies when the saver has deposited £5,000 or more.

If the balance is less than £4,999, Ulster Bank will pay a rate of 2.25 per cent AER/gross per annum (variable).

December saw the largest month-on-month fall in average fixed savings rates in more than a decade, with an even steeper reduction in January, according to new analysis this week.

As of February 1, the average one-year fixed bond paid 4.62 per cent, down from its first of month peak at 5.44 per cent in October, money comparison website Moneyfactscompare.co.uk said.

The average one-year fixed ISA stood at 4.51 per cent, down from 5.27 per cent in October.

However, variable savings rates have remained relatively steady in recent months.

LATEST DEVELOPMENTS:

James Hyde, spokesperson at Moneyfactscompare.co.uk, said: “Average fixed savings rates fell in the Autumn for the first time in a couple of years, with swingeing reductions continuing in the following months. Meanwhile, the average easy access rate has barely shifted at all since peaking in November.

“On October 1, 2023, the average one-year fixed bond paid 2.27 per cent more than the average easy access account – in just four months the gap has narrowed to just 1.45 per cent.

“Even among the best-paying accounts, on October 1 the most lucrative one-year fixed bond paid one per cent more than the market-leading easy access account: whereas now the top-paying easy access account pays 0.04 per cent more than the best one-year fixed deal.

“It remains as essential as ever that savers shop around and switch to get the best possible return on their hard-earned cash.”