Gold price surge should be seen as ‘alarm bell’, financial analyst warns

The price of the precious metal surged 1.6 per cent on Friday

Don't Miss

Most Read

Latest

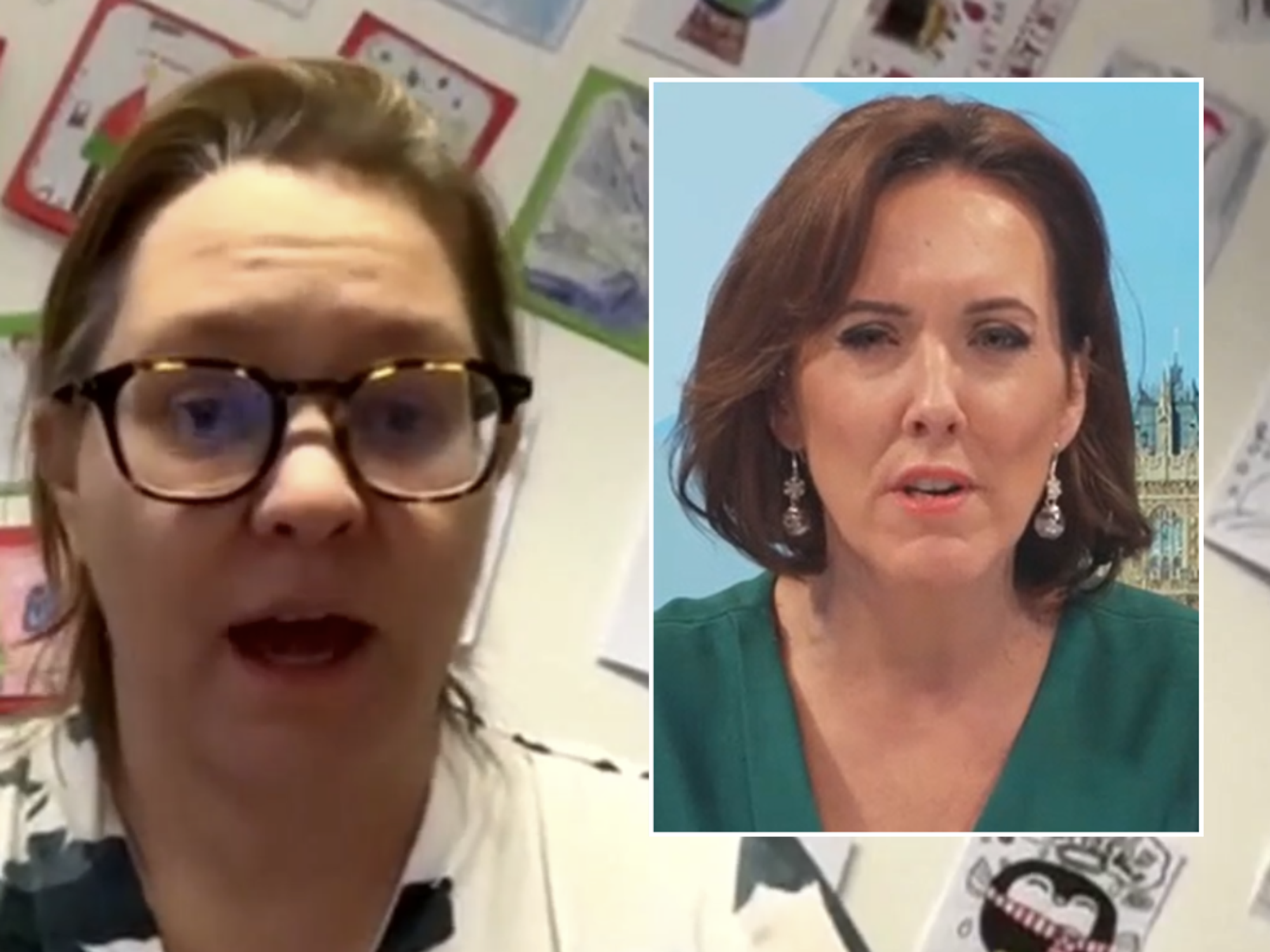

Surging prices in gold should be seen as an “alarm bell”, a veteran financial analyst has told GB News.

In a wide-ranging interview with the People’s Channel, former chairman of the Financial Planning Association, Paul Auslander, gave his prediction on the future of the precious metal before issuing a warning over its perceived value.

At time of writing, the price of the yellow metal has surged beyond $3,350 (£2,484) after climbing more than 1.6 per cent (£40) in a single day.

Speaking to this broadcaster, Auslander, warned the noble metal’s ballooning price “telegraphs concern” in the market.

Giving his prediction, he said: “I don't see it going much higher.

“I think gold filled in value that hadn't been expressed for many years. It was stagnant. It stayed at similar levels.

“I think gold is much like the bond market, it telegraphs concerns going forward, particularly for the stability of decision making that's going on between the World Banks, governments, etc.

“People fear something going off the rails.

Although gold has been rising in price, Auslander warned the surge should be seen as a 'concern'

|GETTY

“It's not like it used to be because of the US dollar. Now, in this conversation, you can add the fact that the US dollar is down 10 per cent, right? And gold's up. So there's a lot of interesting dynamics there.”

When asked to explain further, Auslander said: “I see the fact that it's been rising as an alarm bell.

“And I was surprised that Congress didn't recognise that alarm bell when they added to the debt as much as they did in this big, beautiful tax bill. But it is an alarm bell.

“I don't necessarily predict that it will decrease anytime soon.

Paul Auslander gave his prediction on the price of gold moving forward

|PAUL AUSLANDER

“I think that same telegraphing of a problem will continue in the sense that it will stay up, and it could continue to go up short term.”

Continuing to give his take on silver, which is quickly becoming a more widely sought-after material due to its uses in electronics, solar panels, and medical devices, Auslander said: “It's become more and more important to technology and technology implements.

“Less the way gold is a store of value, silver is more of a trading instrument.

“It’s not unlike crypto. Although silver is a real store of value, and one could argue crypto is a momentum store value.”

More From GB News