Capital gains tax rate raised to 24% in Budget shock for investors

Rumours of a capital gains tax raid were confirmed by Chancellor Rachel Reeves in her fiscal statement

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves has confirmed a significant increase in capital gains tax (CGT) rates for shares and other assets in her Budget today.

The main rate of CGT, which covers shares and various assets, will rise by several percentage points from its current 10 per cent and 20 per cent levels to 20 per cent to 24 per cent for those basic and higher rate taxpayers, respectively.

However, the Chancellor has opted to maintain the existing rates for residential property at 18 per cent and 28 per cent.

The levy is a tax on the profit when you sell, or dispose, of something an that has increased in value. The gain someone makes is taxed, not the amount of money they get.

Assets include the majority of personal possessions worth £6,000 or more, second homes, primary homes if they are let out, business assets and any shares not included in an ISA.

Prior to today, higher rate taxpayers pay CGT at a rate of 28 per cent gains from "carried interest" if they manage an investment fund and 20 per cent on gains from other chargeable assets.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Reeves confirmed the changes to rates paid on capital gains tax

|GETTY

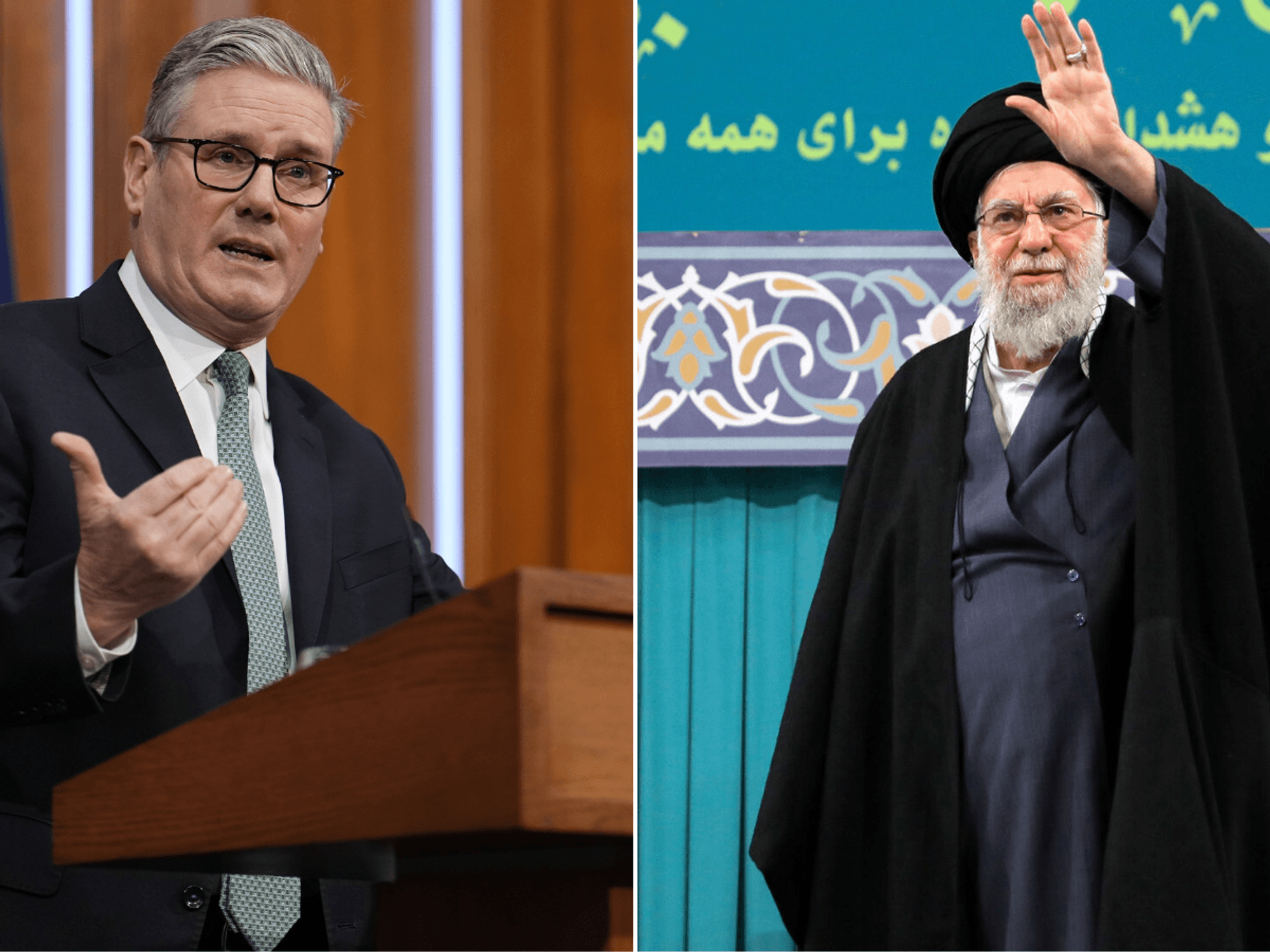

This decision follows earlier comments by Prime Minister Sir Keir Starmer, who had dismissed suggestions of a rise as high as 39 per cent as "wide of the mark".

Analysts have warned this move will impact investors and high-net-worth individuals, potentially altering investment strategies across the UK.

Reactions to the CGT changes have been mixed. A coalition of 500 British entrepreneurs previously urged against the rise in an open letter to the Chancellor.

They argue it could lower tax revenue and jeopardise the UK's startup ecosystem.

Andrew Noble, a partner at Par Equity, warned that the hike to CGT "runs in direct contradiction to Labour's previous pro-business messaging.

He explained: "This will have a greater impact on regional innovation in the North as current and future entrepreneurs weigh up the most attractive destinations to start and scale their businesses in the next 10-15 years.

"As a venture capitalist focused on the North of the UK, we know that many entrepreneurs start businesses in the North because of its position of strength and innovation, following a successful career in London and further afield.

"This group of entrepreneurs is highly mobile and also have the option to relocate overseas. Indeed, a recent survey of 500 business founders found that as much as 72 per cent are now looking to move abroad to countries with more favourable economic structures."

LATEST DEVELOPMENTS:

Reeves has outlined major changes to capital gains tax

| PA MediaAndy Aitken, the CEO and co-founder of Honest, added: "The way these CGT changes are being communicated feels pretty unethical and doesn’t reflect well on the UK’s political landscape.

"No serious business would get away with making weeks of misleading statements to ‘soften the blow’ of a now 'smaller' change.

"The Government has to hope that people will still believe in the risk-reward balance and invest, expecting to sell for significantly more in a few years' time.