Best savings accounts of the week: Full list of the ‘top’ interest rates on offer

Savings interest rates have been on the rise over the last two years

Don't Miss

Most Read

Latest

Experts are sharing the best savings accounts offering high interest rates for the week beginning May 1, 2024.

Britons have benefited from high savings rates thanks to the Bank of England’s decision-making but savers are being urged to grab the best deals before they disappear.

Here is a full list of the best savings accounts currently on the market, according to Moneyfactscompare:

Best easy access accounts:

- Ulster Bank - Loyalty Saver - 5.20 per cent interest rate

- Paragon Bank - Raisin UK - five per cent interest rate

- Close Brothers Savings - Easy Access Account Issue Three - five per cent interest rate

- Kent Reliance - Easy Access Account Issue 70 - 4.96 per cent interest rate.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savings interests rates continue to be high with challenger banks

|GETTY

Best fixed rate bonds:

- Al Rayan Bank - Raisin UK One Year Fixed Term Deposit - 5.20 per cent interest rate

- Al Rayan Bank - 12 Month Fixed Term Deposit - 5.20 per cent interest rate

- RCI Bank - Two Year Fixed Term Savings Account - 5.05 per cent interest rate

- Birmingham Bank - Three Year Fixed Rate Bond Issue Five - 4.73 per cent interest rate

- Shawbrook Bank - Five Year Fixed Rate Bond Issue 49 - 4.57 per cent interest rate.

Best notice accounts:

- First Save - FirstSave 30 Day Notice Account (Feb24) - 4.85 per cent interest rate

- Shawbrook Bank - 45 Day Notice Personal Account Issue 14 - 5.16 per cent interest rate

- Investec Bank plc - 90-Day Notice Saver - 5.25 per cent interest rate.

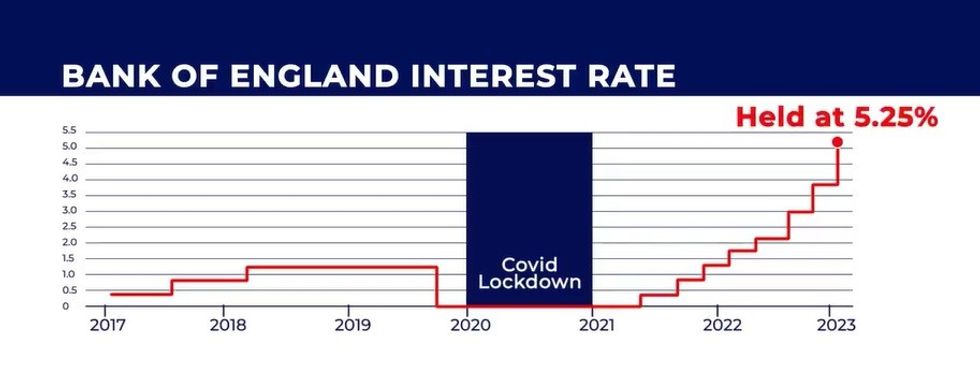

Yesterday, the Bank of England’s Monetary Policy Committee (MPC) voted to keep interest rates at a 16-year high of 5.25 per cent.

The central bank has held the UK’s base rate at this level since August 2023 with a cut expected to take place in the later half of the year.

Some experts are betting on the Bank slashing rates as soon as next month in a boon for borrowers.

However, this will likely result in banks withdrawing high interest accounts from the market in a blow to savers.

LATEST DEVELOPMENTS:

The Bank of England has held the base rate at 5.25 per cent in recent months | GB NEWS

The Bank of England has held the base rate at 5.25 per cent in recent months | GB NEWSFurthermore, experts are urging to savers to take advantage of the tax-free allowance provided through ISASs. Rachel Springall, finance expert at Moneyfacts, noted that high street banks and building societies

Springall said: “Challenger banks and building societies continue to offer the top easy access rates, so savers would be wise to review their account and switch if their loyalty is not being rewarded.

“One area of the market to thrive over recent months has been Cash ISAs; easy access returns have fallen recently, but unlike accounts outside of an ISA wrapper, they are higher than they were six months ago.

“A positive ISA season has been the key to improving accounts for savers this year, ideal for those looking to protect their cash from tax.