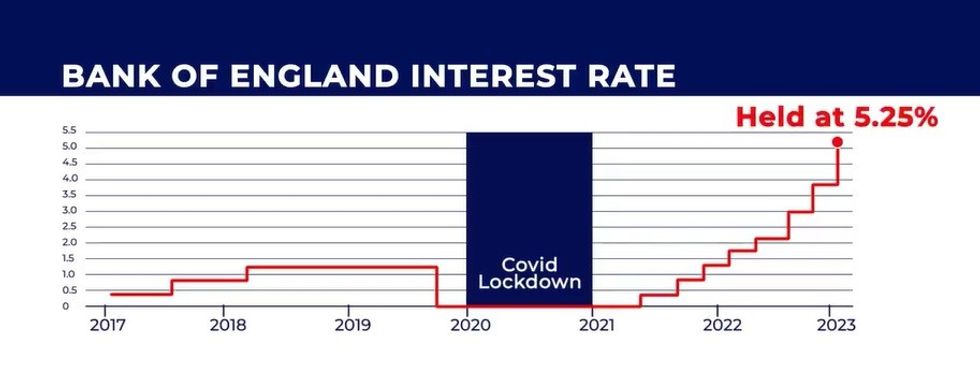

Bank of England votes to hold interest rates at 16-year high: ‘Groundhog day for Britons!’

Millions of Britons have been impacted by the Bank of England’s decision to raise and keep the country’s base rate at 5.25 per cent

Don't Miss

Most Read

The Bank of England has confirmed interest rates will be kept at 5.25 per cent for the sixth consecutive time.

Earlier today, the central bank’s Monetary Policy Committee (MPC) voted to hold the base rate at a 16-year-high.

During today's meeting, the MPC voted by a majority of seven-to-two to hold the base rat at 5.25 per cent.

The two dissenting members preferred to reduce interest rates by 0.25 percentage points, to five per cent.

Based on the Bank's May report, inflation is forecast to be 1.9 per cent in two years' time and 1.6 per cent in three years time.

As part of its announcement, the Bank of England cited its two per cent inflation target "applies at all times".

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Bank of England has held the base rate at 5.25 per cent in recent months | GB NEWS

The Bank of England has held the base rate at 5.25 per cent in recent months | GB NEWSDespite rates being held at a 16-year high, Bank of England governor Andrew Bailey signalled that interest rate cuts are on their way.

Bailey said: “We’ve had encouraging news on inflation and we think it will fall close to our 2% target in the next couple of months.

“We need to see more evidence that inflation will stay low before we can cut interest rates. I’m optimistic that things are moving in the right direction.”

Overall, the MPC indicated it was looking for greater progress on many factors, including services inflation and wage growth, before slashing the base rate.

Interest rates have been raised by the Bank as it attempts to bring the Consumer Price Index (CPI) rate of inflation down to two per cent.

Despite inflation easing to 3.2 per cent, members of the MPC remain hesitant to announce interest rate cuts until the CPI rate falls further.

The decision to hold the base rate at 5.25 per cent for at least another month has been slammed as “Groundhog Day” for millions across the country.

While savers have benefited from high interest rates, it has been a costly decision for mortgage holders and debt borrowers.

Lily Megson, Policy Director at My Pension Expert, explained: “While high interest rates are often touted as good news for savers, the harsh reality is that an unchanged base rate feels like Groundhog Day for Britons.

“Indeed, the hold comes hand-in-hand with the ongoing burden of sticky inflation and the weighty cost of borrowing.

LATEST DEVELOPMENTS:

Interest rate hikes from the Bank of England have impacted savers and homeowners in different ways

| GETTY“For some savvy savers, there is a silver lining to continued higher rates – namely, strong returns on fixed-term products like annuities. Yet in truth, inflation has not fallen quickly enough, with millions struggling to save for long-term goals such as retirement.

“People should not be left to weather this storm alone, as the Government has a critical role to play in ensuring access to independent financial advice and guidance for all.”

Inflation is projected to drop under the Bank of England's target between April and June, but is estimated to jump again to 2.6 per cent in the second half of this year due to the impact of energy bills.

Over the longer term, the Bank of England has lowered its forecast for CPI inflation to 2.25 per cent next year and 1.5 per cent in 2026.