Revealed: 75% of Britons wrongly believe they still own their savings after depositing it in the bank

A new survey has found many Britons wrongly believe they still own their bank deposits, as inflation and low interest erode trust in traditional savings

Don't Miss

Most Read

British savers are increasingly losing trust in banks, with new research revealing that many are unaware of a crucial legal detail.

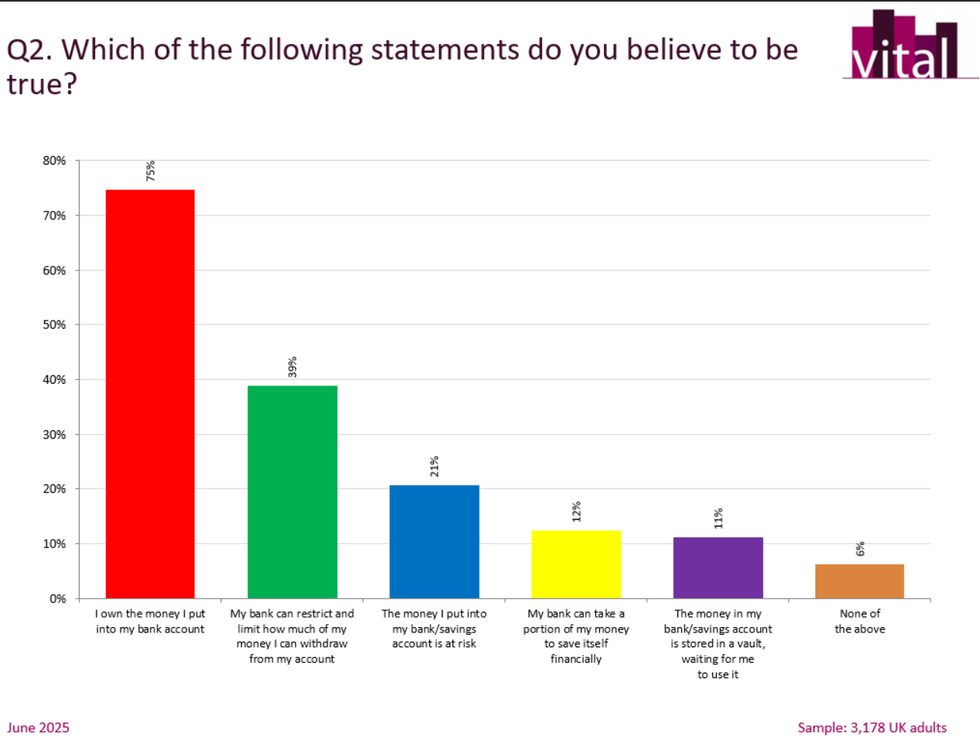

The study, commissioned by gold-based savings platform TallyMoney, found that around 75 per cent of people believe they still own their money once it’s deposited, but in reality, banks become the legal owners.

Over half (52 per cent) of Britons believe banks lack transparency about what happens to their deposits, research showed.

This lack of consumer confidence comes amid stubborn inflation and persistently low interest rates, both of which continue to erode the value of traditional savings.

Many respondents admitted to confusion and concern about the safety of their funds, with more than one in five now considering storing cash at home rather than using a bank.

At the heart of this unease is a widespread legal misunderstanding. Around 75 per cent believe they still own their money once it’s deposited, but in reality, banks become the legal owners.

In exchange, savers receive a promise - an IOU - that the bank will return their money upon request. However, the bank is not required to hold the full amount in reserve.

Despite this, three-quarters of people surveyed still believed their money remained theirs after depositing it.

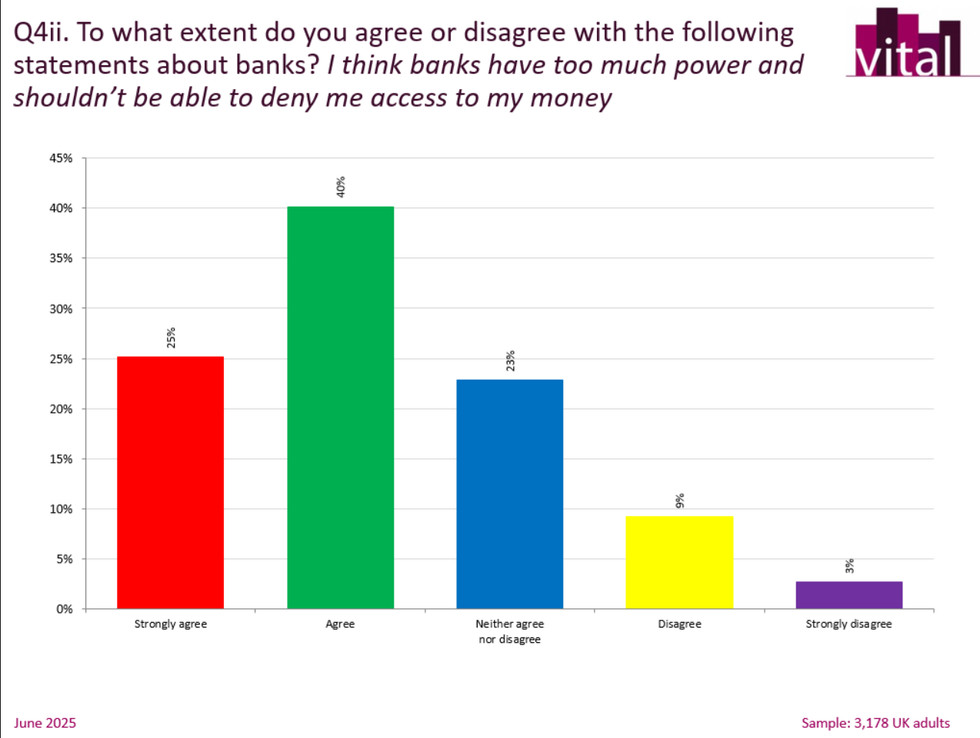

This misconception fuels a sense of mistrust, especially given current economic pressures. Two-thirds of respondents said banks have too much control over their personal funds and should not be able to restrict access to them, though legally, they can.

Around 75% of Britons wrongly believe they still own their savings after depositing it in the bank

|TALLYMONEY/GBNEWS

In response, savers are increasingly exploring alternatives that offer more transparency and control. TallyMoney, for example, allows users to store savings in physical gold that remains legally theirs. Through a mobile app and debit card, customers can access and spend their gold as everyday money, combining traditional security with modern convenience.

Gold continues to appeal as ongoing safety and as a long-term store of value. According to TallyMoney, it has delivered average annual returns of over 11 per cent since 2000 and has risen by 60 per cent in the past two years.

That means £10,000 saved in gold in mid-2023 would now be worth £16,000 - a performance far exceeding that of typical high street savings accounts.

In response, savers are increasingly exploring alternatives that offer more transparency and contro

|TALLY MONEY/GBNEWS

Cameron Parry, TallyMoney’s Founder & CEO, said: "The lack of transparency and misunderstanding of how banks handle people’s deposits, as demonstrated in this research, reflects the disconnect between what people think the financial establishment provides and what the individual actually gets.

"Gold is great, but in addition, we need a system of sound money that protects and benefits depositors and savers, not the banks. That’s why we built TallyMoney."

The growing popularity of platforms like TallyMoney reflects a wider shift in consumer sentiment. Disillusioned by low returns, hidden fees, and inflationary erosion, many savers are seeking tangible alternatives that offer autonomy and stability.

Over the past six months, the price of gold has gone up over 30 per cent peaking above $3,500 in April 2025.

Much of this volatility has mirrored the uncertainty surrounding Donald Trump's trade policies, particularly the announcement of his 'Liberation Day' tariffs. A key driver of the rally in recent months has been global economic uncertainty and fears of further inflation.

While many traditional savers still view bank deposits as the safest option, rising interest in gold and gold-backed platforms signals a broader shift in attitudes toward money and value.

Central banks have been reinforcing this trend. In 2024, they bought over 1,000 tonnes of gold for the third year running. According to the World Gold Council, a further 20 tonnes were added in May alone, showing consistent demand despite slightly lower volumes than late 2023.

Rising interest in gold and gold-backed platforms signals a broader shift in attitudes toward money and value

| GETTY"Gold remains a focus for central banks worldwide," said Marissa Sali, senior research lead for APAC at the World Gold Council. A recent survey found 95 per cent of central bankers expect global gold reserves to rise this year, with 43 per cent anticipating an increase in their own country’s holdings.

Parry added: "Our research shows the public’s increasing distrust in Government-issued currency and the establishment banking system.

"And if we can't trust the Government to control our money, then we need to use a money that’s not controlled by the Government."