Rachel Reeves has 'no credible plan' for the economy as borrowing costs soar, warns ex-OBR official

Labour's history of economic woes and recessions |

GBNEWS

The expert warned that the Chancellor’s policies will fail to halt the rise in UK borrowing costs

Don't Miss

Most Read

Rachel Reeves has come under fire from one of Britain’s most respected economists, who says she has no credible plan to grow the economy or get debt under control.

Sir Charlie Bean, a former senior figure at both the Office for Budget Responsibility and the Bank of England, warned he did not believe the Chancellor’s policies could reverse the sharp rise in UK borrowing costs.

It comes as experts predict Ms Reeves will need to raise at least £30billion in extra taxes at her November Budget to plug a growing hole in the nation’s finances, a gap partly created by her own costly U-turns.

Sir Charlie's critique emerged through his response to a Centre for Macroeconomics survey. He argued that the government "does not really seem to have a clear, coherent and credible plan for fiscal and economic policies".

His primary concern centres on the sustainability of government finances.

He warned: "With debt interest already exceeding £100bn and not far short of 10 per cent of government spending, the Government really cannot afford to see yields on its debt rise substantially more."

The economist emphasised that preserving market confidence in the government's fiscal strategy remains essential.

He noted that maintaining trust among market participants regarding the sustainability of fiscal plans is crucial.

Economists have cautioned that the Chancellor must secure a minimum of £30billion through tax increases to achieve fiscal balance in her November Budget.

This challenging position stems partially from expensive policy reversals that undermined her carefully constructed financial framework.

LATEST DEVELOPMENTS:

Rachel Reeves has no 'credible plan' for the economy as borrowing costs soar, warns ex-OBR official |

Rachel Reeves has no 'credible plan' for the economy as borrowing costs soar, warns ex-OBR official | GETTY

The Chancellor aims to rebuild her economic strategy and reinstate £9.9billion of fiscal headroom to meet her budgetary targets.

This restoration effort seeks to demonstrate to both voters and financial markets that a coherent economic plan exists.

Yet Sir Charlie dismissed the significance of merely recovering this minimal buffer. He suggested that restoring such narrow headroom matters less than establishing comprehensive and believable economic policies.

The economist emphasised that preserving market confidence in the government's fiscal strategy remains essential

| PAGovernment bond yields have climbed from approximately 4.2 per cent before Labour's initial Budget to over 4.7 per cent currently.

Sir Charlie attributed this increase partly to elevated UK inflation, which he linked to the Chancellor's national insurance changes.

He also criticised broader governmental failures, stating: "Further out, I would place more of the blame on the unwillingness of successive UK governments to recognise the realities of the country's economic and fiscal position and their consequent inability to push through an effective policy response."

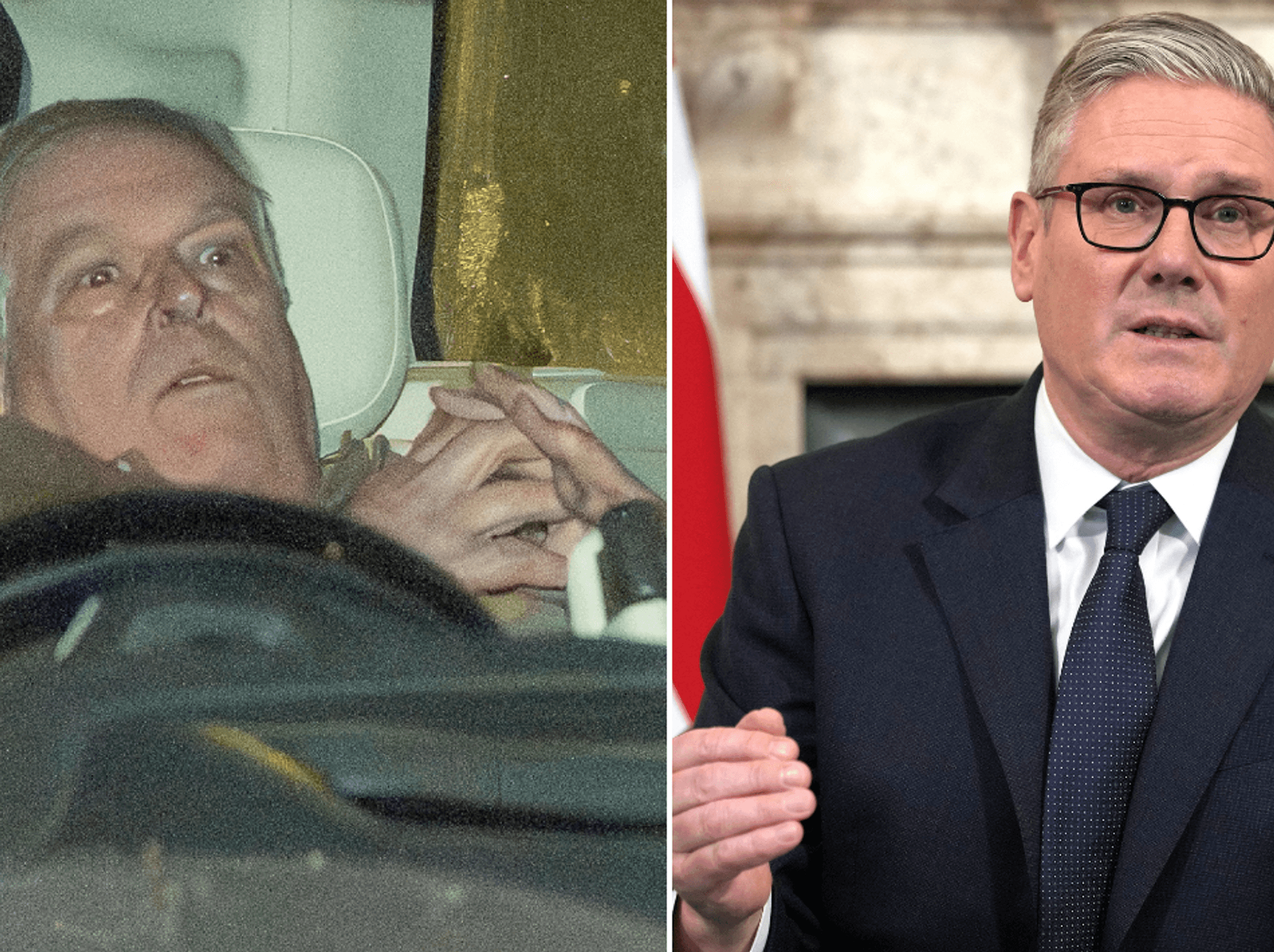

Chancellor Rachel Reeves is confronting mounting fiscal pressures | POOL

Chancellor Rachel Reeves is confronting mounting fiscal pressures | POOL Sir Charlie brings exceptional authority to his assessment, having received a knighthood in 2014 for contributions to monetary policy and central banking following a 14-year tenure at the Bank of England.

He subsequently served as an executive member of the OBR from 2017 to 2021. His primary concern centres on the sustainability of government finances.

A Treasury spokesperson defended the government's approach, asserting: "The Chancellor is focused on making the UK the best place for businesses to invest and attracting the most innovative companies to start, scale, list and stay here."

More From GB News