Bank of England warning: Stock market at risk of crash as overvalued AI could cause 'sharp correction'

'The bond markets are applying what they call the moron premium to the UK economy.' |

GB NEWS

The central bank is sounding the alarm over the market valuation of AI firms being 'over stretched'

Don't Miss

Most Read

The Bank of England has issued a stark warning that financial markets are due a "sharp correction", similar to the dot-com bubble during the late 1990s, due to artificial intelligence (AI) being overhauled.

Tech companies are increasingly vulnerable to the risk that soaring valuations will drop sharply amid potentially “disappointing” progress around AI, according to the central bank.

The Financial Policy Committee (FCA) at Threadneedle Street expressed alarm that dangers of a swift and substantial market adjustment have grown.

The committee stated: "On a number of measures, equity market valuations appear stretched, particularly for technology companies focused on artificial intelligence (AI)."

The Bank of England has issued a warning

|GETTY

Officials highlighted how this situation, coupled with growing dominance of certain firms within stock indices, creates vulnerability should investor sentiment towards AI's potential turn negative.

The committee identified multiple factors that could trigger a reassessment of AI company valuations. Progress falling short of expectations in AI development or implementation might lead to reduced profit forecasts for the sector.

The FPC warned: "Material bottlenecks to AI progress from power, data, or commodity supply chains as well as conceptual breakthroughs which change the anticipated AI infrastructure requirements for the development and utilisation of powerful AI models could also harm valuations."

Infrastructure constraints, including energy availability and data access, represent significant obstacles. Revolutionary advances that alter the fundamental requirements for AI systems could equally undermine current market positions.

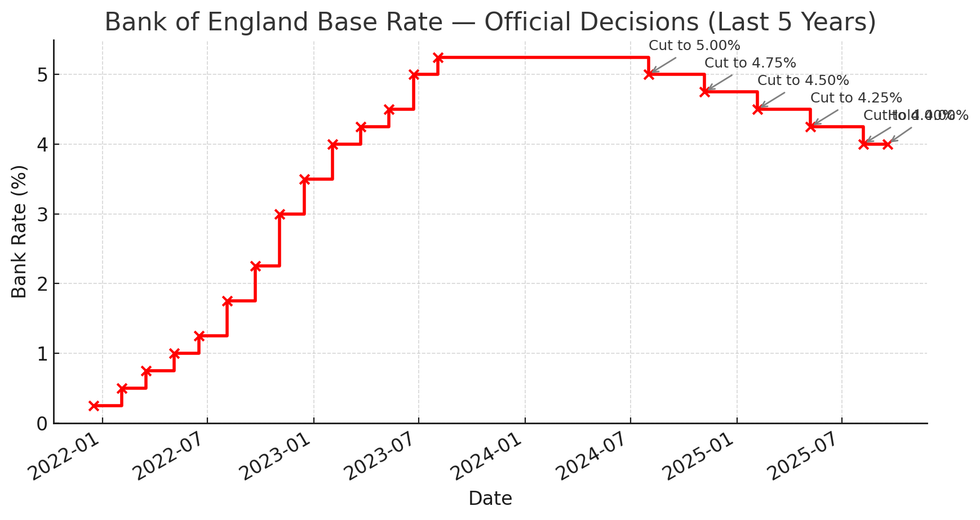

How has the base rate changed in recent years? | CHAT GPT

How has the base rate changed in recent years? | CHAT GPT Threadneedle Street expressed particular unease about potential threats to the Federal Reserve's autonomy under President Donald Trump's administration.

Mr Trump has sought to oust the Federal Reserve’s governor Lisa Cook over allegations she committed mortgage fraud when purchasing a home in 2021, but a judge ruled that the firing was illegal.

He has also repeatedly demanded that the Fed, led by chairman Jerome Powell, reduce its key interest rate.

Similar to the Bank of England, the Fed operates independently of the Government which means it can set the cost of borrowing without political interference.

The committee emphasised that central bank independence forms the foundation of both monetary and financial stability.

"A sudden or significant change in perceptions of Federal Reserve credibility could result in a sharp re-pricing of US dollar assets, including in US sovereign debt markets, with the potential for increased volatility and global spillovers," the FPC cautioned.

Such a credibility crisis could trigger widespread turbulence across international markets.

American government bonds would face particular pressure, potentially destabilising financial systems beyond US borders.

LATEST DEVELOPMENTS:

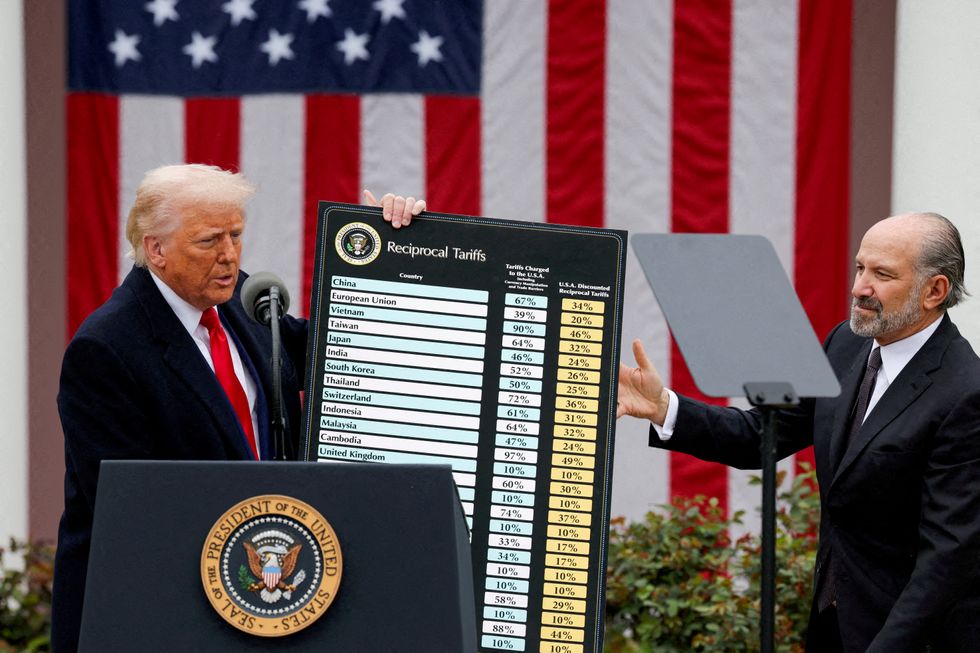

The legal to-and-fro affects Trump's 'Liberation Day' tariffs on imports from most US trading partners | REUTERS

The legal to-and-fro affects Trump's 'Liberation Day' tariffs on imports from most US trading partners | REUTERSThe committee noted that consequences from President Trump's protectionist policies remain incomplete.

Trade tariff uncertainties continue to threaten global economic stability.

International political tensions persist at heightened levels, according to the FPC's assessment.

Military conflicts have sparked anxieties about energy security, though petroleum and maritime transport costs have moderated compared to the committee's previous gathering.

More From GB News