Mortgage market contracts AGAIN amid economic uncertainty as households 'remain squeezed'

Mortgages Richard Blanco |

GB News

Bank of England data shows borrowing slowed in August

Don't Miss

Most Read

Britain's mortgage market experienced another month of contraction as lending figures released this morning revealed a further weakening in borrowing activity.

The Bank of England's latest data showed net mortgage debt taken on by individuals dropped to £4.3billion during August.

This represents a £200million reduction from July's figure, which itself had fallen by £900million from the previous month.

The persistent downward trajectory in mortgage lending underscores the mounting pressures facing British households amid an uncertain economic landscape.

TRENDING

Stories

Videos

Your Say

House purchase approvals also retreated, with lenders granting 64,700 mortgages for property acquisitions in August, down by 500 from the prior month.

The figures paint a sobering picture of a housing market grappling with multiple headwinds.

The Bank of England's comprehensive Money and Credit statistical release disclosed additional weakness across the lending landscape.

Remortgaging activity similarly contracted, with approvals falling by 900 to reach 37,900 in August.

Britain’s mortgage market contracted again this month, with newly released lending figures pointing to a continued decline in borrowing activity

|GETTY

Consumer credit lending remained static at £1.7billion, though the composition shifted marginally.

Credit card borrowing edged down to £700million from July's £800million, whilst other consumer credit forms rose modestly to £1billion.

The data revealed divergent patterns in business lending, with larger corporations increasing their borrowing at an annual rate of 8.6 per cent, up from 8.1 per cent.

Small and medium enterprises saw their borrowing growth reach 1.2 per cent annually, marking the strongest expansion since August 2021.

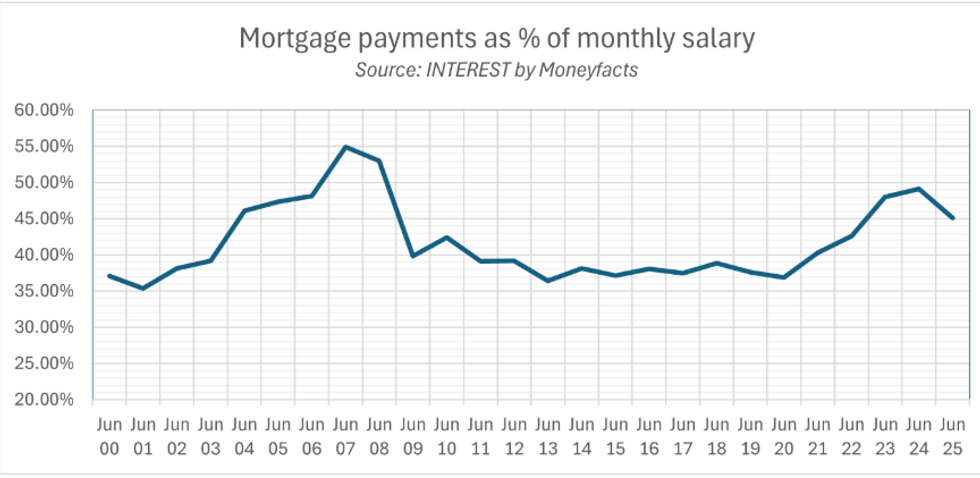

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTSFinancial services expert Richard Pinch from Broadstone consultancy offered a stark assessment of the lending downturn.

"Mortgage borrowing decreased again in August reflecting the continued economic uncertainty lingering over the UK in spite of the most recent rate cut from the Bank of England," he said.

The senior risk director highlighted that persistent inflationary pressures continue to weigh on market sentiment.

"Inflation concerns remain persistent and with another tax-raising Budget looking inevitable at the end of November, household budgets remain squeezed," Mr Pinch added.

His analysis suggests the current malaise in mortgage activity stems from a combination of economic headwinds that show little sign of abating.

The expert's commentary underscores how even monetary policy easing has failed to stimulate borrowing appetite amongst cautious British households. The looming autumn Budget casts a particularly dark shadow over household financial planning.

With Chancellor Rachel Reeves widely expected to implement substantial tax increases at the end of November, prospective homebuyers face an increasingly challenging environment.

The prospect of higher taxation compounds existing affordability constraints, potentially pushing homeownership further beyond reach for many British families.

LATEST DEVELOPMENTS:

Chancellor Rachel Reeves is widely expected to implement substantial tax increases in the budget

| BBCThis fiscal uncertainty appears to be prompting a wait-and-see approach amongst potential borrowers. Market participants anticipate that increased tax burdens will further erode disposable incomes already diminished by elevated living costs.

Such conditions create a perfect storm for mortgage demand, with households prioritising financial resilience over property purchases. Looking ahead, the mortgage market appears set for continued stagnation as Britain moves towards 2026.

Mr Pinch's prognosis offers little comfort for aspiring homeowners: "Until there is more certainty in the market or a significant improvement in borrowing conditions, mortgage volumes are likely to remain depressed as we head into 2026."

This forecast suggests months of subdued activity lie ahead for Britain's property sector.

More From GB News