Rachel Reeves slammed as British drivers face new £3,100 car tax hike - 'Difficult to stomach'

WATCH: Rachel Reeves announces new car tax changes launching in April 2025

|GB NEWS

'The removal of tax incentives, such as applying VED to EVs, also takes away incentives for buyers to make the switch'

Don't Miss

Most Read

Latest

An expert has slammed new car tax changes, describing them as a "difficult one to stomach for motorists" as they could face thousands of pounds in extra charges.

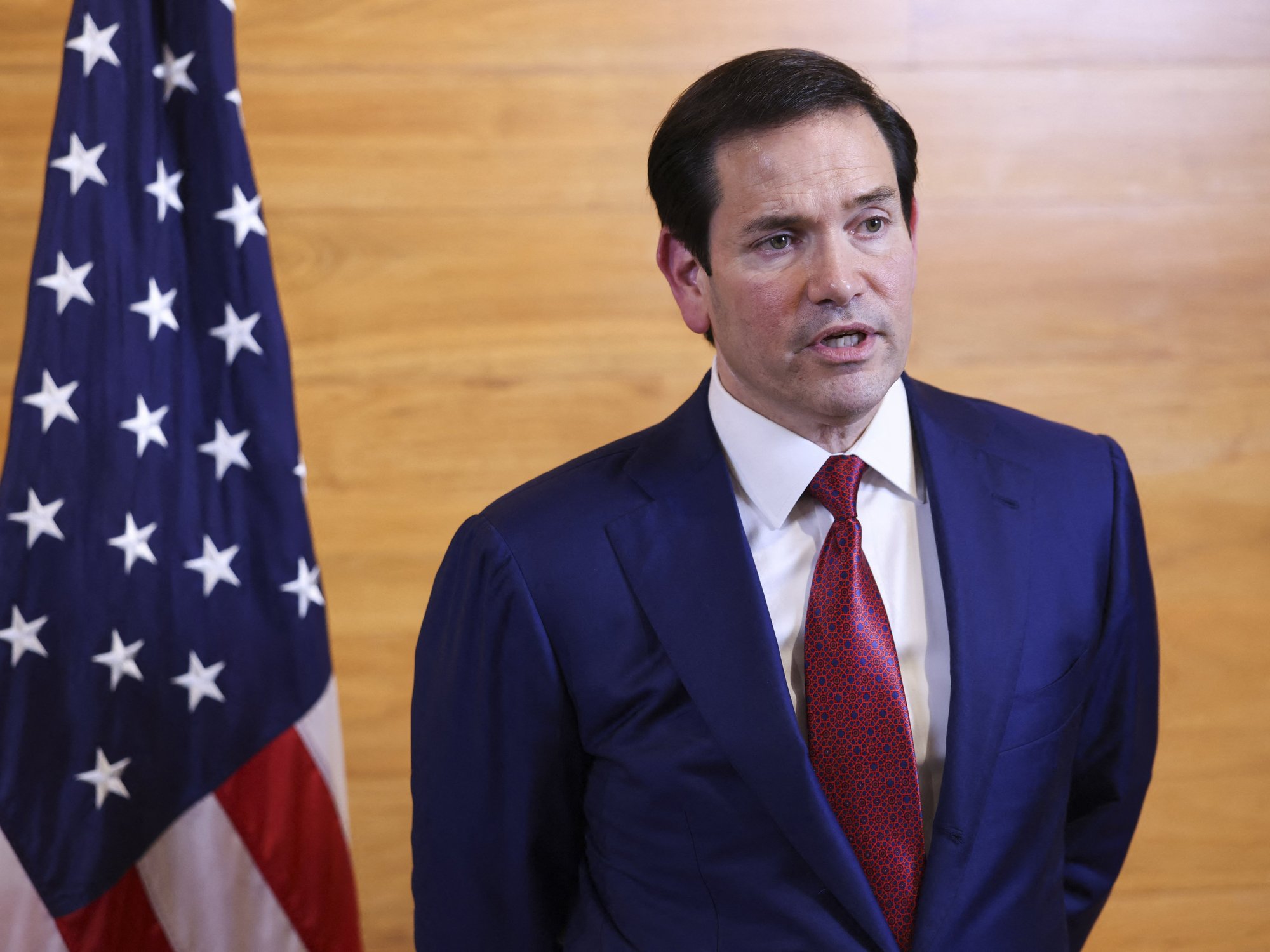

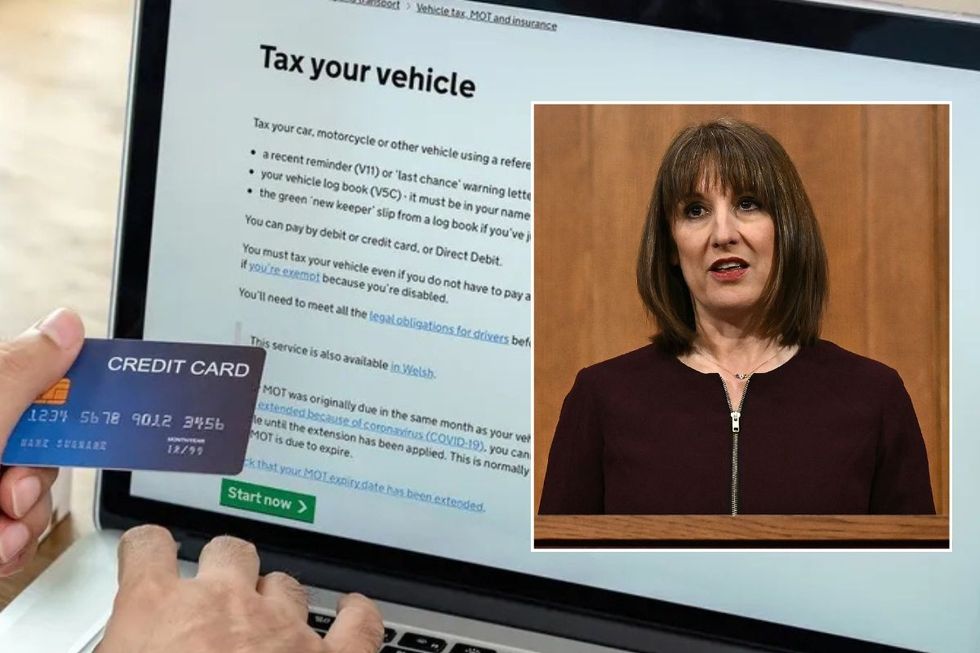

After April 1, 2025, electric car drivers are now required to pay Vehicle Excise Duty, with Chancellor Rachel Reeves confirming the measure and outlining further changes in last October's Autumn Budget.

The tax change was originally announced by former Conservative Chancellor Jeremy Hunt, who said it would ensure a fairer system of taxation.

Any new cars registered after April 1, 2025, will have to pay a standard first year rate of £10 before moving to the standard rate of £195.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

Chancellor Rachel Reeves oversaw new car tax changes at the start of April

|GETTY

However, electric vehicle owners are now also required to pay the Expensive Car Supplement (ECS) if their vehicle costs more than £40,000.

If an EV has a list price above this threshold, owners will need to pay £425 a year for five years. In total, this could cost £3,100 when including the standard rate for five years.

The so-called "luxury car tax" has been in place since 2017, although the threshold has not risen in line with RPI inflation, prompting experts to call for additional law changes.

In recent years, many have suggested that the price could be hiked to £50,000, warning that motorists could be deterred from investing in an electric car if they are slapped with thousands of pounds in extra car tax costs.

John Cassidy, managing director of Sales at Close Brothers Motor Finance, warned the Government that it could face issues in boosting EV adoption without helping drivers.

He added: "While it's encouraging that drivers have more choice around electric vehicle models, and that there are definitive signs that EV technology is improving, private demand is still not where it needs to be.

"The initial costs of EVs, poor charging infrastructure and concerns over electricity bills put prospective buyers off."

The latest data from the Society of Motor Manufacturers (SMMT) shows that electric vehicles maintained a strong market share of more than 20 per cent in April.

Following a record March where almost 70,000 battery electric cars were sold, April saw a drop in sales across the whole market, with petrol and diesel registrations falling year-on-year.

Cassidy lamented the decision to go ahead with introducing car tax charges for electric vehicles to hit drivers with additional charges.

Cassidy added: "The removal of tax incentives, such as applying VED to EVs, also takes away incentives for buyers to make the switch.

"This will also make the Government’s targets, such as the Zero Emission Vehicle (ZEV) mandate and the proposed 2030 ban on new petrol and diesel vehicles, harder to achieve."

LATEST DEVELOPMENTS:

Electric cars are now required to pay Vehicle Excise Duty | PA

Electric cars are now required to pay Vehicle Excise Duty | PAA Government spokesperson highlighted how a record 382,000 electric vehicles were sold last year - the highest total in Europe.

It added: "There are also more than 75,000 public chargepoints now available in the UK, with a new one installed every 29 minutes.

"We're investing over £2.3billion to support industry and consumers make the switch, tapping into a multibillion-pound industry that will create high paid jobs for decades to come, make the UK a clean energy superpower and help deliver our Plan for Change."