Rachel Reeves blamed for record number of car returns after 'misguided' Budget hit on working class

'We have seen record levels of returned vehicles due to redundancies of working people'

Don't Miss

Most Read

Experts have blamed Chancellor Rachel Reeves for record levels of vehicles being returned following changes announced in the Autumn Budget.

Data shows a 43 per cent increase in returned electric or hybrid cars last month from company cars as a result of redundancies.

The dramatic increase in vehicle returns comes as employers across the UK grapple with rising costs and economic uncertainty.

The Budget changes, which took effect last month, included increasing employer's national insurance contributions from 13.8 per cent to 15 per cent.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

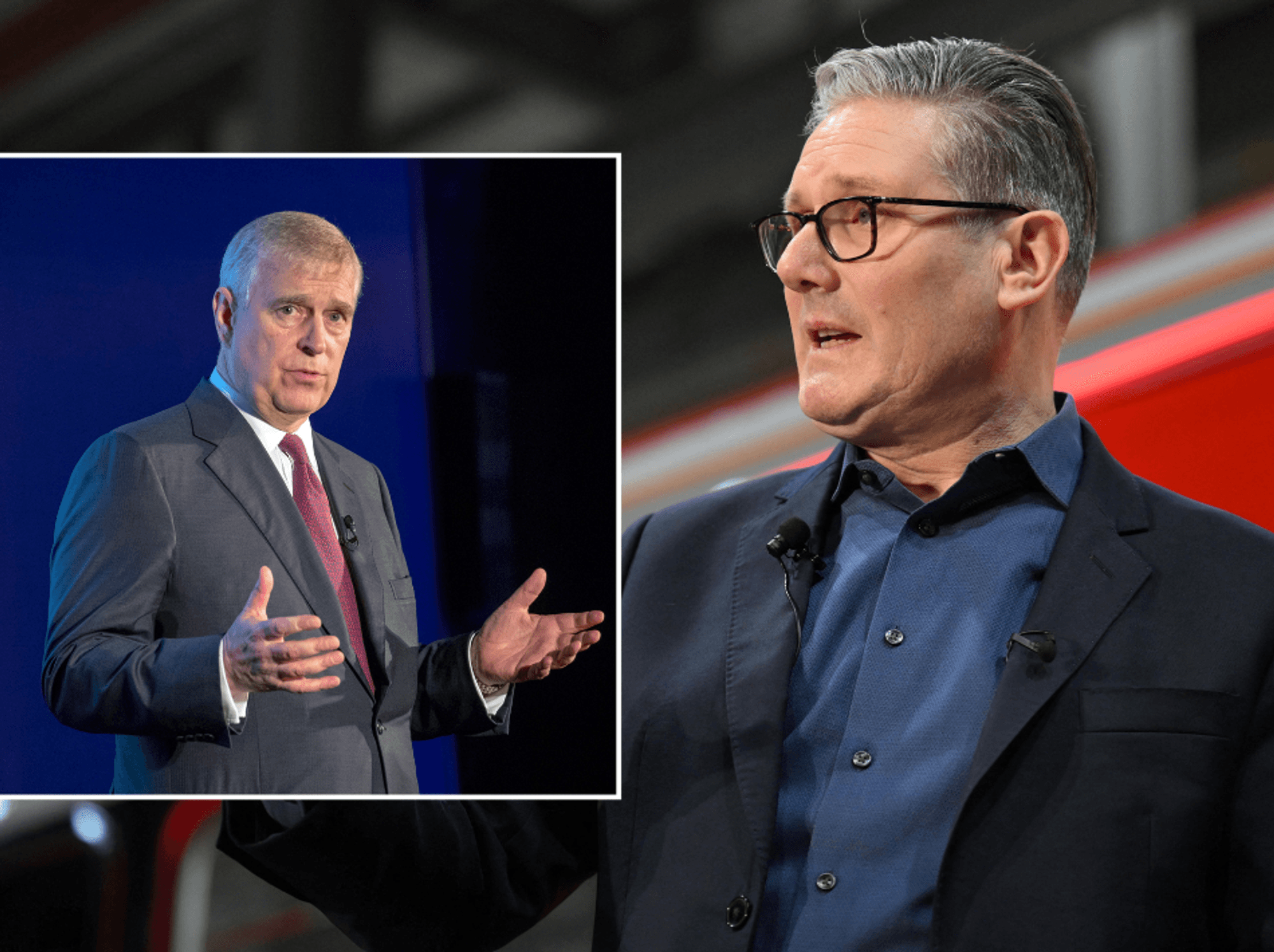

Chancellor Rachel Reeves has been blamed for company cars being returned

|GETTY/PA

The Chancellor also reduced the national insurance contribution (NIC) threshold from £9,100 to £5,000.

Additionally, the minimum wage was increased, creating a triple financial pressure on businesses.

These policy changes have forced many companies to make difficult decisions regarding their workforce.

Andrew Leech, founder of Fleet Evolution and head of Mercia Fleet Management, directly attributes this surge to the Chancellor's recent Budget decisions.

He said: "It did not take a rocket scientist to realise that far from having no effect on working people, the Budget changes would have a profound effect on recruitment and retention of employees.

"The pigeons are clearly coming home to roost. Following on from Rachel Reeves' misguided first Budget, which she said would not affect 'working people', we have seen record levels of returned vehicles due to redundancies of working people."

Leech reported that there is plenty of short-term demand for returned cars, as some companies are less willing to commit to long-term leases due to economic uncertainty.

He said short-term vehicles, especially electric cars, offer businesses a suitable option while they adjust to rising costs following the Budget.

They also benefit businesses as the zero emission vehicles can help them meet corporate sustainability targets at the same time.

During the Autumn Statement, Chancellor Rachel Reeves also outlined plans to treat double cab pick-up vehicles with a payload of more than one tonne as cars for certain tax purposes.

The changes applied for Corporation Tax from April 1, while the new rules applied to income tax, capital allowances, Benefit-in-Kind (BiK) and some deductions from business profits from April 6.

This followed a controversial Court of Appeal judgement, with some businesses and self-employed tradespeople risking paying thousands of pounds to keep their vehicles on the road.

LATEST DEVELOPMENTS:

- M25 closed: Motorists stuck in eight miles of standstill traffic as HGV collision causes fuel spillage

- DVSA under pressure as UK's driving test backlog hits 600,000 - 'It should not be this hard!'

- Petrol and diesel car owners risk £2,000 engine repair cost as mechanic urges Britons to take 'first step'

The Ford Ranger Wildtrak is one of the most popular double cab pick-up trucks | FORD

The Ford Ranger Wildtrak is one of the most popular double cab pick-up trucks | FORDAnyone who purchased, leased or ordered a double cab pick-up truck before April 6 will benefit from transitional arrangements for BiK tax.

They will be able to use the previous tax rules until they dispose of the vehicle, the lease ends, or April 5, 2029.