Drivers call for ‘clear signalling’ on car tax hikes amid General Election mayhem

The salary sacrifice tax system penalising higher polluting vehicles through far higher rates

| GETTY

In the 2022 Autumn Statement benefit in kind tax increases were announced lasting until 2028

Don't Miss

Most Read

Experts have called for an extension of the company car benefit in kind (BiK) taxation tables which gives drivers clarity on how much they will be charged.

BiK taxes are paid by employees in the form of a salary sacrifice for being able to use a company car and is deducted from payslips every month.

The tax is based on the emissions output of the vehicle, with the tax system penalising higher polluting vehicles through far higher rates.

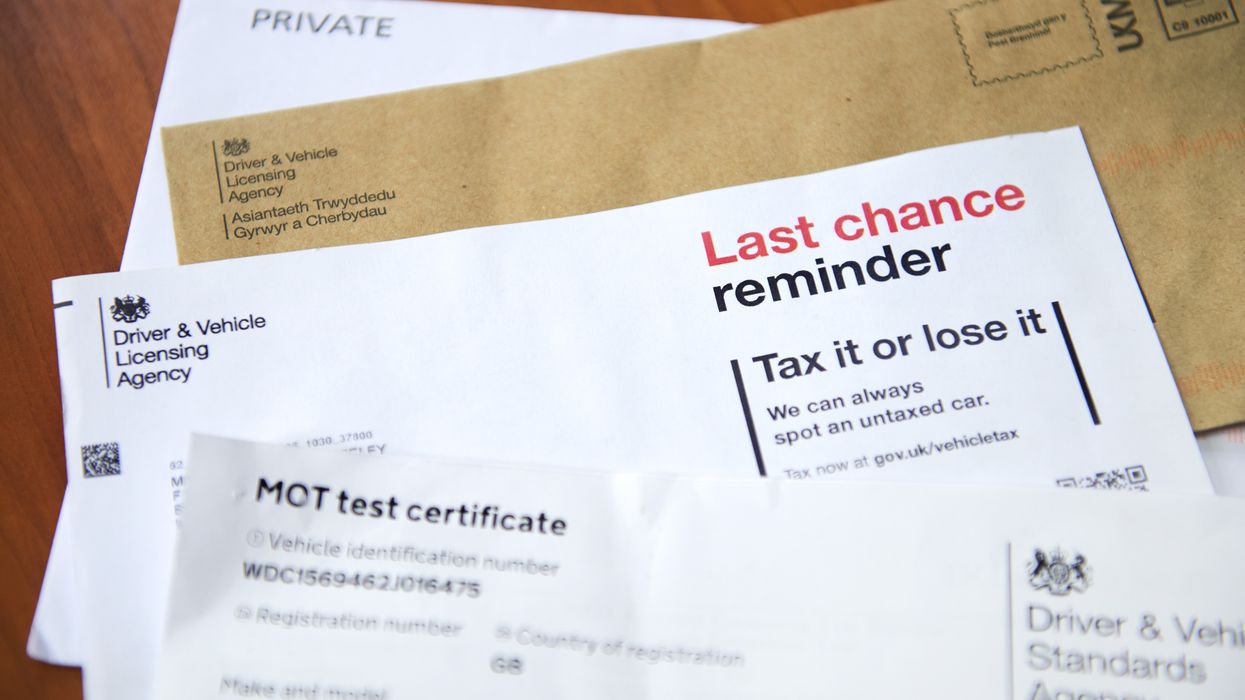

The rate at which vehicles are taxed is stated clearly by the Government in a table but they only run until the 2027/28 tax year.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

BiK tax table will run until 2028

| GETTYNow, as election manifestos roll out, the Association of Fleet Professionals has called for greater clarity on what the tax bracket will be for drivers.

Paul Hollick, chair of the organisation explained that there has been something of a “structural change” in recent years.

This has meant businesses have started operating longer replacement cycles to help “offset their higher purchase cost, rising from typically three years to four or five”.

He warned: “This means that we need the benefit in kind tables to extend longer into the future than was previously the norm.”

In the 2022 Autumn Statement, BiK tax increases were announced. For the 2025 to 2026 tax year, EVs and cars which produce less than 75g of CO2/km will see rates increase by one percentage point up to a maximum appropriate percentage of 20 per cent.

For the 2026-2027 tax year, the rates for cars will rise again by a further one percentage point up to a maximum of 21 per cent.

Rates for all other cars which produce 75g of CO2 per km such as diesel will be increased by one percentage point for 2025-2026 and will then be maintained at this level until April 5, 2028.

However there has been no extension beyond the 2028 date, with drivers eager to find out how much they will owe.

Hollick stated that “clear, positive signalling” is needed from the Government to instill confidence in drivers.

“We’d very much like to see the new tables announced. It’s an easy task and would create a much higher degree of certainty,” he added.

Hollick said the BiK taxation on electric company cars could “easily prove counterproductive”.

He explained: “While electric power has become almost the norm for many operators, it is largely the low hanging fruit that has been picked and we’re entering a more difficult phase.”

LATEST DEVELOPMENTS:

- MOT changes could see driving tech regulated as safety fears spark major crackdown - will you be affected?

- Car insurance prices to plummet under new motoring plans - 'Labour is the only party truly on the side of drivers'

- Drivers warned as four major car brands recall almost 850,000 vehicles for serious safety concerns

BiK taxes are are paid by employees through salary sacrifice measures

| GETTYThe AFP said that ideally it would like to see the BIK tax tables published to 2030 to provide “certainty and peace of mind” for fleets drivers and businesses.