Britons issued urgent warning over 'silent implosion' that threatens to bankrupt UK - 'Sleepwalking into collapse'

GB News

A bombshell new book warns Britain's ageing crisis could tear society apart within two decades

Don't Miss

Most Read

Latest

The UK is heading towards an economic and social crisis caused by an ageing population, according to an explosive new book, published this week (May 27).

‘Time bomb, When Ageing Explodes’ sounds an urgent warning that unless the UK defuses ageing’s explosive force, within two decades society will be devastated by it.

The publication, written by economics expert and journalist Giles Merritt, states that Millennials and Gen-Zers have already been condemned to pay much higher taxes to fund pensions and healthcare for older people, but will receive far less when they retire.

Drawing from a vast array of official reports and studies, Merritt, a Senior Associate Fellow at Belgium’s Egmont Institute, a think tank on international relations, says tax revenues will be increasingly squeezed alongside continuing growth in public spending leading to the point where the welfare state will be shattered and the social contract broken.

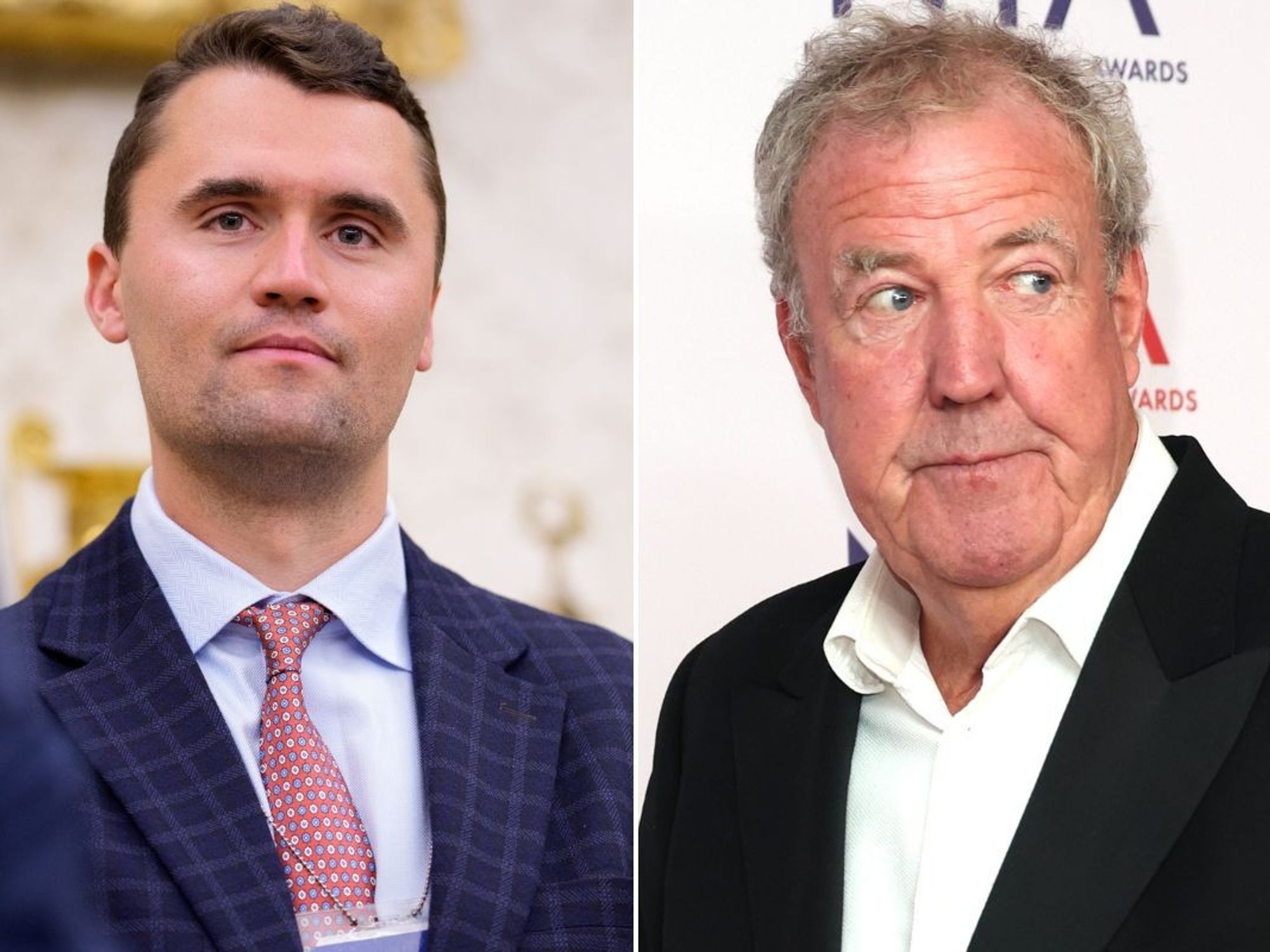

Giles Merritt warns Millennials and Gen-Zers have already been condemned to pay much higher taxes to fund pensions and healthcare for older people

|GETTY

He said: “The ageing timebomb won’t go off with a bang — it’ll be a slow, silent implosion that bankrupts our welfare state and shatters the social contract.”

Over-65s currently account for nearly a quarter of the population, but that figure is expected to rise to one-third by 2050. At the same time, the working-age population is shrinking, leaving fewer taxpayers to fund pensions, healthcare and public services.

His book cites economists, demographers and global bodies, including the International Monetary Fund (IMF), the Organisation for Economic Co-operation and Development - a network of 38 wealthy nations - and the European Commission, which have all repeatedly warned Governments that the costs of ageing will become “unsustainable” without urgent policy action.

One of the main reasons is due to dramatic falls in the “dependency ratio” — the number of workers compared to pensioners. In post-war Britain, there were five workers for every retired person. That figure dropped to 4:1 by the 1990s, and by 2019 was already down to 2.9. By 2070, it is forecast to fall to just 1.7.

LATEST DEVELOPMENTS:

Giles Merritt warned 'the ageing timebomb won’t go off with a bang — it’ll be a slow, silent implosion'

|FLICKR

Giles Merritt said this emerging demographic crisis is: “Quietly brewing up into a destructive maelstrom.”

“It’s the calm before the ageing storm,” he said. “By 2050, healthcare and pensions will consume a quarter of Europe’s GDP.”

Britain is ageing faster than many other European nations, he says.

By 2040, nearly one in three UK residents will be aged 60 or above. The number of people aged 85 and over is projected to more than double, from 1.6 million today to 3.7 million by 2045.

As one of the consequences of this, healthcare costs are expected to double by 2050.

Two-thirds of health spending is already directed toward the over-65s, according to UK Government data.

The financial burden, the book writes, is falling on younger generations. Millennials and Gen-Z workers will be expected to cover the soaring costs of pensioners while facing job insecurity, wage stagnation and housing unaffordability.

‘Time bomb, When Ageing Explodes’ has been published this week

|Giles Merritt

The IMF found UK workers under 35 hold less than 5 per cent of national wealth. In contrast, the average 65-year-old owns ten times more than someone in their twenties or thirties.

“Young people today are worse off than their parents were at the same age,” Merritt states. “They earn less, have less job security, and are being outvoted at the ballot box.”

The Resolution Foundation says the value of inherited wealth in the UK has doubled in 20 years to £90billion annually, and is set to double again by 2035.

Europe’s average fertility rate has fallen to 1.5 children per woman — well below the replacement rate of 2.1. In the UK, it is now 1.49, the lowest since records began.

Meanwhile, life expectancy continues to rise. A baby boy born in Britain today is expected to live to 86. For girls, the average is 90.

This demographic shift is causing what experts call a “gerontocracy” — a society increasingly dominated by older people who vote in large numbers, but contribute less in taxes.

The average 65-year-old owns ten times more than someone in their twenties or thirties

|GETTY

The UK’s working-age population is projected to fall from 41 million today to 36 million by 2050. Across Europe, the active labour force will shrink from 265 million to 230 million by mid-century.

This is already causing severe labour shortages in key sectors including healthcare, agriculture, logistics and hospitality.

Across the UK, employers are struggling to fill vacancies, with over 1 million job openings unfilled in early 2024, according to the Office for National Statistics.

Merritt says immigration is a key solution to workforce decline, but public hostility and political reluctance have prevented serious action.

A 2010 EU report warned that Europe would need 100 million migrants by 2050 to stabilise its workforce. The UK’s decision to leave the EU, combined with tighter immigration rules, has cut inflows dramatically.

In 2022, only 180,000 Ukrainians were granted refuge in the UK, compared to 1.2 million in Germany and 1 million in Poland.

“Migrant workers produce 40 per cent more economic output than if they stayed in their home countries,” Merritt says, citing McKinsey Global Institute research. “They are not a cost — they are an economic asset.”

Giles Merritt

|GETTY

Hopes that digital technologies or artificial intelligence will compensate for a smaller workforce are proving unrealistic.

The UK’s productivity growth in the decade to 2019 was the lowest in 120 years, according to the LSE and Resolution Foundation.

A 2017 study showed the UK had just 70 industrial robots per 10,000 workers, compared to 310 in Germany and 630 in South Korea.

“Europe’s ageing population is going to cause a sharp productivity slowdown,” the World Economic Forum warned.

Merritt says higher taxes are inevitable to pay for ageing.

“Tax is the elephant in the room,” he writes. “Yet Governments remain unwilling to discuss it openly.”

The UK’s tax revenues average 35 per cent of GDP, compared to 45 per cent in Germany. The IMF argues that higher taxation has not hurt German growth: its GDP per capita is 16 per cent higher than Britain’s.

Tax evasion is another major issue. The EU and US each lose an estimated $1trillion a year to tax avoidance, much of it by multinational corporations and the ultra-wealthy.

Merritt says governments have repeatedly ignored the early warning signs. “We’ve been warned for 20 years,” he says.

“The cost of living crisis triggered by COVID-19 and Ukraine has only masked a much deeper demographic crisis.”

He highlighted a 2017 House of Commons report estimating that the debt burden being passed to Britain’s young is £7.6trillion — five times the UK’s annual GDP.

Meanwhile, Oxford University’s Institute of Population Ageing has called for a 10 per cent rise in income tax to cover future shortfalls.

Merritt is among experts calling for a serious, fact-based public debate about ageing, taxes, migration and workforce policy.

“Unless the UK confronts the scale of the crisis,” he warns, “it risks economic stagnation, intergenerational conflict and irreversible decline.”

A Government spokesperson said: “We are driving down drug use, ensuring more people receive timely treatment and support, and making our streets and communities safer.

“This government is committed to tackling drug and alcohol abuse, and we remain on high alert to emerging drug threats.”