It's the figures behind the figures Rachel Reeves delivered today which are most disheartening - Nigel Nelson

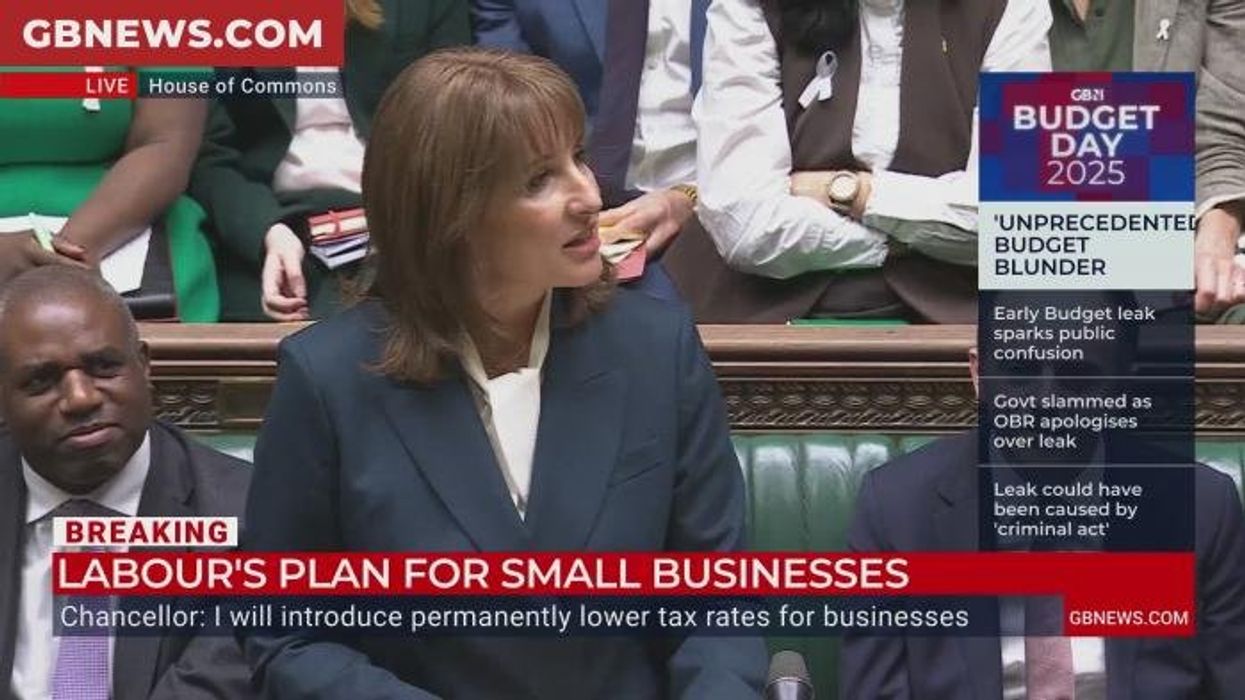

Chancellor Rachel Reeves confirms Labour will not increase national insurance, VAT and basic higher or additional rates of income tax |

GB

They show what a mess the British economy is really in, writes Fleet Street's longest-serving political editor

Don't Miss

Most Read

Trending on GB News

It’s the figures behind the figures Rachel Reeves delivered today which are most disheartening. They show what a mess the British economy is really in.

And because of a monumental cock-up by the Office for Budget Responsibility we got to hear those figures before Ms Reeves had even opened her mouth.

Shadow Chancellor Mel Stride called it "outrageous", the Chancellor, "a serious error". Before this leak added to the shambolic lead-up to this Budget, Deputy Speaker Nus Ghani had a statement up her sleeve chastising Ms Reeves for all the other leaks which caused so much market and public uncertainty.

All this against a background of national debt running into trillions, and at 95 per cent of GDP, the highest since the 1960s when we were still paying off the residual cost of World War Two.

Research by the House of Commons Library shows that £1 in every £12 spent by the government goes on servicing this debt. Ms Reeves said it is even worse than that - £1 in every ten. There has been some productivity growth in the last six years, but the measure of how much better off we are individually is dire.

GDP per head is under one per cent - 0.8 per cent to be exact over the same period - and prices keep going up from 1.7 per cent in September 2024 to almost double the Bank of England’s two per cent target now.

The OBR's promise that they will come down had Tory MPs sniggering. The welfare bill is more than £300billion, and it's a monster to cut. Even the Tories fell £4billion short on their 2015 plan to lop £12billion off it.

With things the way they are, it’s a wonder the Chancellor found any cash to spare at all, yet as always, there were winners and losers in this Budget.

The winners are the 460,000 children who will be lifted out of poverty now that we are rid of Tory Chancellor George Osborne’s mean-spirited two-child benefit cap.

At the other end of the age scale, Britain’s 13 million pensioners will be £550 better off, while rail commuters are to pay no more for their tickets next year than they did this.

If you’re on a waiting list for NHS treatment, you should be able to get it a little sooner, thanks to 250 more clinics, and your prescriptions are to remain under a tenner. Bingo players are quid's in, and 2.7 million minimum wage earners will have more in their pockets.

It's the figures behind the figures Rachel Reeves delivered today which are most disheartening - Nigel Nelson |

It's the figures behind the figures Rachel Reeves delivered today which are most disheartening - Nigel Nelson | PA

But if you’re a milkshake-loving, latte-drinking, electric car-driving owner of a home worth more than £2million, you will have some choice words today about the sugar tax, EV pay-per-mile and £2,500 hike in your council tax, a few of them polite.

Having ruled out manifesto-busting big taxes such as VAT and income tax (although there was a wobble on that second one), Ms Reeves was faced with smaller hikes. That manifesto promise - a mistake in my view - made her life difficult.

Together, these taxes raise more than £500billion, affect everyone, which means the grumbling if they rise is spread evenly, and a few small tweaks can bring in mega money.

Small taxes hit smaller groups who squeal loudly about paying more when others do not. Just look at the farmers. All tax increases have their upsides and downsides.

Had Ms Reeves gone ahead with an income tax rise, inflation would drop because spending does. Good. But because spending does, growth falters, too. Bad.

Yet it must be right that those who can most afford it should pay most, something Rachel Reeves has always believed in. A GB News viewer helpfully trawled her social media to repost an interview I did with her three years ago when she was Shadow Chancellor.

In it, she told me: “Those with the broadest shoulders should bear the heaviest burden.”

Today, she showed that sentiment hasn’t changed. Her "smorgasbord" of tax hikes will mean cold cuts for some, such as online gamblers, pension savers, cash ISA holders and boozers and smokers.

But her hardest sell is going to be the freeze on tax thresholds until 2031, which will drag 780,000 workers into tax for the first time and pitch 920,000 basic rate payers into the 40 per cent higher band.

Will all this be enough to straighten out Britain? Centre for Policy Studies Director Robert Colville quoted American politician Phil Gramm of the Senate Banking Committee, comparing balancing a Budget to going to heaven.“Everyone wants to do it,” the senator said.

“But no one wants to do what you have to do to get there.”

This Budget will need a few days to settle before we know whether Ms Reeves is taking us towards economic heaven or hell.

Our Standards: The GB News Editorial Charter

More From GB News