Did Rachel Reeves just hint at an early election? Nigel Farage must be rubbing his hands - Adam Chapman

Chancellor Rachel Reeves slams Nigel Farage's promises for Reform's economic policy, saying they lack detail |

GB

The Reform leader's prophecy could be about to come true, writes GB News' Opinion Editor

Don't Miss

Most Read

Trending on GB News

Delivering his damning verdict on the Budget, Nigel Farage declared Britain is now trapped in an “economic doom-loop”.

The Reform UK leader is not wrong.

Having ruled out raising the headline rates of tax, which would have violated her manifesto pledge, Chancellor Rachel Reeves opted for a death by a thousand cuts instead, unveiling dozens of smaller tax hikes that will raise £26billion by 2029-30.

Pension savers, high-end homeowners and income tax payers will bear the brunt of these measures.

A freeze on tax thresholds until 2031 will drag 780,000 workers into tax for the first time and pitch 920,000 basic rate payers into the 40 per cent higher band.

People are dragged into paying 20 per cent income tax if their earnings rise above £12,570, with the 40 per cent rate from £50,271 and the 45 per cent band from £125,140.

This will bring the UK's tax take to an all-time high of 38 per cent of national income in 2030-31, according to the OBR.

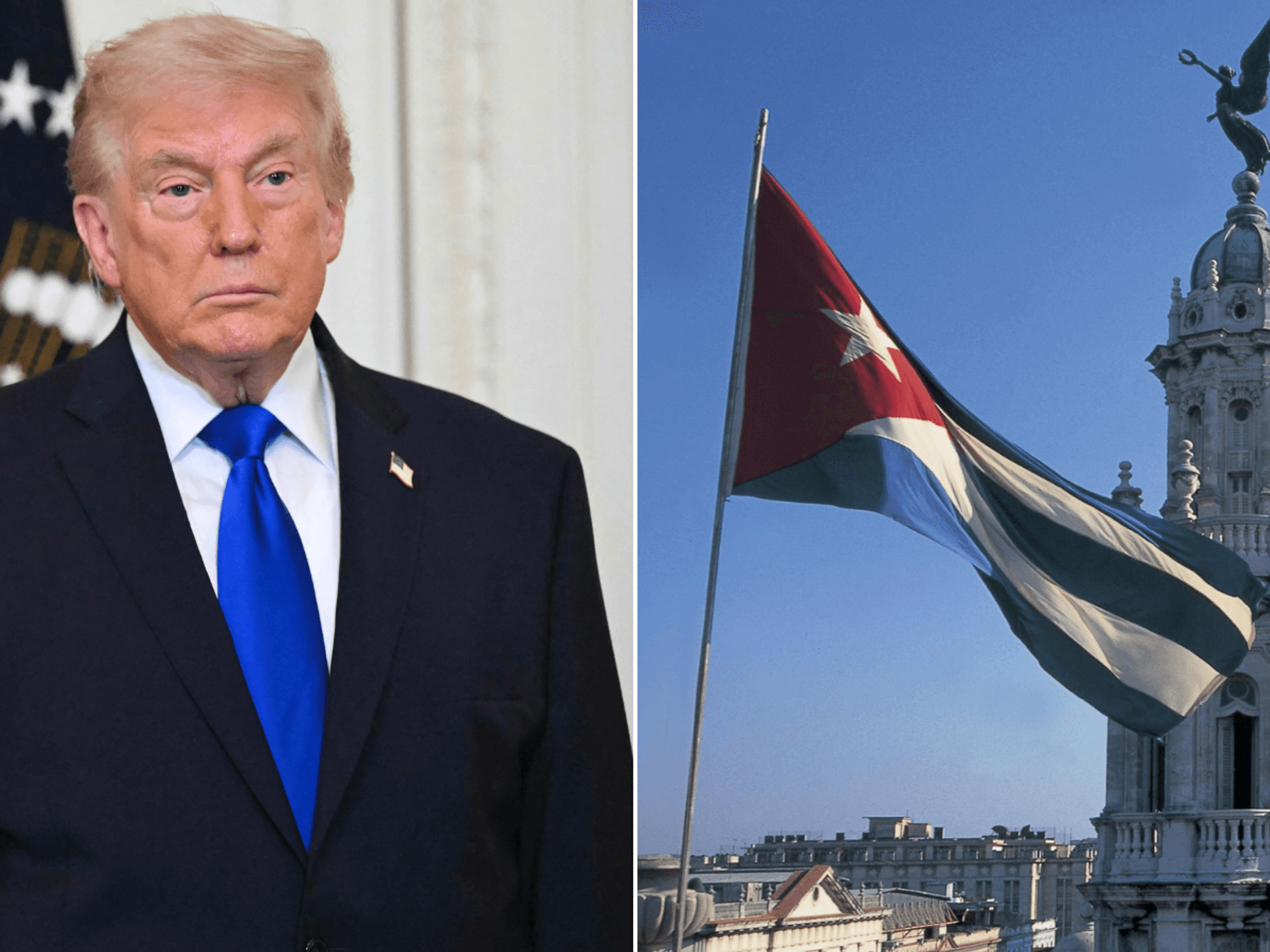

Did Rachel Reeves just hint at an early election? Nigel Farage must be rubbing his hands - Adam Chapman |

Did Rachel Reeves just hint at an early election? Nigel Farage must be rubbing his hands - Adam Chapman | Getty Images

Staring down the barrel of a socialist nightmare, Mr Farage came out swinging, but he failed to land the knockout blow.

By delaying economic pain until 2029-30, the Chancellor has lent credence to his claim that the Government will call an early general election in 2027.

There is a logic to bringing it forward three years.

The Budget will be in the rearview mirror, and households will not yet feel the bite of the tax rises.

Voters could be fooled into thinking the economy has taken a soft landing, buying Labour some time to recover from its slump.

Equally, a 2027 election creates an opportunity for Keir Starmer's Government to bow out before the economy tanks, which is looking increasingly likely.

Britain's debt burden sits at around 100 per cent of GDP. The cost of servicing this debt has risen to £104.9bn - almost double the entire defence budget.

This leaves the country extremely vulnerable to economic shocks at home and abroad.

If investors lose confidence in Britain's ability to manage its finances, they could stop buying Government debt altogether, compounding these effects.

Flailing in the polls, Labour desperately needs a win to restore public confidence - an early general election might just hedge its bets.

Since the Prime Minister is apeing Reform’s policies at every turn, why not grant the party’s — and the public’s — ultimate wish?

Our Standards: The GB News Editorial Charter

More From GB News