Payment chaos at the weekend 'is the latest sign a completely cashless society is a bad idea'

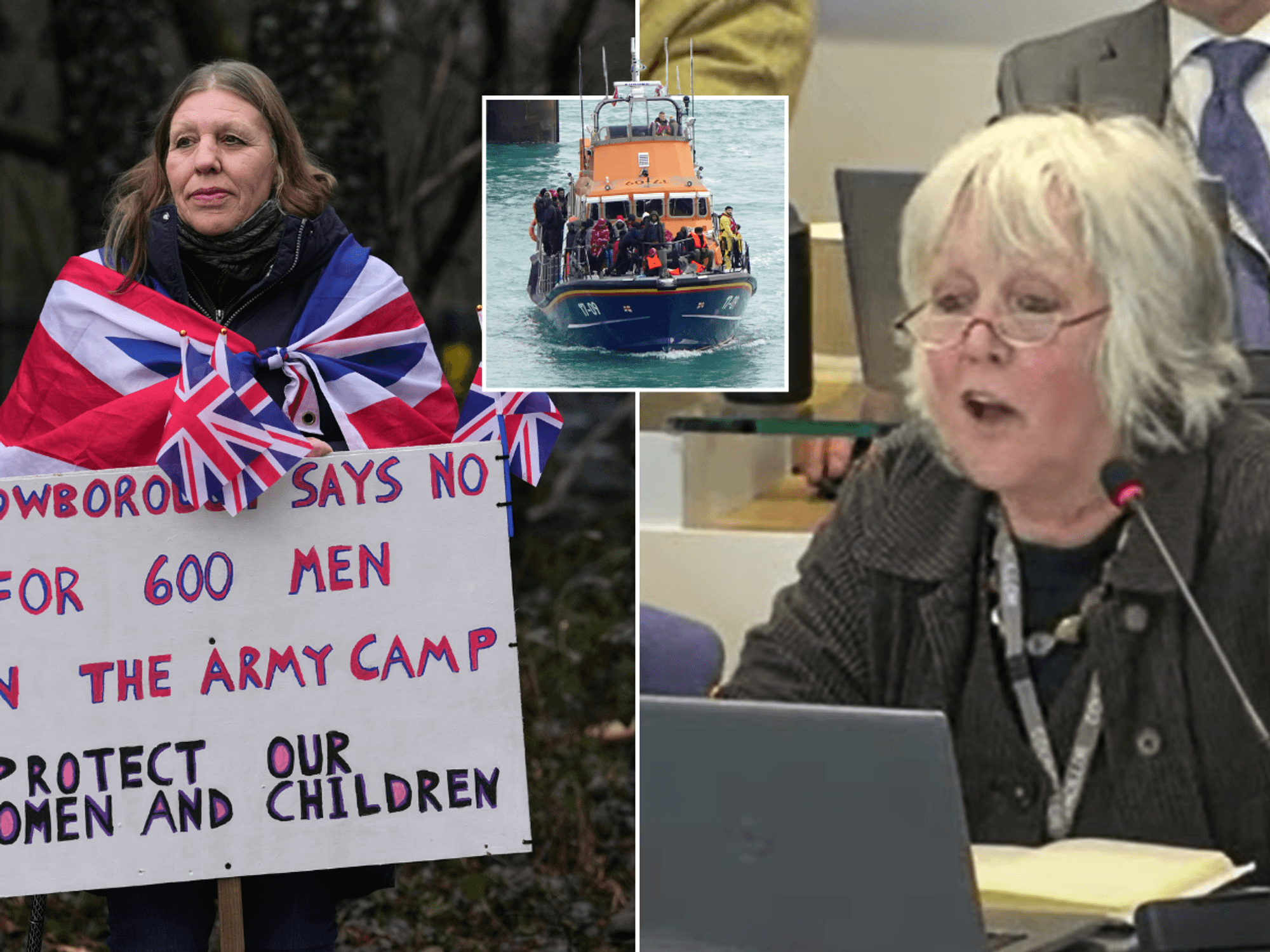

Andrew Martin says the card payment chaos seen at the weekend shows the importance of cash

|GETTY | ANDREW MARTIN | SMEB

It’s taken a crisis for Britain to realise just how important cash can be, writes Andrew Martin, founder of fintech company SMEB

Don't Miss

Most Read

Latest

Over the weekend, a nationwide technical outage meant that two of the UK’s biggest supermarkets were unable to accept contactless payments.

Thousands of customers were stranded, unable to purchase their groceries, unless they had cash in hand.

This is just the latest sign that the march to a completely cashless society might be a bad idea.

More and more people are turning to cash. Last year, cash use rose for the first time in a decade.

Research from the British Retail Consortium payment survey found that 19 per cent of all transactions in Britain were completed by cash, representing millions of pounds every day.

Many view cash as a convenient, secure payment method, and they know that it won’t simply disappear - even if your internet reception does. Unfortunately, getting your hands on cash is not as easy as it should be.

Are you worried about a cashless society? Do you prefer to use card and contactless? Share your views by emailing money@gbnews.uk.

More and more people are turning to cash, writes Andrew Martin

|GETTY

High street banks aren’t paying attention – instead, they continue to close branches. We’ve lost 6,000 branches of banks and building societies since 2015.

By the end of this year, a total of 30 parliamentary constituencies will no longer provide physical banking services for its residents.

In January 2021, Sweden made a regulatory change, executing a complete U-turn by making cash a permanent payment alternative.

As a result, major banks are now required to maintain their cash services for both consumers and businesses.

For banks, cash access is a huge cost, and they’d rather handle all transactions digitally, customer desire be damned.

These closures are creating banking ‘deserts’ across the UK and the impact on both individuals and local businesses is unforgivable.

For those affected, access to crucial financial services, such as the ability to withdraw and deposit cash, is no longer possible - unless you have the time and means to travel to another town.

This is easier said than done if you are living in one of the UK’s beautiful, but typically less connected, rural areas.

Communities in rural areas will suffer the most. Branch closures will impact their economic growth, hinder any efforts or progress they’ve made towards financial inclusion, and force locals to depend on online services, despite living in areas where internet connection is less reliable than in major cities.

The government response is incomplete and too slow.

Rishi Sunak says everyone should be able to walk less than 60 minutes to a cashpoint and has supported the installation of Banking Hubs in post offices and other areas.

But the rollout of these hubs has been comically slow – 37 hubs are operational despite thousands of bank closures. It’s simply not fit for purpose and urgent action is needed.

LATEST DEVELOPMENTS:

WATCH NOW: GB News panellists discuss cash usage in February 2024

So, what can we do? If you live in an area where you do not have adequate banking services, don’t continue to suffer in silence.

Make it clear to your MP or local councillor the impact that it is having on you/your family/your business /your wider community so that it becomes an issue that they can no longer ignore.

Make sure they know how you continue to rely on cash for your daily life.

You shouldn’t have to demand having easy access to cash but if you do, make sure you are loud about it.