Virgin Money launches new ‘flexible’ mortgage deal with £500 cashback offer

Mortgage lenders, including Virgin Money, are launching new products onto the market

Don't Miss

Most Read

Virgin Money has announced a new mortgage product which gives homeowners greater “flexibility” to switch to a more favourable deal and a £500 cashback deal. The lender has introduced a five-year fixed rate mortgage which allows customers to switch after two years without having to pay an early repayment charge.

This deal is Virgin Money’s Fix and Switch which launched earlier today and is available exclusively through any intermediary registered with the lender. As it stands, this product is available for residential purchase customers at 85 per cent and 90 per cent loan-to-value (LTV).

Virgin Money has launched a new mortgage deal

|GETTY

As part of the new offering, Virgin Money is giving customers the option of two different products, which include:

- Five Year Fixed, Two Year Early Repayment Charge at 85 per cent LTV Fee Saver at 5.14 per cent

- Five Year Fixed, Two Year Early Repayment Charge at 90 per cent LTV Fee Saver at 5.27 per cent

On top of these mortgage deals, customers are also being offered a cashback incentive from the lender worth £500.

It should be noted that customers will have their affordability assessment for Fix and Switch based on a five-year deal.

David Hollingworth, the associate director at L&C Mortgages said: “The mortgage market has provided so many ups and downs in the last couple of years that it’s understandable that borrowers will be struggling to decide on the best approach.

“Virgin Money’s innovative product offers an alternative and welcome solution to those that feel there’s room for rates to improve over the next couple of years but don’t want to be caught out if the outlook shifts again.

“There will no doubt be customers attracted to the ongoing certainty of rate if required but with the flexibility to review in 2 years.”

Craig Calder, the head of secured lending at Virgin Money, added: “In today’s higher interest rate environment, many mortgage borrowers are looking for long-term payment certainty, but don’t want to be tied in for the long-term.

LATEST DEVELOPMENTS:

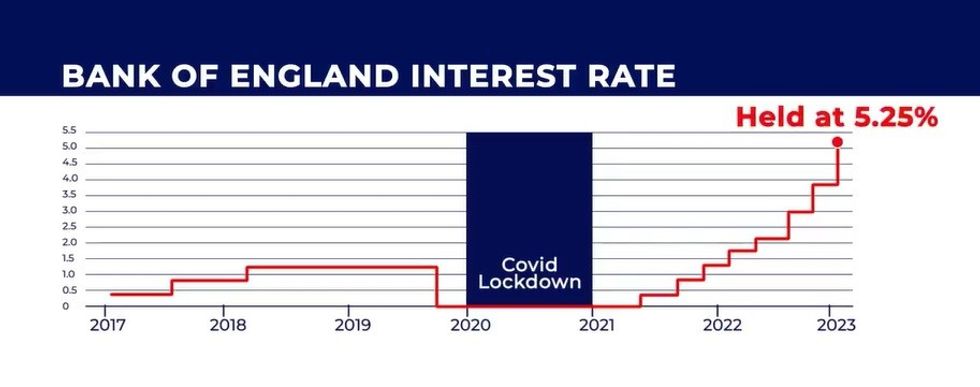

The Bank of England base rate is currently at a 15-year high | GB NEWS

The Bank of England base rate is currently at a 15-year high | GB NEWS“Fix and Switch is the perfect solution for them, providing the certainty of a five-year fixed rate with the flexibility of a two-year ERC if rates begin to fall.”

Mortgage holders have been saddled with rising repayments following the Bank of England’s decision to raise interest rates over the last year-and-a-half.

Economists have warned that the central bank will likely keep the base rate at its current level of 5.25 per cent for at least another month.

The Bank of England will next make an announcement regarding interest rates on February 2, 2024.