UK unemployment remains at 4.7 per cent - highest level since 2021

GBNEWS

| Labour's history of economic woes and recessionsWages are still climbing, with average regular pay up five per cent in the year to June

Don't Miss

Most Read

Latest

The UK’s unemployment rate held steady at 4.7 per cent in the three months to June, according to the latest figures from the Office for National Statistics.

This was unchanged from the rate recorded in the three months to May.

UK average regular earnings growth stayed at five per cent in the three months to June, according to the Office for National Statistics.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Once inflation is taken into account, that means workers are 1.5 per cent better off in real terms than they were a year ago. It marks a small but welcome boost to spending power after years of prices rising faster than pay.

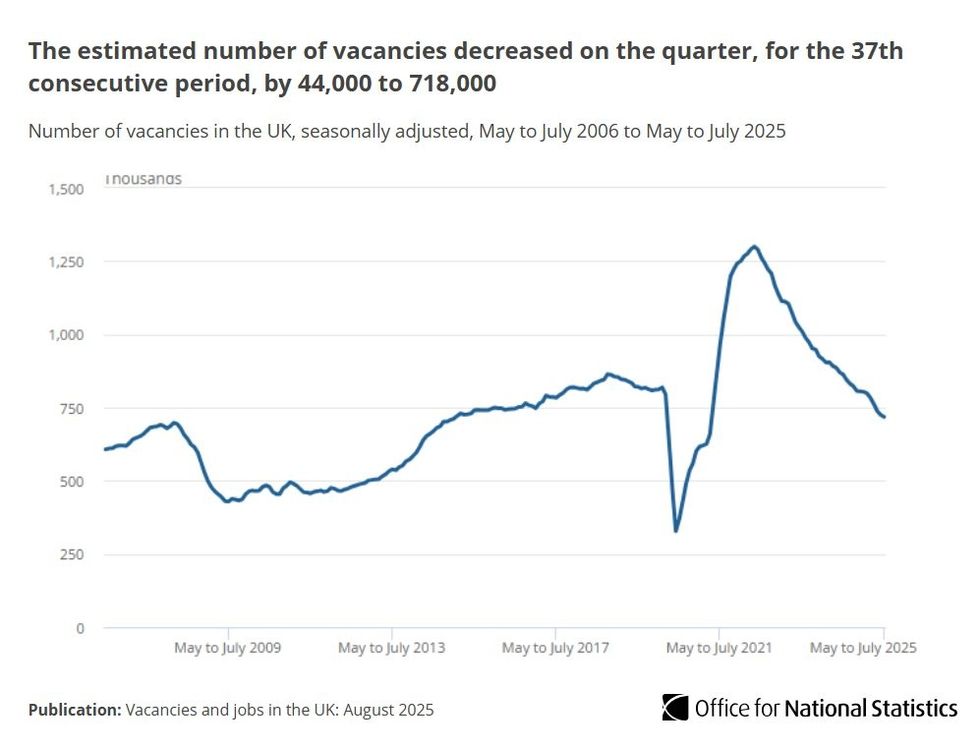

The estimated number of vacancies fell by 44,000, or 5.8 per cent, in the three months to July, bringing the total to 718,000. This marks the 37th consecutive quarterly decline, with vacancies falling in 16 of the 18 industry sectors.

The ONS said feedback from its Vacancy Survey suggests some firms are holding back on recruitment or not replacing staff who leave.

Minister for Employment, Alison McGovern, said: "Today’s figures show real progress with economic inactivity down, and 384,000 jobs added to the economy since last summer, putting more money in people’s pockets.

“We are determined to see unemployment fall that’s why we’re focused on getting people into good jobs by joining up work, health and skills support and transforming jobcentres to focus on genuine support not ticking boxes.

"As we grow the economy and transform opportunity in every area with our Plan for Change, we will ensure no one will be left on the scrapheap."

ONS

|The estimated number of vacancies fell by 44,000, or 5.8 per cent, in the three months to July, bringing the total to 718,000

Professor Joe Nellis, economic adviser at MHA, said the sustained drop in vacancies reflects "a downturn in recruitment activity, rather than mass redundancies," as businesses respond to economic uncertainty.

He warned that sluggish growth and a belief among business owners that "the UK does not reward entrepreneurial risk-taking" are contributing to a reluctance to hire.

"The result is that businesses are electing to save rather than invest in new talent, and employees are opting to stay in role rather than entering the daunting job market," he said, adding that while concerns over AI’s impact on young jobseekers are valid, "economic concerns continue to be the main driver of falling recruitment."

Despite vacancy levels continuing to slide and candidate availability rising, regular pay, excluding bonuses, held at five per cent in the three months to June.

ONS

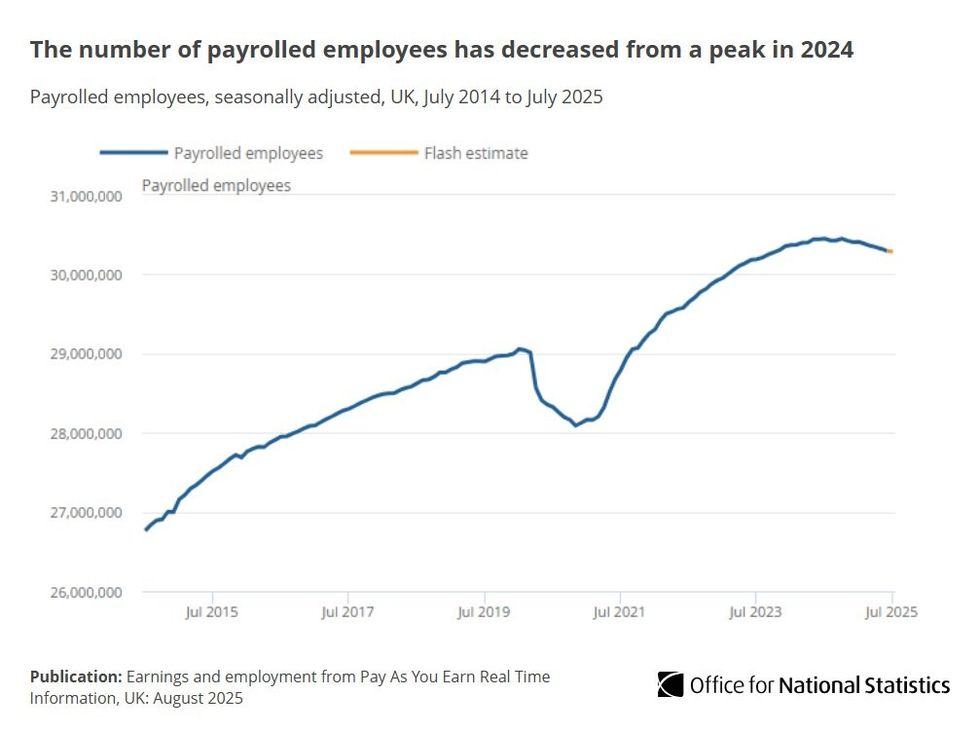

|Payrolled employment decreased by 8,000 employees in July 2025, compared with June 2025

However, total pay, which includes bonuses, fell to 4.6 per cent. Public sector pay growth continued to outpace the private sector, coming in at 5.7 per cent versus 4.8 per cent in the private sector, reflecting inflation-busting pay awards for public sector workers in recent months.

Alice Haine, Personal Finance Analyst at Bestinvest by Evelyn Partners, the wealth manager said: "Slowing wage growth is far from reassuring for households, especially with consumer price inflation back on the rise and forecast to peak at four per cent in September by the Bank of England.

"While workers may take comfort in the fact that pre-tax incomes are still growing faster than inflation for now – delivering real terms growth of 1.5 per cent on regular salaries and 1.1 per centon total pay, which includes bonuses – this is offset by a heavier tax burden and the risk that wage growth could slow further from here.

"The toxic combination of elevated living costs, high interest rates and frozen income tax thresholds is already squeezing household budgets.

"As more people are dragged deeper into the tax net as their wages increase, maintaining an existing lifestyle, saving effectively for short- medium- and long-term goals and tackling problem debts can feel like a challenge."

ONS director of economic statistics Liz McKeown said: "Taken together, these latest figures point to a continued cooling of the labour market.

"The number of employees on payroll has now fallen in 10 of the last 12 months, with these falls concentrated in hospitality and retail. Job vacancies, likewise, have continued to fall, also driven by fewer opportunities in these industries."

Another report, from KPMG and the Recruitment and Employment Confederation (REC), showed that recruitment across the UK fell sharply in July, for permanent and temporary jobs.

GETTY | High interest rates and inflation have impacted Britons ability to navigate the economy

GETTY | High interest rates and inflation have impacted Britons ability to navigate the economy

This was often linked to employers’ gloomy outlook, and increased pressure on recruitment budgets.

The report showed the steepest reduction in vacancies since April, while availability of staff rose at a rate that was among the fastest since the survey began in 1997.

This has hit pay growth, with starting salaries rising at the weakest rate in almost four and a half years, it said. Demand for permanent staff was said to be down across all 10 employment categories apart from engineering.

Kate Shoesmith, the REC deputy chief executive said: "With starting salaries and temp pay rising only modestly, it was right to cut interest rates last week. More action like this, to stabilise the business cost-base, is what will support growth and boost the jobs market this year. That is what the chancellor should be keeping firmly in mind when preparing this year’s autumn budget."