Council tax could rise by up to 410% under proposal as Labour urged to 'reform' - how much could you pay?

GB News

Labour is being called to address the 'outdated' council tax system by a leading think tank

Don't Miss

Most Read

Households could see their council tax bills rise by more than 400 per cent under radical reforms proposed by the Institute for Fiscal Studies (IFS)

The reforms would dramatically redistribute the tax burden, adding thousands of pounds to bills in the South while many households in the North would pay far less.

Kingston upon Hull could see bills fall by as much as 60 per cent, with Stoke on Trent and Blackpool would enjoy cuts of 57 per cent and 56 per cent respectively.

The IFT says the existing framework has become disconnected from property values and is frozen in time since 1991.

Angela Rayner controls council tax bands at the moment

| GETTY / paStuart Adam, who co-authored the think tank’s 2020 analysis, told the Daily Mail: "The Government should use our report as their blueprint for reforming the outdated council tax system.

"The failure to revalue council tax for 34 years and counting means the tax bills households face bear less and less relation to the values of their properties.”

If Labour adopted the IFS’s recommendations to revalue council tax bands in line with today’s property prices and apply a percentage-based system, the following areas would face the largest increases:

- Westminster with a 410 per cent increase

- Kensington and Chelsea with a 358 per cent increase

- Hammersmith and Fulham with a 166 per cent increase

- Wandsworth with a 166 per cent increase

- Camden with a 155 per cent increase

- City of London with a 150 per cent increase

- Hackney with a 110 per cent increase

- Islington with a 107 per cent increase

- Richmond upon Thames with a 101 per cent increase

- Merton with a 91 per cent increase

The current anomalies are striking. Wandsworth households pay around £998 a year despite average property values of £756,091.

In Rutland, residents hand over £2,671 annually even though average homes there are worth £434,694. Critics say these disparities stem from the system’s origins.

When the poll tax was scrapped in 1990, officials rushed to introduce a replacement.

Estate agents carried out what was described as a “stop gap valuation”, sometimes estimating hundreds of homes in a single day by driving through neighbourhoods.

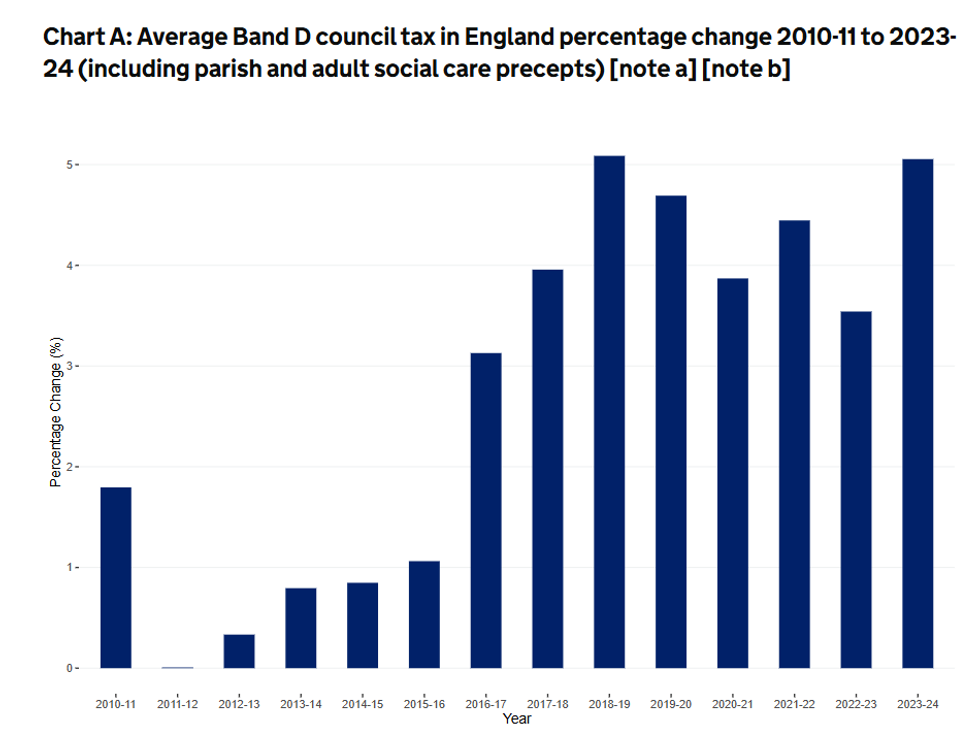

Council tax rises over the years

| GOV.UKMoney Saving Expert Martin Lewis has campaigned to highlight these flaws, pointing out that many households have potentially overpaid for decades because of inaccurate banding.

Chancellor Rachel Reeves pledged during last summer’s election campaign that Labour had no plans to alter England’s council tax bands, insisting the party did not want to see the tax burden on working people increase.

However, developments in Wales cast doubt on whether this position can hold. Welsh authorities have already committed to revaluing properties in 2028, creating pressure for England to follow.

Conservative leader Kemi Badenoch has warned that the Welsh decision could trigger similar changes across England in the years ahead.

LATEST DEVELOPMENTS:

Rayner could step down amid stamp duty row

| PASupporters of Reform UK argue that after more than three decades of unfairness, change is now inevitable regardless of Labour’s electoral promises.

Nigel Farage, whose party has topped the polls for months, will tell his party on Friday to prepare for power as soon as 2027, warning the financial markets could foreclose on the Labour Government, and force an early election.

Mr Farage will issue the alert in a speech to his annual conference in Birmingham.