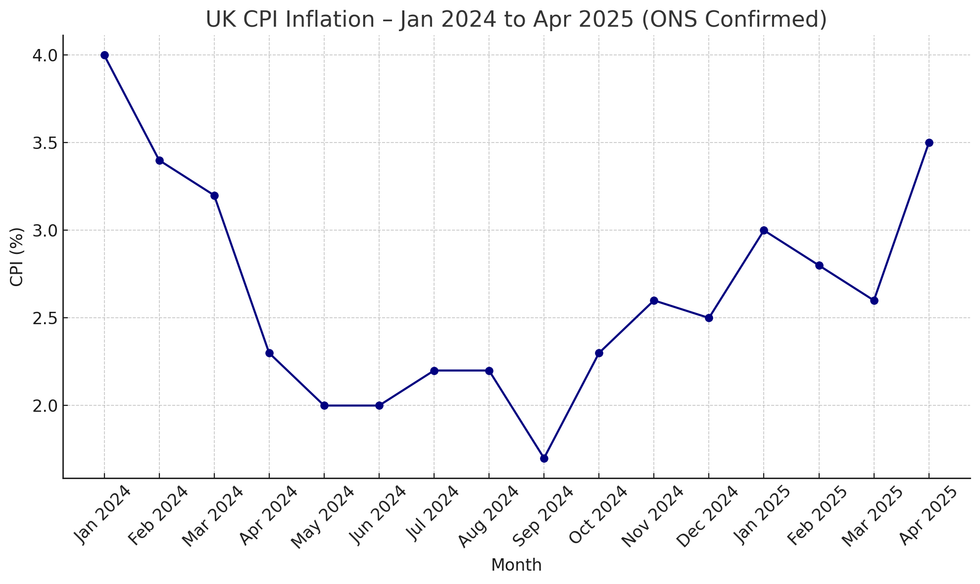

UK inflation soars to 3.5% in fresh blow to Rachel Reeves as April price hikes add pressure to household costs

Inflation hits 3.5% |

GBNEWS

Experts have warned that inflation could climb as high as 3.7 per cent by the end of the year

Don't Miss

Most Read

UK inflation rose to 3.5 per cent in the year to April 2025, up from 2.6 per cent in March, according to the Office for National Statistics.

The jump from 2.6 per cent in March marks a sharp rise in the cost of living for households.

This rise in inflation means the overall cost of living is rising more quickly again, with households feeling the pressure from more expensive goods and services.

It may also pressure the Bank of England to hold interest rates higher for longer, undermining Rachel Reeves’s efforts to stimulate growth through recent rate cuts.

Prices jumped by 1.2 per cent in April alone, compared to a smaller 0.3 per cent rise during the same month last year.

Core inflation, which strips out the more volatile items such as food, alcohol and tobacco, also rose, increasing to 3.8 per cent from 3.4 per cent in March, with CPI services inflation also swinging upwards and rising to 5.4 per cent from 4.7 per cent in March.

The steep monthly increase reflects a wave of April price hikes including a 6.4 per cent rise in Ofgem’s energy price cap, along with sharp increases in water, mobile and broadband bills along with higher council tax, car tax and stamp duty costs.

The rise marks the highest inflation rate in over a year and could put fresh pressure on the Bank of England to reconsider future interest rate cuts, just weeks after it lowered the base rate to 4.25 per cent

Inflation jumped to 3.5%

|ONS figures/GBNEWS

Finance experts had predicted a rise above three per cent for April's figure. Julien Lafargue, chief market strategist at Barclays Private Bank, said: "April is likely to show UK headline inflation jump back up above three per cent," citing National Insurance rise for businesses as a key catalyst.

Many firms are thought to have responded to April’s National Insurance hike and minimum wage increase by raising prices to offset higher costs, contributing to the rise in inflation.

Alice Haine, Personal Finance Analyst at Bestinvest by Evelyn Partners, the online investment platform, said: "Since the start of April, businesses up and down the country have been forced to handle higher employment costs – a result of the increase in the rate of National Insurance employers pay on employee salaries announced in the Autumn Budget last year and a rise in the minimum wage.

"In the run-up to the change, major companies warned they had no option but to pass on some of the increased burden to consumers, something the latest inflation reading lays bare."

Kevin Mountford, co-founder of Raisin UK, says longer-term pressures could push inflation even higher by the end of the year, fuelled by rising costs and external factors such as fallout from Trump-era tariffs.

RIsing inflation, combined with the lingering effects of Trump-era tariffs, poses a challenge for the Bank of England following its recent interest rate cut

| PAHe warned that inflation could reach 3.7 percent by the end of the year, fuelled by rising energy and utility costs, including water bills.

Water and sewerage charges alone surged by 26.1 per cent in April, the largest monthly increase since records began in 1988. This, along with higher transport and recreation costs, has more than offset the modest fall in clothing and footwear prices.

Haines said: "An uptick in the headline inflation figure is likely to be a source of concern for households who may be fearing a return to the dark days of rapid price rises that devastated household budgets during the cost-of-living crisis.

"Higher inflation diminishes spending power and erodes savings, making it difficult for people to maintain the living standards they have become accustomed to."

Mountford said: "Clearly a lot will have been learned through the cost of living crisis but it remains imperative that UK consumers look to budget effectively and cut out unnecessary spending by continuing to shop wisely.

"For consumers, reviewing outgoings such as insurances, mobile and TV deals and switching to alternative products and providers or cancelling unused subscriptions altogether, can result in significant savings.

This rise in inflation means the overall cost of living is rising more quickly again, with households feeling the pressure from more expensive goods and services

| GB NEWS"If you are looking to switch, do take into account the costs that can be associated with this to make sure it is worthwhile for you."

David Morrison, Senior Market Analyst at FCA-regulated fintech and financial services provider, Trade Nation said: "While the inflationary spike doesn’t come as a shock, it was larger than expected. It demonstrates that the path to the Bank of England’s two per cent target remains challenging.

"For consumers, it means continued pressure on household budgets, and for policymakers, it’s likely to delay any immediate moves toward interest rate cuts.

"This is very disappointing news whichever way one looks at it. Both Core and Headline CPI came in above last month’s readings. And more worryingly, significantly above expectations.

"The market reaction was swift: sterling shot higher against both the US dollar and euro, before pulling back. We will have to wait and see if the Bank of England chooses to look past this data release, or if they decide that the jump in inflation makes it impossible to cut rates anytime soon."

More From GB News