Is Britain heading towards a cliff? Three charts signal economic disaster is coming as 'suspicious' pattern emerges

GB

The latest ONS data on GDP growth contains hidden warnings

Don't Miss

Most Read

On Monday, the Office for National Statistics (ONS) confirmed that the UK economy grew by 0.7 per cent in the first quarter of the year, as measured by Gross Domestic Product (GDP).

That may sound impressive and was certainly better than most had expected a few months earlier. But unfortunately, it was as good as it gets.

The data should come with at least three health warnings.

First, there are questions about the reliability of the ONS data. In particular, there is a suspicious pattern in the GDP numbers.

As Chart 1 shows, growth has been strongest in the first quarter of the year in each of the last three years, before tailing off sharply, even though the numbers are supposed to adjust for any seasonal distortions.

First, there are questions about the reliability of the ONS data. In particular, there is a suspicious pattern in the GDP numbers.

As Chart 1 shows (see below), growth has been strongest in the first quarter of the year in each of the last three years, before tailing off sharply, even though the numbers are supposed to adjust for any seasonal distortions.

Growth has been strongest in the first quarter of the year in each of the last three years, before tailing off sharply

|Julian Jessop

The upshot is that the headline GDP numbers overstated the strength of the economy in the first quarter. Surveys of private businesses, such as the Purchasing Managers' Index (PMI), probably provide a more accurate picture.

As Chart 2 illustrates (see below), they confirm that underlying growth has been much weaker.

Underlying growth has been much weaker than headline GDP numbers suggest

|Julian Jessop

Third, the first quarter is now, of course, ‘old news’. We already know that the second quarter got off to a bad start, with the first estimate of monthly GDP suggesting that the economy shrunk by 0.3 per cent in April alone.

This partly reflected the unwinding of the temporary factors that had boosted GDP in the first quarter, such as the anticipation of US tariffs and stamp duty changes. But there were new shocks too, led by the increases in employers' National Insurance and in the national minimum wage.

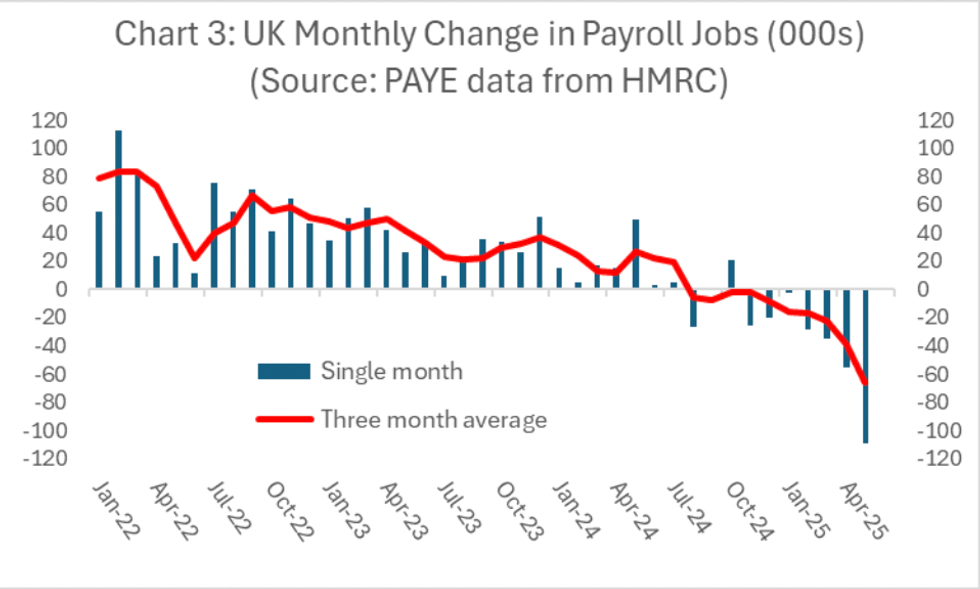

As Chart 3 below shows, higher payroll costs have contributed to a sharp downturn in the labour market, which already appears to be falling off a cliff. Food and energy bills have risen further, too.

Higher payroll costs have contributed to a sharp downturn in the labour market

|Julian Jessop

Mixed picture

All is not necessarily lost. Some surveys (including the PMIs) suggest that business confidence is stabilising again or even recovering slightly, including hiring intentions, as fears of a global trade war and the initial shock of the jump in payroll costs subside.

The cooling job market will also make it easier for the Bank of England to keep cutting interest rates, despite higher inflation. Altogether, this makes a recession less likely.

However, underlying growth remains sluggish, at best. The economy is set to grow by little more than one per cent over 2025 as a whole, little changed from last year, and well short of the numbers needed to fix the public finances.

With no sign that government spending is being brought back under control, Rachel Reeves may have to come back with even more tax increases in the Autumn Budget. In the meantime, business and consumer confidence are still fragile, and global uncertainty remains high.

In short, the supposed strong growth in the first quarter is now well behind us. The UK economy is already teetering on the brink again, and it may not take much more to push it over.