Triple lock pressure mounts as Rachel Reeves could cut pension tax relief to curb soaring costs

Watch as Britons react to triple lock pension warning |

GBNews

State pension future may depend on Government’s £25bn investment plan

Don't Miss

Most Read

Labour could be compelled to overhaul pension tax relief arrangements to maintain its commitment to the state pension triple lock, as Government costs are projected to reach £15.5billion annually by 2029/2030.

The Office for Budget Responsibility's latest forecasts indicate state pension expenditure will be three times higher than previously anticipated, creating significant pressure on the Treasury to identify alternative funding mechanisms.

The Government has promised to keep the triple lock in place for the rest of this Parliament. This means the state pension will rise each year by whichever is highest: inflation, average earnings growth, or 2.5 per cent.

But with costs rising much faster than expected, there is growing talk that ministers may have to rethink how workplace pensions are taxed. This could help fund the growing pension bill without changing the triple lock itself.

Experts say the Government can’t afford to ignore the warning signs, even if it's politically difficult to make changes right now.

Amy Knight, personal finance expert and business commentator at NerdWallet UK, said: "Political and financial implications aside, the mechanics of changing the triple lock would be a major undertaking, so the Government will be reluctant to tackle it during this parliament."

She added: "However, to avoid accusations of recklessness, ministers will want to acknowledge they have taken the OBR's concerns seriously."

The state pension increased by 4.1 per cent in April under the triple lock formula, continuing the pattern of annual rises that have contributed to the expanding costs facing the Department for Work and Pensions.

One potential solution being discussed involves adjusting the tax relief structure for workplace pensions whilst ensuring savers don't lose out.

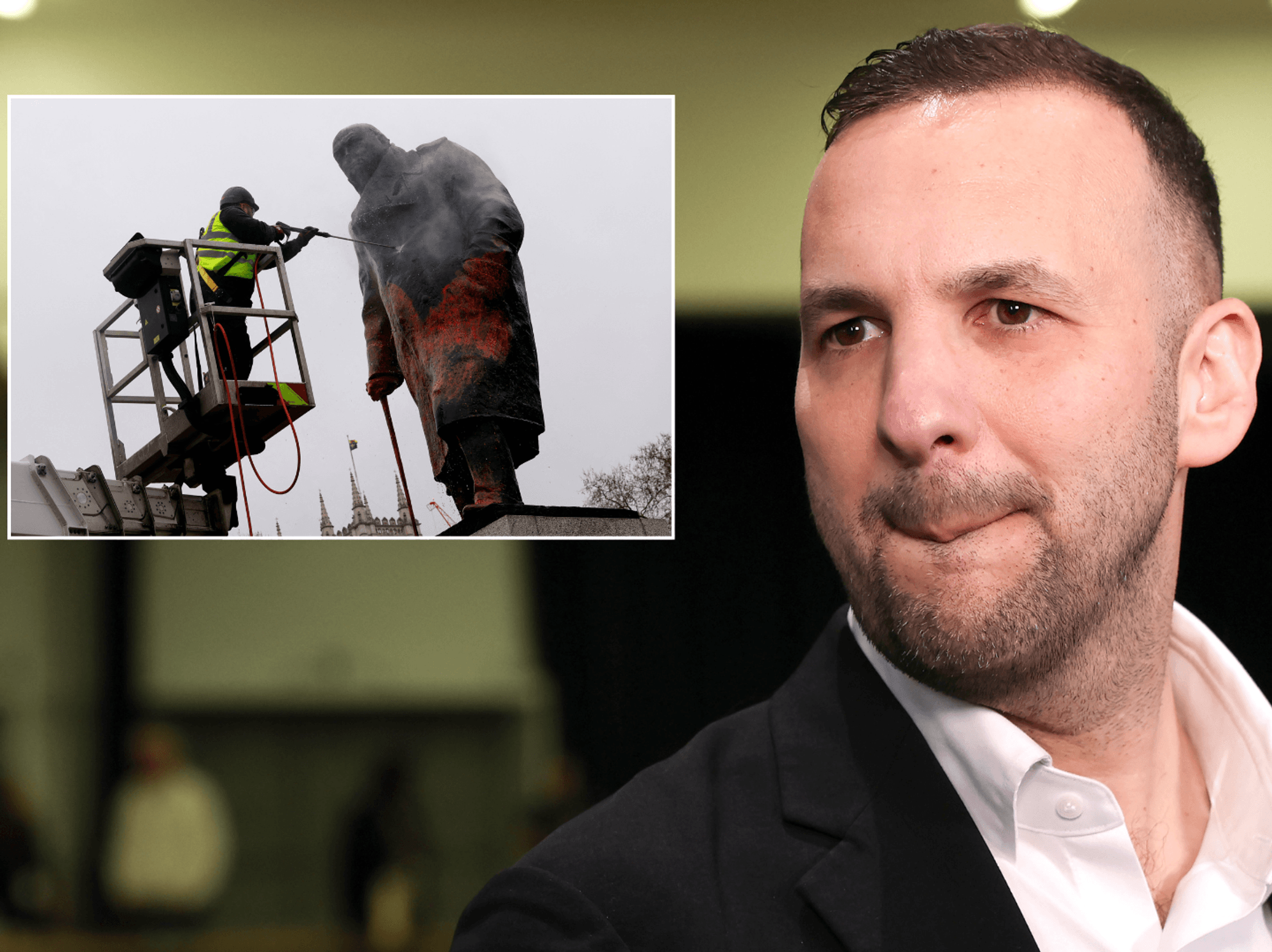

Triple lock pressure mounts as Rachel Reeves could cut pension tax relief to curb soaring costs

| GETTYKnight explained: "One approach the Government could consider is to offer less generous tax relief on workplace pension schemes and ask employers to make up the shortfall."

Under current rules, employers must contribute at least three per cent of workers' salaries to workplace pensions, whilst tax relief increases employees' four per cent net contributions to an effective five per cent.

"If companies were forced to increase their contribution, the amount of tax relief could be reduced, without shrinking the saver's pension," Knight said.

Under current rules, employers must contribute at least three per cent of workers' salaries to workplace pensions

| GETTYThis approach would allow the Government to generate savings from reduced tax relief whilst maintaining the overall value of pension contributions through increased employer payments.

The likelihood of major reforms during this Parliament remains low, with the ongoing Pensions Schemes Bill rollout continuing until 2030.

Knight noted: "This makes another big reform, such as an overhaul of the Triple Lock, less likely in the next five years."

The success of the Government's "megafund" approach to pension investments could prove crucial in determining whether more radical changes become necessary.

The likelihood of major reforms during this Parliament remains low

| GETTY"If the megafund approach starts to deliver the economic boost the Government is hoping for, the state pension could be safe for longer," Knight said.

However, she warned: "If the Pensions Schemes Bill fails to bring about a quick win, the current Government could be forced to review the conditions under which the state pension gets increased year on year."

More From GB News