Is the triple lock under threat? Third of young people back SCRAPPING pensioner scheme

A third of young people have said they would back scrapping the state pension triple lock

|GETTY

The Labour Party and Conservative Party have both said they are committed to the state pension triple lock ahead of the upcoming General Election

Don't Miss

Most Read

Latest

The cost of the state pension triple lock is causing a generational divide, with younger people fearing they will have to foot the bill.

There’s strong support for the policy among older voters, while younger counterparts have said they would be more likely to back a political party that proposes scrapping the triple lock altogether, new research shows.

A survey of more than 2,000 UK adults, commissioned by AJ Bell, found two-thirds (41 per cent) of people aged 65+ said they would be less likely to vote for a party that considered ditching the triple lock in favour of an inflation link. Just 12 per cent said they would be more likely to support that party.

Meanwhile, more than a third (37 per cent) of those aged 18 to 34 said they would vote for a party that proposed scrapping the triple lock, while 17 per cent would be less likely.

Tom Selby, director of public policy at AJ Bell, said the findings were not surprising, as young people may be worried about paying for the annual increases, particularly as the Conservatives have not proposed to unfreeze income tax thresholds for working-age Britons.

Selby said: “For younger people, retirement is a long, long way away, and many will understandably fear that generous increases to the state pension today will ultimately be paid for by them.

“We can see that risk in the fact the Conservatives have not proposed unfreezing tax thresholds for non-pensioners, and there’s also a real danger that planned state pension age increases will end up being accelerated to balance the books if the triple-lock is retained.”

It comes amid growing concerns about the affordability of the triple lock - the mechanism which uprates the state pension by the highest out of earnings, inflation and 2.5 per cent.

The Institute for Fiscal Studies (IFS) estimates by 2050, the triple lock could cost between an extra £5billion and £40billion per year in today’s terms, with the wide range due to the level of uncertainty around the triple lock components. Specifically, it’s not known what inflation and earnings will be.

Selby has called for the General Election winner to lay out a plan for the future of the triple lock.

He said: “The next government should really be reviewing the state pension triple-lock and setting out a clear goal for the policy.”Selby said other than “pure election tactics”, it was “hard to think of a good reason” to increase the personal allowance for pensioners alone - which the Conservative Party has pledged to do to stop people being taxed on the state pension. Pensioners currently face paying this tax because of Rishi Sunak and Jeremy Hunt’s six-year freeze to the tax-free threshold.

He added: “It would make much more sense to come clean about the aim of the triple-lock, which has never been articulated, and then set a sensible path to achieving that aim.

“Instead, we are left with the random ratchet of the triple-lock with no clear goal, and the increasing likelihood the state pension age will need to rise faster to cover the cost – meaning it will be those below state pension age who end up paying the price again.”

What could the state pension look like in the future?

Selby acknowledges that committing to the state pension triple lock may be an easy choice for both major parties for political reasons, but warned the point of the triple lock needs to be looked at.

“The demographic timebomb hitting the UK means at some point the next government will need to address the fundamental questions of what the state pension should be worth and when people should receive it,” he said.

Selby said increasing the state pension age - or accelerating planned increases - would save “bucket loads of cash”, but it would come at a severe electoral cost.

Another option is to replace the triple lock with a link to earnings or inflation, or both - removing the 2.5 per cent component.

Policymakers may also consider means-testing the state pension to take account of wealth, but Selby warned it would be very costly and complicated to administer.

A research briefing by the House of Commons Library points out another alternative which has been proposed - involving introducing a "smoothed earnings link" with the option to further top-up state pensions in periods of high inflation and a clawback mechanism to avoid compounding increases relative to earnings.

Selby called for the next government to put “stability and predictability” at the heart of state pension policy.

He said: “To plan for retirement over decades, people need to have at least a decent idea of what they can expect to receive from the state and when they will receive it.

“The triple lock, and more recently Rishi Sunak’s proposed quadruple lock, do not provide that certainty.

“They merely allow politicians to avoid addressing the vital question of what a fair value for the state pension would be and how long people should, on average, be in receipt of it.

“Given the grip the triple lock has on state pension policy at the moment, an independent review will likely be needed if we are to get anything resembling the cross-party settlement required to deliver long-term stability.”

READ MORE:

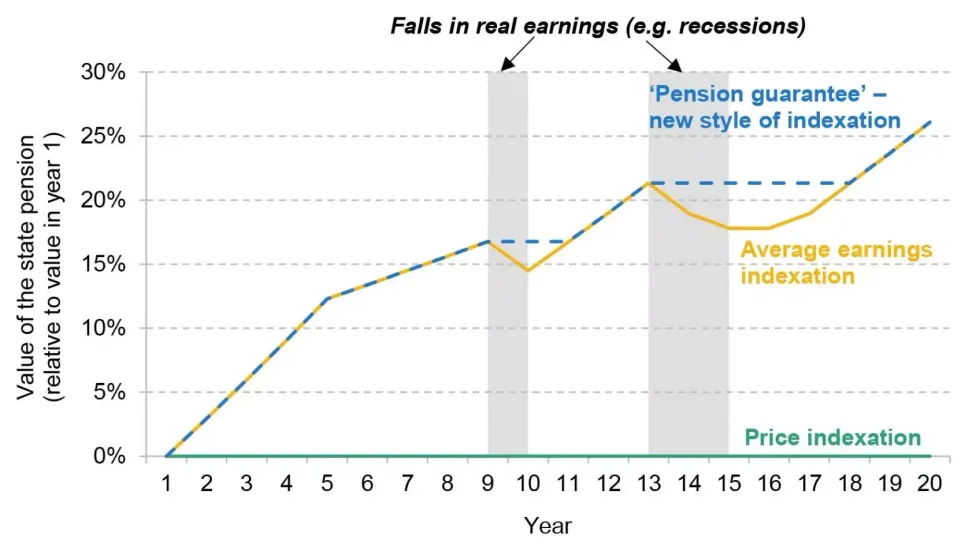

Chart: How the state pension 'four point guarantee' could work

The IFS chart suggests how a 'four-point pension guarantee' could work

|IFS

Last year, the IFS proposed a new “four-point pension guarantee”, which would require the government to set a target level for the new state pension, expressed as a share of median full-time earnings.

The think-tank said politicians should then legislate a pathway to reach the level for the new and basic state pension relative to earnings which they deem appropriate, with a specific timetable.

Rather than the triple lock, increases in the state pension would in the long run keep pace with growth in average earnings, so pensioners would benefit when living standards rise.

Both before and after the target level is reached, the state pension would increase at least in line with inflation each year.

So, during any period where average earnings growth is below inflation, the value of the state pension would instead rise in line with prices.

The third guarantee proposed the state pension would not be means-tested.

The fourth point proposes the state pension age will only rise as longevity at older ages increases, and never by the full amount of that longevity increase.

The history of the state pension triple lock

The triple lock was announced by the Coalition Government in 2010 and first implemented in the 2011/12 financial year.

Before then, the state pension had been uprated at least in line with prices since 1980, when an earnings link was ended by the then-incoming Conservative Government.

The triple lock was temporarily suspended in the 2021/22 financial year, due to volatile earnings figures following the coronavirus pandemic.