State pension triple lock declared 'unsustainable' as Rachel Reeves implored to axe 'unfair' payment rise

Dawn Neesom fumes ‘Labour hates old people’ as Rachel Reeves plots to ‘take everything she can’ from pensioners |

GB NEWS

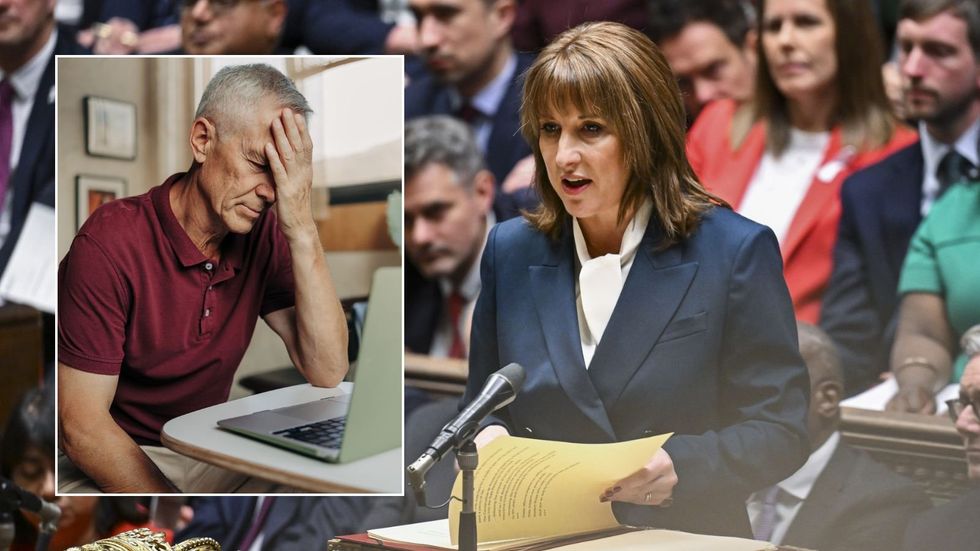

Concerns have been raised over the long-term viability of the state pension triple lock

Don't Miss

Most Read

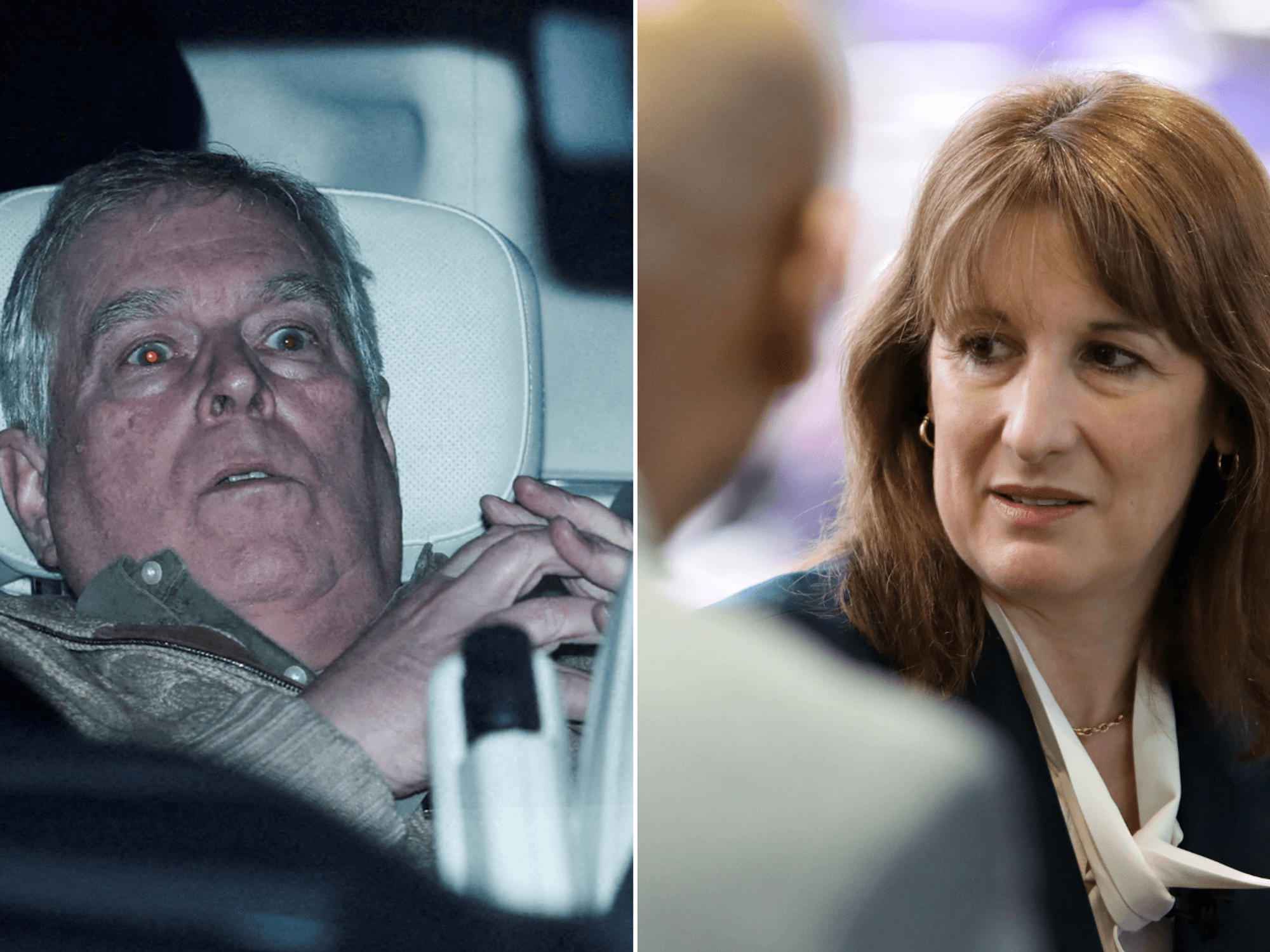

The "unsustainable" state pension triple lock must be axed, Chancellor Rachel Reeves has been told by MPs hours after she delivered her Budget statement to the House of Commons.

MPs are urging the Treasury to abandon the payment uprate mechanism with guarantees the state pension rises every year in line with inflation, average wages or 2.5 per cent; whichever is highest.

During her Budget, the Chancellor reaffirmed her commitment to the triple lock and announced a 4.8 per cent payment rate increase for payments from April 2025; in line with average wage growth.

Yesterday, MPs called for "courage" in addressing the policy during Commons debates, with prominent Tories breaking ranks to challenge the triple lock and its growing cost on working-age taxpayers.

The Chancellor is being called to reconsider the state pension triple lock

|GETTY

The interventions mark a significant shift in Conservative Party positioning on the policy introduced by the coalition government, as MPs warned about mounting costs and demographic pressures facing Britain's welfare system.

Sir Edward Leigh, the 75-year-old MP for Gainsborough and Father of the House, declared the triple lock "unsustainable" and "completely unfair on younger people if the burden of older people, through the triple lock, increases year by year".

The veteran parliamentarian acknowledged political constraints, stating: "Frankly, our Government never dared tackle it having brought it in because they knew that the Labour Party would crucify them at the ballot box.

"Now the Labour Party is caught in the same bind. We all have children, we all have grandchildren. We all see our own children struggling to get on the housing market."

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR Tom Tugendhat, the Conservative former minister, echoed concerns about demographic realities, telling MPs: "The honesty is the demographics of this country are going against us."

Despite acknowledging his front bench's disagreement, Mr Tugendhat insisted: "We simply cannot afford the level of welfare payments that we are making. We need to be clear that health and pensions are now costing too much."

The UK's fiscal watchdog's support supports these warnings as concerns over the long-term viability of the state pension continue to be an issue for the Government.

In its post-Budget report, the Office for Budget Responsibility (OBR) calculated that implementing the triple lock instead of earnings-only increases will cost an additional £15.5 billion yearly by 2029-30.

Notably, the OBR attributed this surge to inflation and earnings volatility, noting costs have reached approximately three times original projections.

Despite these figures, the Government remains steadfast in its support for the triple lock despite these Conservative criticisms.

Treasury Budget documents confirm the administration's "commitment to the triple lock for the duration of this Parliament" will "support the incomes of over 12 million pensioners".

This pledge comes as OBR analysis shows welfare spending's share of GDP rising primarily through increased health, disability and pensioner expenditure.

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR The fiscal watchdog notes pension spending growth stems from the triple lock's impact, though this will be partially counterbalanced between 2026 and 2028 when the state pension age increases from 66 to 67.

According to the OBR, higher benefit uprating will increase spending by £3.1billion in 2029-30 with around half (£1.6billion).

This is due to higher CPI uprating for working-age benefits, with the rest mostly due to higher earnings increasing triple lock uprating for pensions (£1.4billion).

More From GB News