State pension payments set to rise even HIGHER than expected in boost for recipients

‘Rubbing our noses in it!’ State pension rise will be swallowed up, retiree fears - ‘Doesn’t go anywhere’ |

GB News

ONS raises wage growth estimate, likely locking in higher state pension payments from April 2026

Don't Miss

Most Read

Millions of state pensioners are set for a higher than expected boost next year thanks to new triple lock figures released today.

Under the triple lock, the state pension goes up each year by either inflation, 2.5 per cent or average earnings growth - whichever is the highest figure.

The Office for National Statistics (ONS) has revised its estimate for average earnings growth between May and July 2025 from 4.7 per cent to 4.8 per cent - a change that will directly affect millions of pensioners across the UK.

The updated figure determines the increase to state pensions under the Government’s triple lock, which looks set to exceed both inflation levels and the 2.5 per cent guarantee.

With this, pensioners are set to receive a larger rise in their weekly payments from April 2026.

The triple lock mechanism ensures state pensions rise by whichever is highest: inflation, average earnings growth or 2.5 per cent - with average earnings growth announced on Tuesday.

Under the new rates, recipients of the new state pension will see weekly payments increase from £230.25 to £241.30 — a rise of £11.05.

This translates to an annual income of £12,547.60, up from £11,973.00.

TRENDING

Stories

Videos

Your Say

Those receiving the basic state pension will experience a weekly increase from £176.45 to £184.90, a rise of £8.45.

Their annual income will grow from £9,175.40 to £9,614.80, an improvement of £439.40 a year.

The new state pension applies to those who reached retirement age after April 2016, while the basic pension covers earlier retirees.

Both fall under the triple lock protection, guaranteeing these increases from April 2026.

The updated figure determines the increase to state pensions under the Government’s triple lock, which looks set to exceed both inflation levels and the 2.5% guarantee

| gettyAccording to estimates shared on X by financial journalist Paul Lewis, the change will add more than £100million to total state pension spending.

This additional cost comes as the Government continues to honour its triple lock pledge despite debate over its long-term sustainability and means testing.

While the 0.1 percentage point increase may appear modest, those receiving the new state pension will receive about £10 more annually than they would have under the previous 4.7 per cent projection.

Steve Webb, partner at LCP, said: "We can now be pretty certain that the new state pension and the basic state pension will rise by 4.8 per cent."

LATEST DEVELOPMENTS

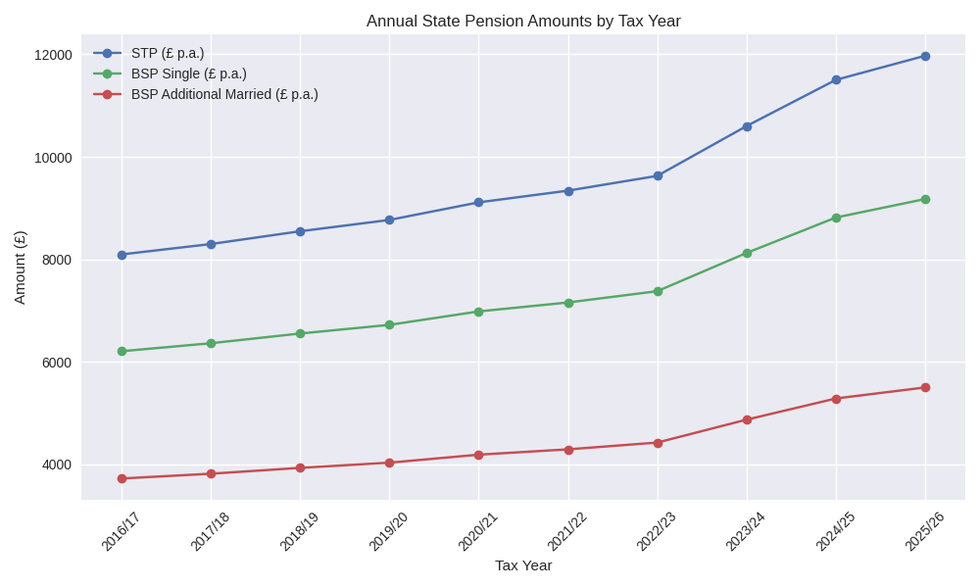

Annual State Pension Amounts by Tax Year

|TFP calculators/CoPilot

He issued a warning however for pensioners to consider the tax implications.

"This will keep the headline rate of the state pension below the income tax threshold for one more year, but it will go above the tax threshold in 2027 if allowances do not rise," Mr Webb said.

If income tax thresholds remain frozen while pensions continue to rise under the triple lock, state pensioners could find themselves paying tax on their state pension income for the first time.

According to HMRC data, there are currently 8.72 million people over state pension age paying income tax, as they will also receive a private pension.

Analysts predict that the latest rise could push an additional 400,000 pensioners, those dependent entirely on the state pension, into the tax bracket next year.

Nigel Farage has not commited to maintaining the triple lock

| PAThe Labour Government has so far declined to guarantee its continuation beyond the current Parliament, while Reform UK leader Nigel Farage has stated he “won’t absolutely commit” to maintaining the policy if elected.

During last month’s statistics release, Work and Pensions Secretary Pat McFadden reaffirmed the Government’s stance: “This Government is committed to maintaining the triple lock for the course of this Parliament.

“The OBR estimates that will mean a rise in the state pension of around £1,900 a year over the course of the Parliament.

"That’s a commitment from the Government to the United Kingdom’s pensioners to maintain the value of the state pension, and that’s something that we said we’d do at the election, and something that we will keep to.”

More From GB News