Pension tax raid fears grow as Rachel Reeves implored to avoid £7bn HMRC raid: 'We need a commitment!'

Finance expert discusses the controversy of the pension triple lock

|GB NEWS

Economists are urging the Labour Government to keep tax-free benefits linked to pension savings in place

Don't Miss

Most Read

Labour will be forced to respond to calls for a "pensions tax lock" as Britons become increasingly concerned their retirement savings will be targeted by HM Revenue and Customs (HMRC) in Chancellor Rachel Reeves's Autumn Budget.

A parliamentary petition calling for a commitment has exceeded 10,000 signatures, which should trigger a mandatory Government response, as reports circulate the Treasury is eyeing a £7billion tax raid on pensions.

The petition was initiated by investment platform AJ Bell at the beginning of October and seeks assurances from Chancellor that she will safeguard the tax benefits that support UK retirement savings.

Specifically, the petition requests that Ms Reeves make a public pledge to preserve both pension tax relief and tax-free cash allowances.

The Labour Government will be forced to respond to calls for a 'pension tax lock'

|GETTY

Retirement experts from AJ Bell argues these incentives should remain unchanged for the remainder of the current parliamentary term.

According to the financial services firm, maintaining that such stability would enable individuals to make retirement plans with confidence.

This latest petition emerges against a backdrop of speculation about potential reforms to pension taxation ahead of the November 26's Budget.

Without clear Government statements on maintaining existing arrangements, rumours have proliferated among savers concerned about their future retirement provisions.

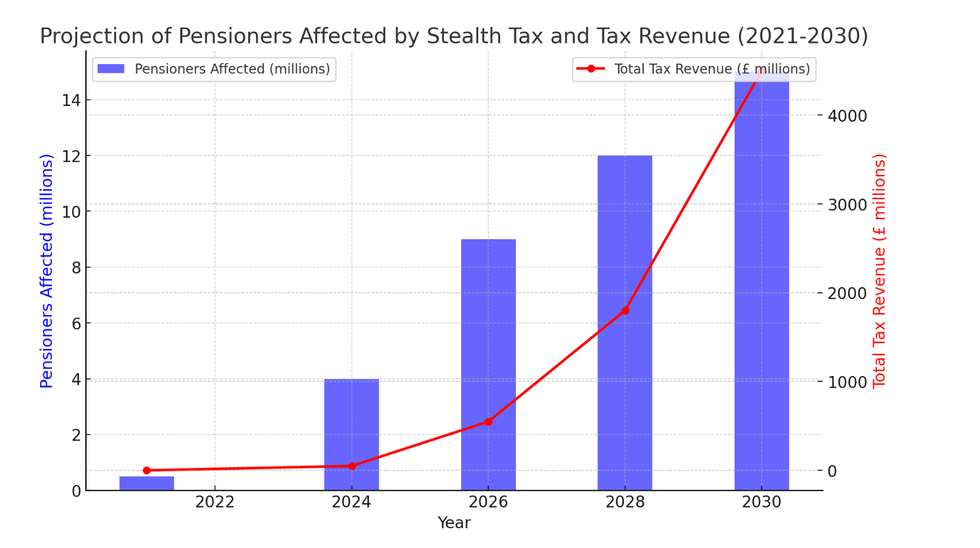

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT In its initial call for a "pensions tax lock", AJ Bell urged the Treasury to keep the 25 per cent tax-free cash entitlement linked to pension savings or existing tax relief rules, under which contributions are made from pre-tax income and taxed upon withdrawal.

Based on the firm's own analysis, the change would come at "zero cost to the Exchequer" while providing savers with confidence to plan for retirement without fear of shifting rules.

They also asserted it would end "damaging speculation" about the future of pension tax incentives, which it warned risks undermining saver confidence and prompting hasty or ill-informed decisions.

AJ Bell's campaign reflects broader worries that have emerged as savers seek certainty about whether they can continue planning their retirements under present tax rules.

Tom Selby, AJ Bell's director of public policy, stated that "pension savers across the UK have sent a clear message to the Chancellor".

Mr Selby added: "We need a firm commitment to a Pension Tax Lock to allow people to plan ahead with certainty."

He urged the Government to fulfil its obligation by making "a public pledge not to tinker with the cornerstone of long-term retirement planning".

He explained: "This Government insists it is on the side of those who work hard and said on winning power that delivering stability was at the heart of its agenda.

LATEST DEVELOPMENTS:

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR "Now is the time to show it really means that. Anyone sacrificing take home pay today to save for the future deserves a concrete promise from the Government that they will have the right to access their pension on the same terms as the generation that came before them."

Alongside calls to protect tax benefits linked to pensions, the Chancellor is under pressure to examine Britain's ballooning benefits bill, with many warning about the growing cost of the state pension.

The Office for Budget Responsibility's (OBR) figures suggest triple lock expenditure is £10billion more than initially forecast.

As well as this, analysts have suggested the state pension age should be raised earlier than expected to bring down the retirement benefit's expense.

More From GB News