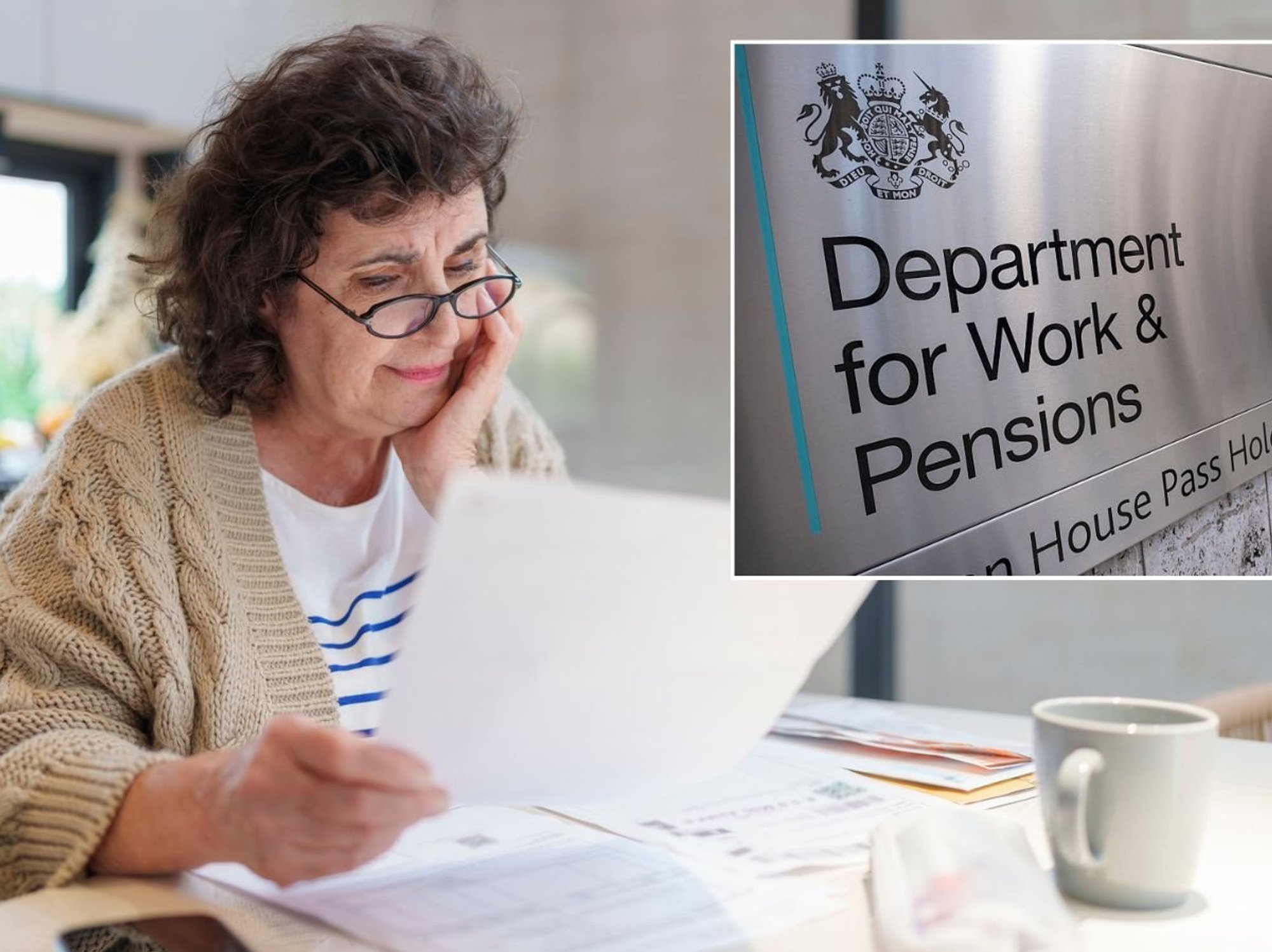

‘Growing numbers’ of retirees face being taxed on state pension sparking tax demand warning

Pensioners have been told to look out for a “simple assessment” tax demand amid frozen income tax thresholds

|GETTY

Pensioners have been told to look out for a “simple assessment” tax demand as more and more pensioners face being taxed on their state pension

Don't Miss

Most Read

Latest

Pensioners with a “relatively large” state pension but little else in terms of taxable income are being urged to look out for a “simple assessment” tax demand from HMRC.

Writing exclusively for GB News, Sir Steve Webb has warned “growing numbers” of pensioners are likely to be affected.

This is due to the state pension rising under the triple lock mechanism, but the personal allowance remains frozen until 2028, something which is known as fiscal drag.

It means pensioners are being taken closer to, and sometimes beyond, the threshold for paying the 20 per cent basic rate of tax.

Steve Webb is a partner at pension consultants LCP and was pensions minister from 2010 to 2015

|LCP

GB News spoke to a pensioner who found she had to pay tax despite only getting the state pension and a “small” pension income.

Sir Steve, partner at LCP and former pensions minister, explained: “With the tax threshold frozen and state pensions increasing by nearly 20 per cent between 2022 and 2024, growing numbers of pensioners are finding themselves liable for tax purely on the basis of their state pension.”

The state pension is paid before the deduction of any tax, meaning people liable to pay tax on just the state pension will owe HMRC money at the end of the year.

Sir Steve added: “This would affect anyone whose total taxable income is over the tax threshold (currently £12,570) and who doesn’t have a company pension or other pension income where tax is collected through use of a tax code.”

In an exclusive article for GB News members, Sir Steve explained in detail how simple assessment works.

Last year, Sir Steve warned hundreds of thousands of pensioners would have to start setting aside some of their state pension for unexpected tax demands.

Analysis by LCP found hundreds of thousands of pensioners being dragged into the tax net for the first time have no PAYE income, such as earnings or private pensions, which could be used to collect the tax owed.

As a result, they are set to get tax demands the year after they get the payments.

LATEST DEVELOPMENTS:

WATCH NOW: Tory MP Greg Smith slams 'absurd' tax on pensioners

Sir Steve suggested affected pensioners start setting aside money now for when the tax demand arrives.

He added: "Any pensioner with a pension next year over £242 per week will have tax to pay, and if they do not have a private pension through which the tax can be collected, they may need to set some money aside for an unwelcome tax demand."

A Treasury spokesperson said: “Our older population have the right to security and dignity in retirement which is why this year we provided the biggest ever cash increase to the state pension, a 10.1 per cent rise, which comes on top of extra direct cash payments worth up to £1,350 each to support with cost of living challenges and protection from rises in energy bills.

“We have taken three million people out of paying tax altogether since 2010 through raising the personal allowance, and the Chancellor has said he wants to lower the tax burden further but sound money must come first.”