State pension future in doubt as advisers issue warning to young people who face 'very nasty old age'

JP Morgan warns advisers plan for no state pension future

Don't Miss

Most Read

Financial advisers should plan for a future in which the state pension no longer exists when working with younger clients, according to a senior strategist at JP Morgan Asset Management.

Karen Ward, the firm’s chief market strategist for EMEA, issued the warning while speaking at the Let’s Grow conference hosted by Parmenion.

She argued that the country is laying the groundwork for today’s younger generations to face what she described as a “very nasty old age” unless expectations change.

Ms Ward, who previously chaired the Council of Economic Advisers at HM Treasury during Philip Hammond’s tenure as chancellor, said mounting pressures on public finances raise serious questions about the long‑term sustainability of the welfare system.

TRENDING

Stories

Videos

Your Say

She also highlighted low levels of financial understanding across the UK, noting that Britain “averages the financial knowledge level of a 12‑year‑old”, leaving it behind comparable developed economies and compounding the risks faced by younger adults.

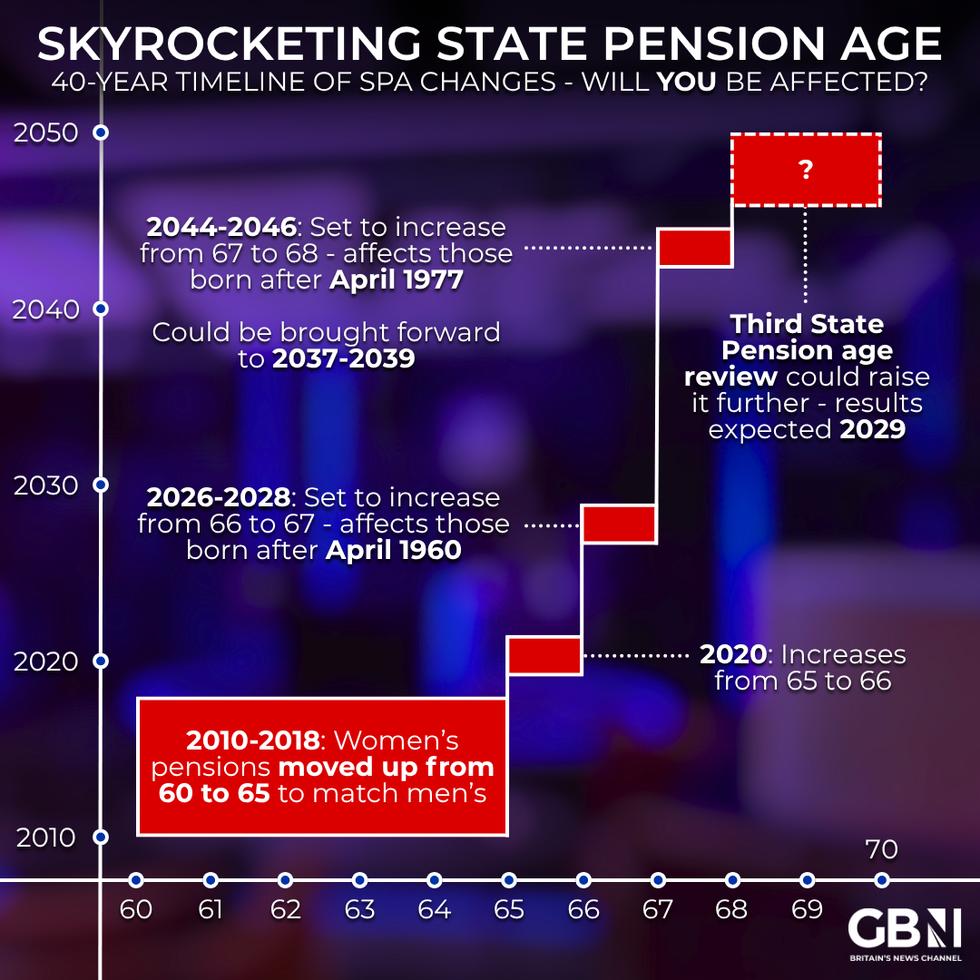

Her remarks come as the state pension age is due to rise from 66 to 67 in April 2026, a change she suggested may be only the beginning of more radical adjustments as demographic pressures intensify.

She added that trust in the financial services industry remains damaged following the 2008 financial crisis.

She argued this presents an opportunity for advisers, who are often viewed as more trustworthy than large institutions, to help younger clients prepare for a future with less state support.

The potential loss of the state pension would leave many retirees financially exposed.

JP Morgan warns advisers plan for no state pension future

|GETTY

Research published by Quilter in August 2025 found that state pension payments account for half of total income for people aged 80 to 84, while those aged 70 to 74 rely on it for 47 per cent of their household income.

The findings underline how vulnerable older people would be if state provision were reduced or withdrawn.

Financial pressures are already rising among those approaching retirement.

A report published in December 2025 by the Standard Life Centre for the Future of Retirement found that 250,000 more people aged 60 to 64 are now living in relative income poverty compared with 2010.

The poverty rate for this age group increasing from 16 per cent in 2009–10 to 22 per cent in 2023–24.

LATEST DEVELOPMENTS

Are you affected by state pension age changes? | GETTY

Are you affected by state pension age changes? | GETTYThe report highlighted the growing strain faced by people nearing state pension age.

Ms Ward’s warning comes against a backdrop of wider financial vulnerability across Britain.

Research by Fair4All Finance found that 20.3 million adults were living in financially vulnerable circumstances — a 16 per cent rise from 17.5 million in 2022.

Younger adults were among the hardest hit, with the number regularly relying on borrowing rising by 45 per cent to 1.9 million.

Many struggle to build savings as living costs outpace incomes, and one in five young workers are now employed on zero‑hours contracts.

Regular earnings pressures have fuelled greater reliance on buy now, pay later services and short‑term credit

|GETTY

Irregular earnings have driven increased use of buy now, pay later products and short‑term credit.

Fair4All Finance said 44 per cent of UK adults are now experiencing some form of financial vulnerability, with almost three million people pushed into financial difficulty over the past year alone.

Ms Ward said these trends reinforce the need for long‑term planning that does not assume continued state support.

She urged advisers to prepare younger clients for a future in which personal savings and private provision play a far greater role than the state pension.

More From GB News