Martin Lewis issues state pension warning as Britons urged to remember 'five-year' rule

The host of The Martin Show Money Show Live is urging people to check if they are eligible for the full state pension amount

Don't Miss

Most Read

Latest

Martin Lewis is sounding the alarm for thousands of Britons about a "five-year" rule that should be remembered for securing the full state pension during his recent BBC podcast.

Responding to a listener seeking retirement planning guidance, Mr Lewis explained the fundamental principle behind pension entitlement, notably when it comes to National Insurance contributions.

"You generally need 35 years-ish, and it is a huge capital letter 'ISH', to get the full state pension," he stated. "35 years-ish of National Insurance contributions and then you get the full state pension when you hit retirement age."

For those under the new state pension system, roughly 35 complete years of NI contributions are typically necessary to qualify for the maximum amount. This contrasts with the older basic state pension, which generally required 30 years of contributions.

Martin Lewis has issued a 'five-year' rule reminder when it comes to state pensions

|GETTY

At present, individuals become eligible to claim their state pension upon reaching 66 years of age. However, this threshold is set to rise from April this year, with gradual increases scheduled until it reaches 67 by April 2028.

The full new state pension currently stands at £230.25 weekly, equating to £11,973 per year. It is worth noting that pension payments do not commence automatically once someone reaches the qualifying age.

Claimants must actively apply to begin receiving their entitlement. Some individuals choose to delay their claim beyond the qualifying age, which can result in enhanced payments when they eventually apply.

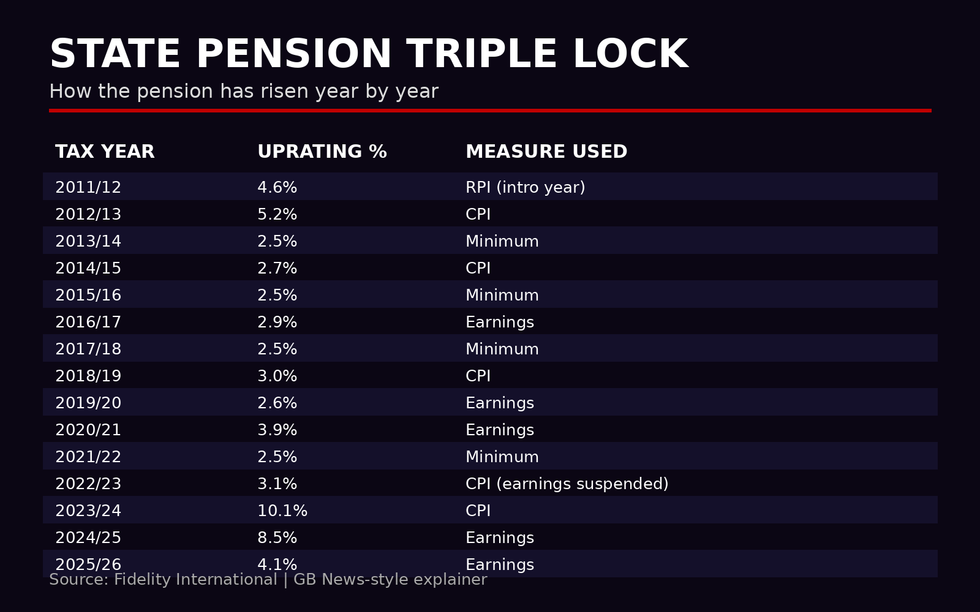

Under the triple lock policy, these payments are due to rise by 4.8 percent from next April. Thanks to this mechanism, payment rates rise by either the rate of inflation, average wage growth, or inflation; whichever is highest.

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL This increase will boost the full new state pension to £241.30 per week. On an annual basis, recipients of the retirement benefit will receive £12,547.60 following the uplift.

The triple lock mechanism ensures pension payments increase each year by whichever is highest among the consumer price index (CPI) rate of iinflation, average earnings growth, or 2.5 percent.

Mr Lewis was responding to a listener who had consolidated their private pensions and was examining their state pension entitlement as part of broader retirement planning.

The individual had checked their forecast using the HMRC app and appeared on course for the full amount. Mr Lewis offered a practical solution for those concerned about gaps in their contribution record.

The Martin Lewis Money Show Live host gave the following instruction to Britons: "If you stop work now, you can always buy back up to six years of past National Insurance contributions.

"So stop work, carry on with your life, and then make sure you put a note in your diary, sending yourself a delayed email, however you tend to it, for about five years' time, to go and check this process and see where you are again."

He recommended using the Government's forecast tool available on gov.uk, which displays both missing National Insurance contribution years and projected entitlement.

However, Mr Lewis cautioned that the DWP system remains "complicated" and he could not provide "cast-iron guarantees" about final state pension payment amounts.

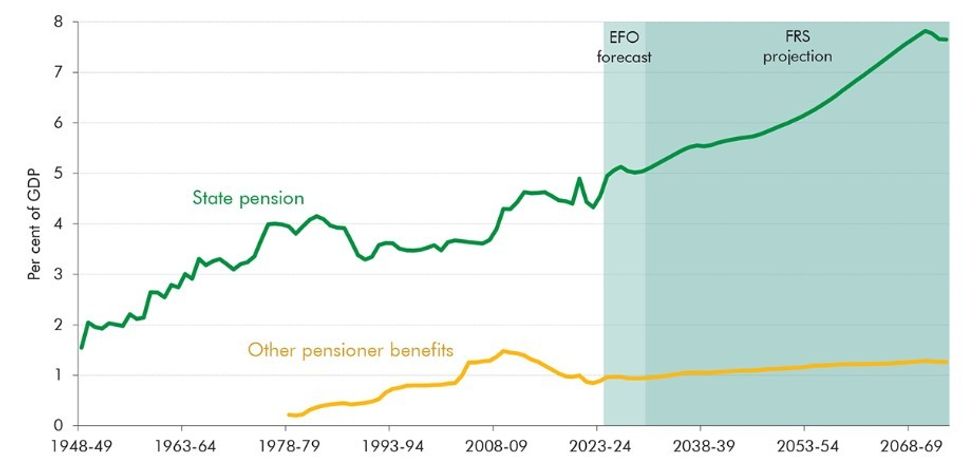

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR Despite the looming triple lock boost, Aegron's pensions director Steven Cameron perviously warned older Britons are at risk of paying tax on their state pension due to the impact of fiscal drag.

He shared: "The sting in the tail is that by 2027/28, the full new state pension will exceed the personal allowance which has today been frozen until 2031, leading to even those relying solely on the full new state pension for retirement income facing a tax liability.

"This liability will grow in future years and if the triple lock led to the same increases from now till 2031, it could grow to over £500. The Chancellor has offered some assurances by saying pensioners won’t have the admin burden of completing simple assessment tax returns.

"However, importantly, this is not the same as waiving the tax. The Government is to look into alternative approaches to dealing with the tax charges. It’s important that this made as easy and stress-free as possible for pensioners."

More From GB News