Skipton Building Society issues urgent warning as Budget move leaves savers at risk of paying more tax

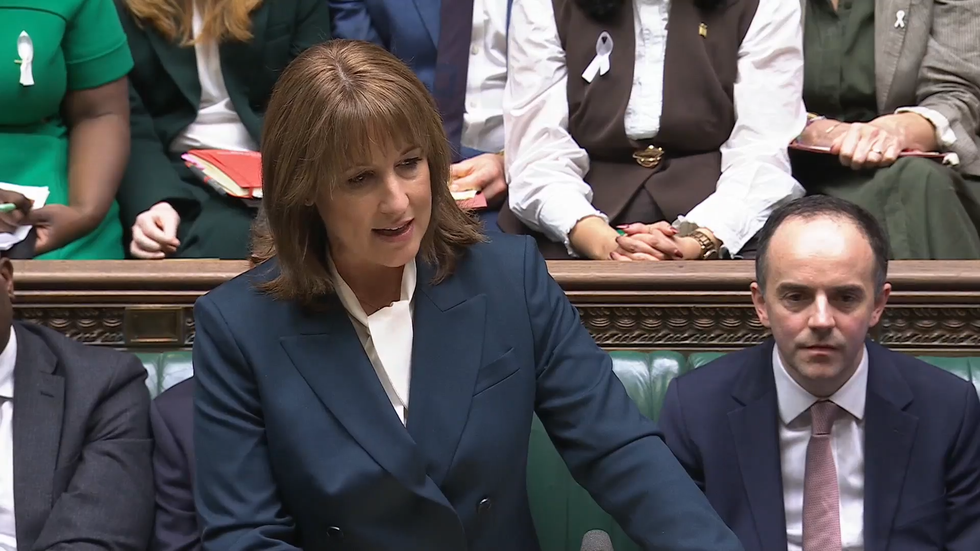

Chancellor Rachel Reeves mocks Green Party leader Zack Polanski during her Autumn Budget announcement |

GB News

Two thirds of Cash ISA customers view £12,000 cap for under 65s unfavourably

Don't Miss

Most Read

Chancellor Rachel Reeves has announced plans to reduce the tax-free Cash ISA allowance from £20,000 to £12,000 for savers under 65 from 2027, prompting significant concern among account holders.

The proposed cut has drawn a strongly negative response in polling carried out among Cash ISA customers.

The research shows 67 per cent of holders view the announcement unfavourably, indicating widespread dissatisfaction with the change.

Alex Sitaras, who leads savings and partnership products at Skipton Building Society, said the reduction would expose many more people under 65 to tax on savings that are currently shielded from charges.

TRENDING

Stories

Videos

Your Say

He said: "Slashing the cap so sharply means many more people under 65 will end up paying tax on savings that were previously protected so making the right moves now is vital."

The overall annual ISA limit will remain at £20,000, meaning savers will be able to distribute contributions across multiple ISA types if they choose to do so.

Mr Sitaras advises that those affected consider using Stocks and Shares ISAs alongside Cash ISAs to maintain tax efficiency and, for some, diversify their financial planning.

He also encouraged account holders to make full use of the existing £20,000 Cash ISA allowance before the reduced limit is introduced.

However, he cautioned against moving money into investments purely to avoid the lower cap.

He said: "It's important not to let the tax tail wag the investment dog people shouldn't feel pushed into investing simply because the Cash ISA cap is falling."

Two thirds of Cash ISA customers view £12,000 cap for under 65s unfavourably

|GETTY

According to Mr Sitaras, Stocks and Shares ISAs can provide opportunities for long-term tax-efficient growth, but savers should ensure any investment decisions align with their financial goals and tolerance for risk.

Aside from ISA diversification, he pointed to several alternative tax-efficient options available to households.

Premium Bonds allow individuals to shelter up to £50,000 from tax through monthly prize draws, although returns are determined by luck rather than a fixed interest rate.

The Personal Savings Allowance also remains an important factor, with basic rate taxpayers able to earn up to £1,000 in interest each year without paying tax.

At a four per cent rate, that means a basic rate taxpayer could hold £25,000 in a standard savings account before tax becomes due. Higher earners qualify for reduced allowances.

Junior ISAs offer another route for families wishing to save on behalf of children, allowing annual contributions of £9,000 per child.

LATEST DEVELOPMENTS

Rachel Reeves announced her Budget on Wednesday | POOL

Rachel Reeves announced her Budget on Wednesday | POOLThese accounts belong to the child and become accessible at age 18.

Polling by OnePoll among 563 Cash ISA holders highlighted dissatisfaction with the Government's direction on savings policy.

Three quarters of respondents said ministers should be encouraging saving rather than reducing access to tax-efficient accounts.

73 per cent said the lower allowance reduced the appeal of Cash ISAs, while 53 per cent described the reduction as unfair for those who had planned their finances around the existing £20,000 limit.

Nearly half of respondents, 44 per cent, said they would need to revise their savings plans in response to the announcement.

26 per cent said they expected to shift more money into investment products, while 20 per cent anticipated raising their workplace pension contributions as a potentially more tax-efficient alternative.

Despite the changes not taking effect until 2027, 53 per cent of those surveyed said they intend to use the full reduced £12,000 allowance once it is introduced.

Mr Sitaras said the announcement had created uncertainty among savers as they consider how best to adjust.

He described the public response as marked by "frustration, confusion and, for some, real concern about making the wrong move."

He said that although the modification to allowances may feel like a sudden rule change, a range of tax-efficient options remain available to those who take time to understand their needs.

Mr Sitaras emphasised the importance of choosing a savings or investment approach that reflects individual circumstances.

|GETTY

Mr Sitaras emphasised the importance of choosing a savings or investment approach that reflects individual circumstances.

"What matters most is choosing the right approach for your circumstances, whether that's cash, investments, or a blend of both."

According to the polling, 52 per cent of people believe financial advice will be essential in navigating the changes, with 41 per cent likely to seek guidance on maximising returns.

"The good news is no one has to figure this out alone," noting that specialist support is widely accessible for those who want it.

More From GB News