National Insurance overhaul from Rachel Reeves as Britons 'face higher levels of taxation'

Chancellor Rachel Reeves announces Labour will freeze income tax thresholds and equivalent National Insurance thresholds at their current level until 2031 |

GB NEWS

A tax threshold freeze and changes to salary sacrifice rules are among the National Insurance changes

Don't Miss

Most Read

Chancellor Rachel Reeves has announced major reform to National Insurance, which is expected to impact workers, employers and those preparing to save for retirement.

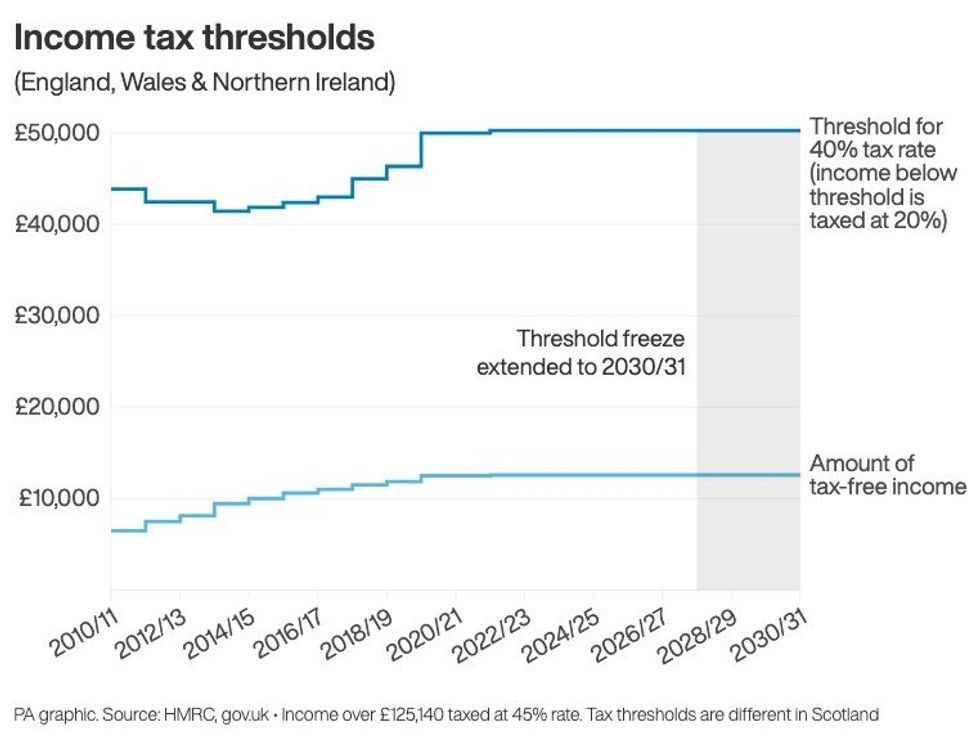

While addressing the House of Commons, the Chancellor confirmed the existing freeze on tax thresholds will be extended until 2030-31, which will also include National Insurance.

As such, more Britons will be impacted by fiscal drag, which occurs when incomes or inflation rise at a time when tax thresholds are keep at the same level over a period of time.

Due to this, more taxpayers face being pulled into higher brackets. With this move from the Chancellor, tax thresholds will stay the same for the 2028-29, 2029-30 and 2030-31 financial years.

What are the Chancellor's National Insurance changes?

|GETTY

This will lead to an estimated 920,000 extra higher rate taxpayers, according to the Office for Budget Responsibility (OBR).

Furthermore, salary-sacrifice contributions to workplace pension pots will now be slapped with a £2,000 cap from April 2029, at which point savings will no longer be exempt from National Insurance.

With this Budget reform, salary-sacrificed contributions above that limit will be subject to both employer and employee National Insurance, or 15 per cent and eight per cent, respectively for earnings under £50,270 and two per cent on income above that level.

Based on the OBR's projections, this tax policy policy is expected to raise £4.7billion in 2029-30 and £2.6billion in 2030-31.

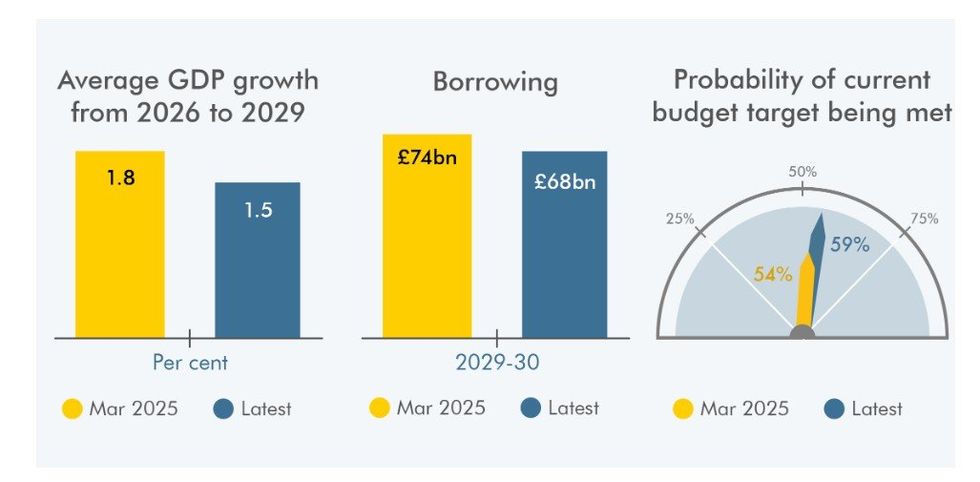

What is the state of the UK economy?

|OBR

What are the experts saying about the National Insurance threshold freeze?

Chris Ball, the chief executive of financial advisory firm Hoxton Wealth, broke down why the Chancellor's decision to keep thresholds at the same level will mean better financial management from everyday Britons.

He explained: "This seems to be a continuation of an ongoing trend, with more people being brought into higher tax bands almost surreptitiously.

"It does mean that tax planning becomes even more important, with people needing to make sure of their allowances, and to look at their contributions, because more people will be drawn into the £100,000. And so it just makes planning even more important."

The policy, which applies to income tax and national insurance contributions, will rake in £8.3billion for the Treasury in 2029/30, according to the OBR's estimates.

What are the experts saying about pension contributions being made liable for National Insurance?

Mr Ball added: "For lower and middle earners, changes to the salary sacrifice rules are going to have less impact than for those that earning far more than the average.

"They are going to be the ones paying the brunt. They are going to be facing higher levels of taxation, though it does deliver on Labour's manifesto promise of ensuring those with the broadest shoulders should be the ones to bear the brunt.

"But because introduction has been set at April 2029, implementation may not even happen and it could be retracted.

"The fact that it is not an immediate change could be reassuring, but people n need to maximise what they do in the next few years and not look at just pensions, but other tax vehicles for their own individual circumstances."

LATEST DEVELOPMENTS

How will the income tax threshold freeze impact you?

|PA

More From GB News