Pension system to be overhauled in 2026 - here are the three major reforms YOU need to prepare for

Rachel Reeves and the FCA are preparing changes to pension savings

Don't Miss

Most Read

Britain's pension system is set to experience a drastic overhaul in 2026, with three major reforms to affect the returns for millions of retirement savers across the country going forward.

Said reforms are part of Chancellor Rachel Reeves's policy agenda under the Labour Government, as well as regulations being enforced by the Financial Conduct Authority (FCA).

Here is a full list of the pension system changes coming this year:

- Nationwide introduction of pension dashboards

- New approach to financial guidance through the FCA's Targeted Support initiative

- Comprehensive legislation addressing poorly performing schemes alongside the growing challenge of fragmented pension savings.

Major pension reforms are on their way in 2026

|GETTY

Pension dashboards

This secure online tool, which is developed for everyone in the UK, allows people see all their pension information, including workplace, private and state pension pots, in one place for free

Pension dashboards will commence their phased introduction throughout 2026, with every retirement savings scheme obligated to establish connections by October 31.

It should be noted that the rollout schedule will differ based on the size and category of each pension arrangement, but providers are obligated to meet the autumn deadline.

Jonathan Watts-Lay, director at WEALTH at work, claims the dashboards will give people a view of all their pensions in one place, helping them make more informed decisions about their financial future.

Pension reforms are being rolled out by the FCA | PA

Pension reforms are being rolled out by the FCA | PA The Targeted Support regime

As confirmed last year, the UK's financial services regulator is preparing to launch its new Targeted Support scheme in April, though this remains subject to parliamentary approval.

This initiative from the FCA aims to fill the void between general guidance and comprehensive regulated financial advice for those preparing their finances for retirement.

Under the new framework, authorised organisations such as banks, building societies, pension providers, and employers operating workplace pension schemes will be permitted to provide customised recommendations to groups of people sharing comparable financial circumstances.

The approach is intended to make professional support both more accessible and cost-effective for individuals who might otherwise avoid seeking full financial advice due to expense or complexity.

LATEST DEVELOPMENTS

Pension Schemes Bill

The Pension Schemes Bill, anticipated to receive royal assent by mid-2026, targets both underperforming schemes and the proliferation of small pension pots generated through automatic enrolment.

Approximately 13 million deferred pension pots are currently valued at less than £1,000, with this figure growing by one million annually every year, Government data found.

A newly established Small Pots Delivery Group is creating a system to transfer qualifying pots to authorised consolidators, though implementation is expected around 2030.

The legislation additionally mandates "guided retirement" provisions, compelling defined contribution schemes to provide default solutions converting savings into retirement income.

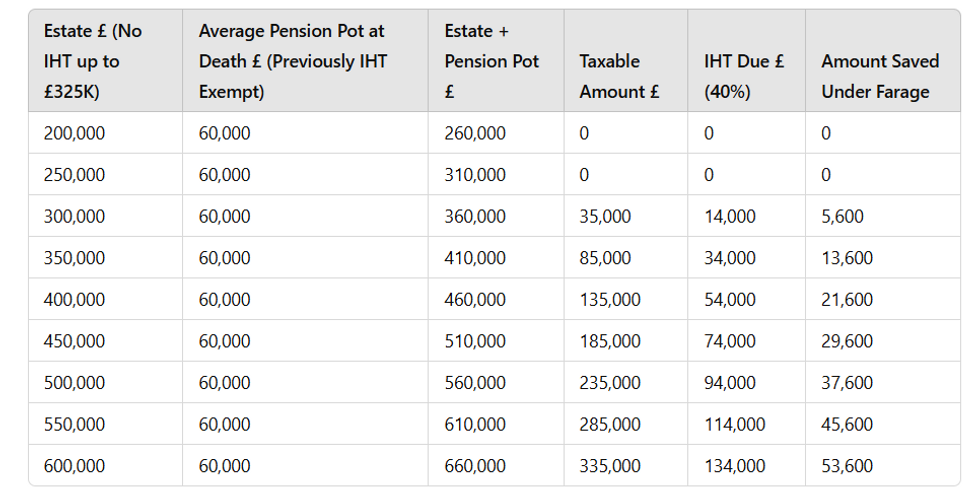

How much could you save? Pension pot | GBN

How much could you save? Pension pot | GBNMr Watts-Lay warns that defaulting individuals into standardised options risks repeating past issues seen with annuities, which resulted in people missed out on better deals.

Glyn Bradley, the chair of the IFoA Pensions Board, said: "The Pension Schemes Bill is a significant step in improving the UK pensions system. The IFoA supports the Government’s efforts to better support pension savers and stimulate growth in the economy.

"As the Bill progresses, there is a valuable opportunity to refine it further and deliver the strongest possible outcomes for pension savers across the UK. It is encouraging to see provisions in the Bill to promote better value for members from their pension plans.

"This will help to simplify the experience for savers, help them to plan their retirement and cut down on the complexity of drawing down pension income. There is still work to do."

More From GB News