State pension means-testing 'could guarantee its survival' as calls for DWP reform grow

The future of the state pension is in doubt

Don't Miss

Most Read

State pension payments should be means-tested to "guarantee its survival" amid the retirement benefit's growing cost, a former Conservative MP and member of the House of Lords has claimed.

Lord Craig Mackinlay of Richborough, who is also a chartered accountant, and previously served on the Department for Work and Pensions (DWP) and Public Accounts Select Committees, is calling for reform to the retirement benefit.

Britain's contributory state pension reaches its centenary this month, with Britons currently needing 35 years of National Insurance contributions to claim the full, new amount.

Concerns have been raised over the DWP retirement benefit's cost with the Office for Budget Responsibility (OBR) warning the state pension will be £10billion a year more expensive by 2029-30.

A former MP is calling on the state pension to be means-tested

|GETTY

Writing in The Telegraph, Lord Mackinlay said: "Can the increasingly top-heavy population age pyramid , which is heading towards two workers per pensioner, generate enough tax to support the retired?

"Is the current plan for a retirement age of 68 beyond 2046 enough? What about the escalating cost of healthcare across an ageing population? So what will Rachel Reeves do?

"She’s currently facing the conundrum of what to do about tax from April 2027 when the state pension will exceed the frozen personal allowance of £12,570 a year.

"After 100 years of universality, perhaps means-testing will be her wizard solution. Doing so could become another uniquely bad British incentive to drop out and rely on the state."

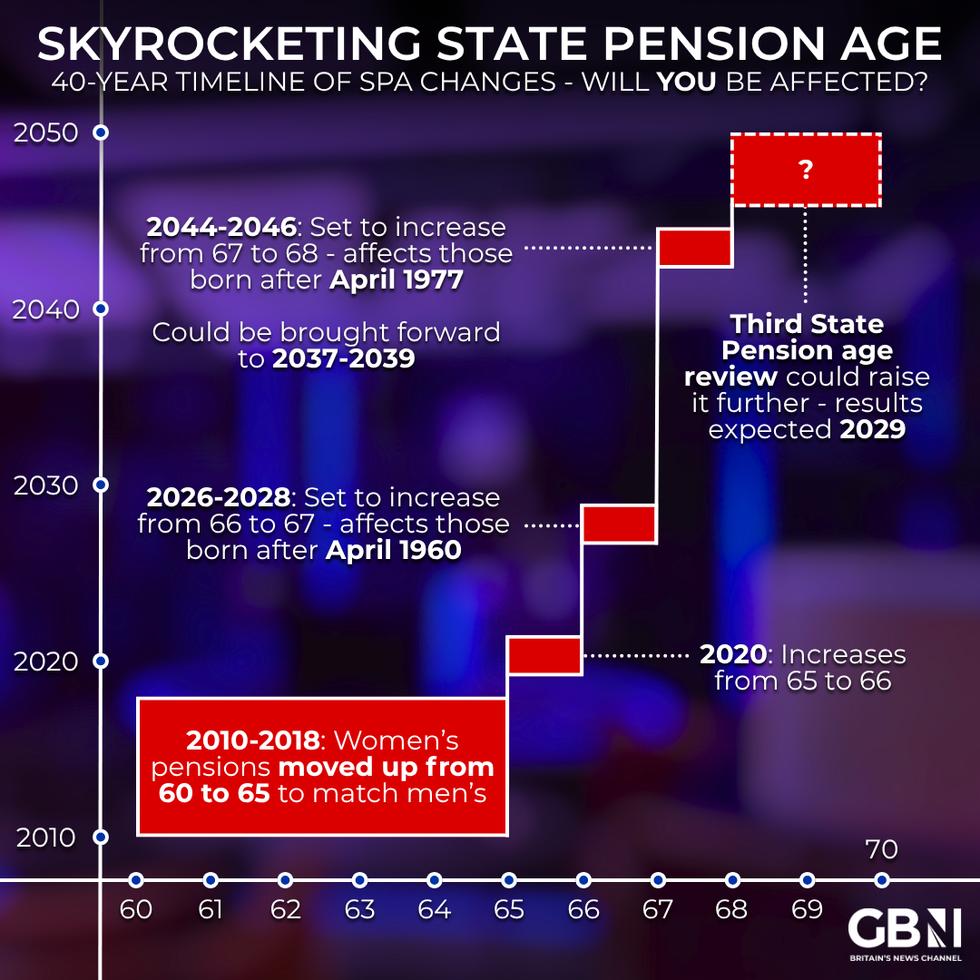

Are you affected by state pension age changes? | GETTY

Are you affected by state pension age changes? | GETTYLATEST DEVELOPMENTS

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR According to research conducted by Pensions UK, some 89 per cent agree that the state pension should always rise with the cost of living, which has been guaranteed thanks to the triple lock.

Under the triple lock payment mechanism, state pension rates rise every year in line with either inflation, average wage growth, or 2.5 per cent; whichever is the highest figure.

When asked which pension-related issues the Government should prioritise, keeping the state pension rising with inflation (58 per cent) and ensuring it is enough to live on (56 per cent) were the top concerns.

Other priorities of the British public included keeping pension tax rules simple and stable (28 per cent) or improving financial education for younger people (26 per cent).

These findings come as the Government’s Pension Schemes Bill is making its passage through Parliament, highlighting public expectations for reforms that secure a fairer and more adequate foundation for retirement income.

Zoe Alexander, the executive director of Policy and Advocacy at Pensions UK, said: "Households are under pressure, but what really stands out is that people are continuing to save through automatic enrolment, and indeed 65 per cent of people believe contributions should go up.

"This demonstrates both the value people place on retirement security and the power of automatic enrolment. It puts the onus on politicians and industry, and the current Pensions Commission, to make sure the system works well for as many savers as possible.

"Encouragingly, many of the reforms in the Pension Schemes Bill, such as action on small pots, guided retirement products and a new value for money regime, reflect what the public want and what Pensions UK has long called for.

Pensioners could be at a heightened risk | GETTY

Pensioners could be at a heightened risk | GETTY "Our research shows that people want Government to focus on protecting the value of pensions and helping them grow steadily over time."

Chancellor Rachel Reeves has pledged to keep the triple lock in place at least until the end of this Parliament, which will end on April 2026.

Alternatives to the triple lock have been suggested, including linking state pension payment hikes solely with either average wage growth or inflation as part of a double lock.

Furthermore, some economists have suggested the state pension age should be raised to as high as 70 to bring down the cost of the benefit on the public purse.

More From GB News