Fears surge of global financial meltdown as US bank COLLAPSES in biggest failure since 2008 - 'This is just the beginning'

Silicon Valley Bank (SVP) was put under US government control on Friday

|Reuter

The collapse of a US bank has sparked fears about the state of the banking sector

Don't Miss

Most Read

Latest

Concerns over a global financial crash have surged after Silicon Valley Bank (SVP) was put under US government control in the biggest failure of a US bank since the 2008 financial crisis.

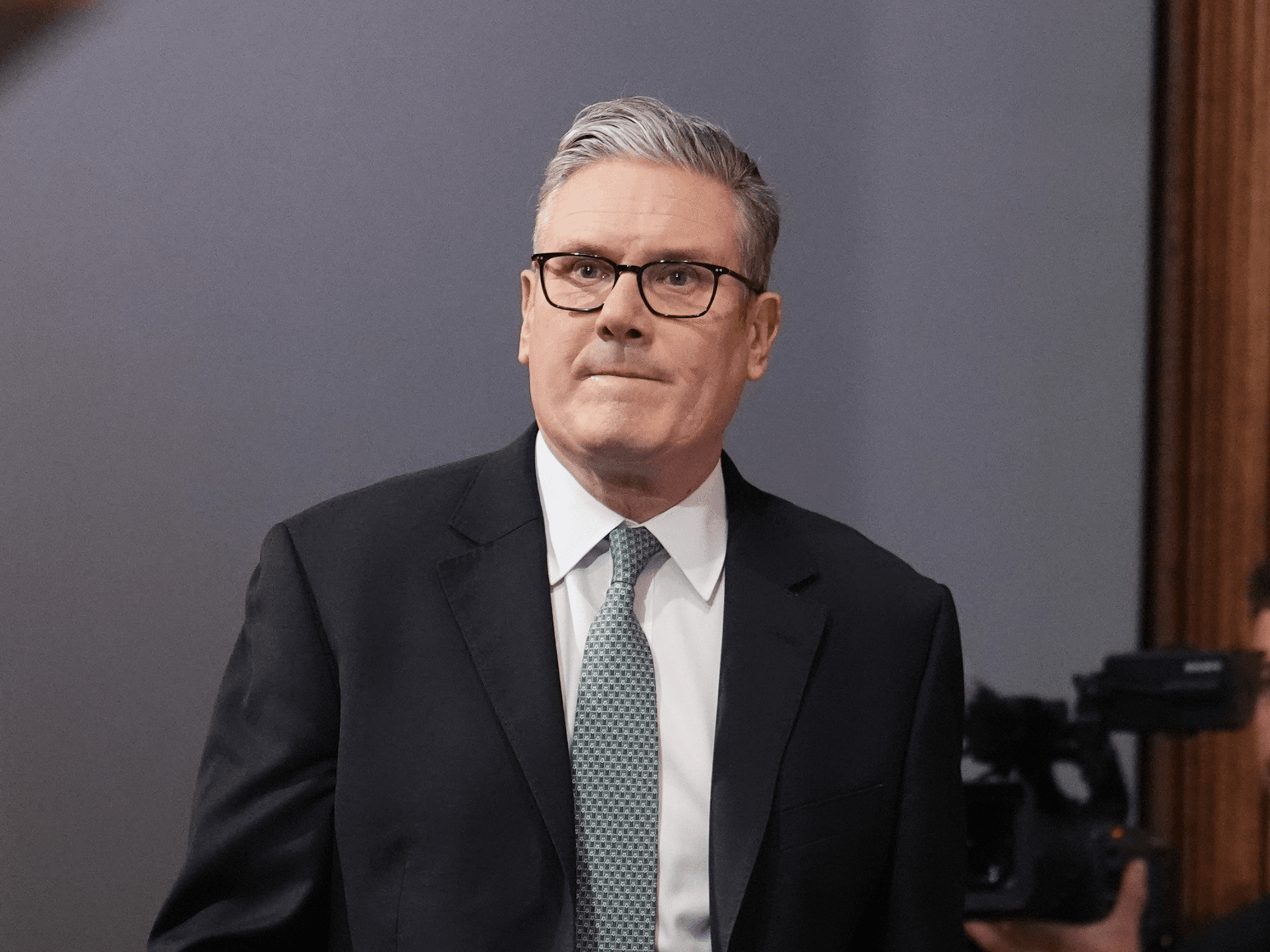

The collapse poses “serious risk” to businesses worldwide as Chancellor Jeremy Hunt, Rishi Sunak and the Governor of the Bank of England held crisis talks last night over concerns for the UK’s tech and life science sectors.

The Bank of England said it would apply to place SVPUK into a Bank Insolvency Procedure and the firm will stop making payments or accepting deposits.

SVBUK is a subsidiary of Silicon Valley Bank and was the first location it opened outside the US.

Chancellor Jeremy Hunt held crisis talks last night over concerns for the UK’s tech and life science sectors

|PA

The UK Government have promised to “minimise” damage to British firms from SVB's collapse and issued assurances there is no “systemic risk” to the UK's financial system.

But business leaders in Britain have raised concerns that the failure could cause further problems in the UK, warning that they could face going bust if they can’t get their funds from the bank, which could result in thousands of job losses.

Shadow Chancellor Rachel Reeves said the British start-up industry must not “pay the price” for the failure of Silicon Valley Bank UK.

There are also fears that the crash will spread across the world with bases in China, India and in Europe.

While there is no risk to the UK’s financial system as a whole, Hunt said “there is a serious risk to our technology and life sciences sectors, many of whom bank with this bank”.

“The Prime Minister and I and the Governor of the Bank of England are absolutely determined to do everything we can to protect the future of these very, very important companies,” Hunt said.

“We want to find a way that minimises or, if we possibly can, avoids all losses to those incredibly promising companies.

“What we will do is bring forward very quickly a plan to make sure that they can meet their operational cash flow requirements.”

The Chancellor declined to say whether the Government will guarantee 100 per cent of the deposits companies had with the lender or whether it could mean stepping in with taxpayers’ money.

Financial expert Harvey Jones claims that the crash “is just the beginning” which could result the collapse of the UK housing market.

A financial expert claims that the UK bank crash could cause the UK's housing market to collapse

|PA

“Why is this happening now? The answer is that we are paying the price for decades of free and easy money, which saw central bankers respond to every financial problem by slashing interest rates ever lower, and pumping out yet more monetary stimulus,” he told The Express.

“For years, I moaned this was only building up problems for the future, as cheap money inflated asset values everywhere, but particularly house prices.

“We should have had a correction after the financial crisis, but the Bank of England averted that by slashing base rates to 0.5 percent in March 2009.

“So prices flew even higher. The same happened in 2020, during the pandemic. Another blast of low interest rates and monetary stimulus, and prices rocketed again.

“Markets expect the BoE to increase bank rate to 4.25 percent on March 23, but it will have to go even higher unless we get lucky and inflation starts falling sharpish.

“If base rate hits six percent over here, too, then mortgage rates will fly to seven or eight percent and it's finally game over for the housing market.”