Older Britons at 'particular risk' of £6bn stealth tax on savings interest: 'Millions have to pay!'

Analysts have issued a warning about a tax raid on savings

Don't Miss

Most Read

Older Britons are at risk of being slapped with tax on savings interest as part of a £6billion HM Revenue and Customs (HMRC) raid later this year, financial experts are warning.

Bank and building customers have been impacted by frozen tax allowances which have been breached by rising savings interest, resulting in fiscal drag.

This issue has been partially exacerbated by the Bank of England's decision to raise interest rates, which has seen savers awarded with higher returns.

Despite the Bank of England's recent base rate reduction, approximately one in 15 taxpayers across Britain will face taxation on their savings this financial year, according to new data from AJ Bell.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

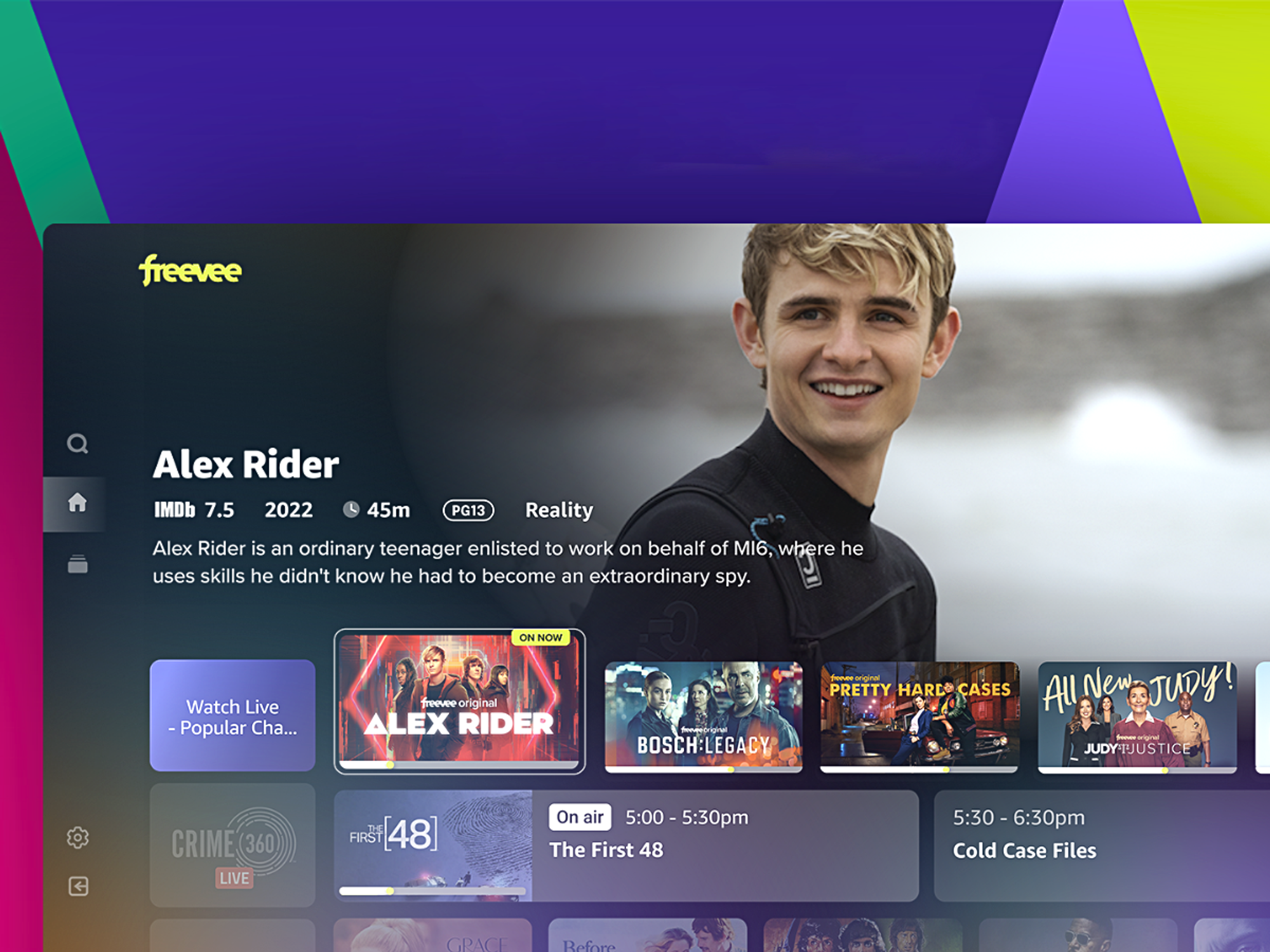

GETTY

|Experts have issued a warning about the impact of a tax on savings

The investment platform's Freedom of Information request revealed that UK savers collectively earn roughly £20billion annually from non-ISA cash accounts, resulting in an estimated £6billion national tax liability.

"Even though the Bank of England cut interest rates this week, millions of savers will still be hit with a tax bill for their savings interest," warned Laura Suter, AJ Bell's director of personal finance.

Current savings rates mean taxpayers require far smaller deposits before encountering tax obligations.

With leading easy-access accounts offering 5.1 per cent, basic-rate taxpayers exceed their £1,000 annual tax-free threshold with just £19,600 in savings.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

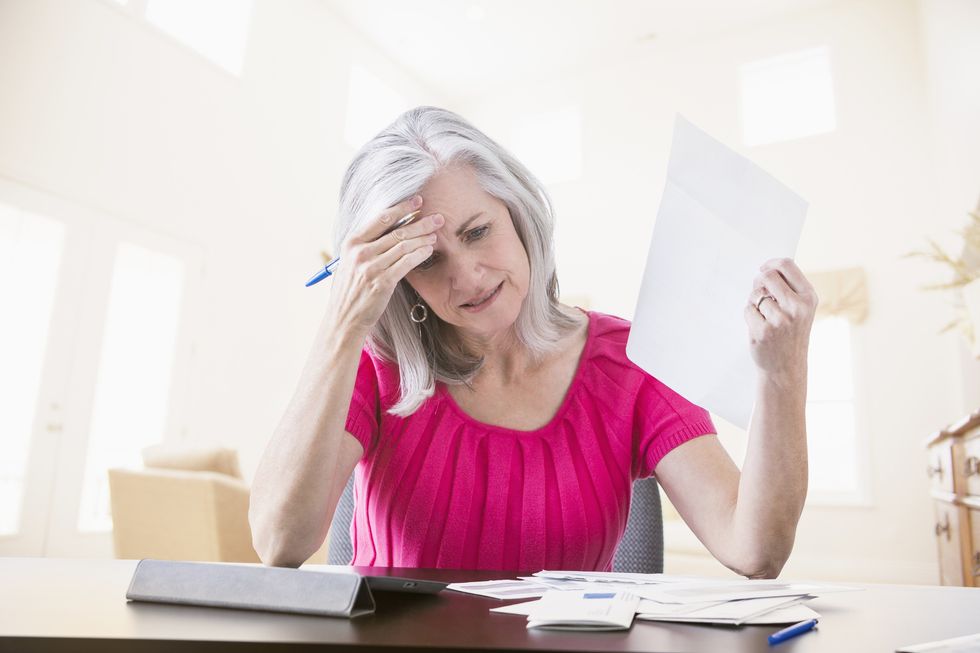

GETTY | Britons could pay more tax on their savings, according to new research

GETTY | Britons could pay more tax on their savings, according to new research

Higher-rate taxpayers face even tighter constraints, needing only £9,800 before surpassing their reduced £500 allowance.

Additional-rate earners receive no personal savings allowance whatsoever, paying 45 per cent tax on all interest earned.

"Many won't realise that even having relatively modest sums in their savings accounts could land them with a tax bill," Suter explained.

The situation represents a dramatic shift from recent years when significantly larger deposits were required to trigger tax liabilities.

In December 2021, basic-rate taxpayers could hold £154,000 before reaching their tax-free limit, compared to today's £19,600 threshold.

When base rates sat at 0.1 per cent, savers needed £1million to generate £1,000 in annual interest. Now, the same tax-free amount is reached with deposits below £20,000.

"As interest rates have been cut from their peak, many savers may assume the problem with being hit with a tax bill for their cash savings is in the rear-view mirror, but savings rates are still far higher than years ago, meaning millions will have to pay tax," Suter noted.

Pensioners approaching or in retirement face particular vulnerability to these unexpected tax charges. Many accumulate substantial cash reserves for retirement spending, preferring liquid assets over investment risk.

LATEST DEVELOPMENTS:

GETTY | Fiscal drag is dragging Britons into higher tax brackets

GETTY | Fiscal drag is dragging Britons into higher tax brackets

"Older savers who are nearing retirement are particularly at risk of an unwanted tax bill for their cash savings," Suter observed.

She noted that rising state pensions consume increasing portions of personal allowances, potentially pushing retirees into higher tax brackets when combined with other pension income.

According to the finance analyst transferring funds into ISAs offers protection but requires time. Someone with £100,000 today would need until 2030 to shelter their entire pot within ISA wrappers.

Furthermore, Suter highlighted that couples can reduce liabilities by transferring assets to the partner in the lower tax bracket and maximising both partners' allowances.