Savings disaster as Britons have lost £3k to inflation despite high interest rates: 'Loyalty does not pay!'

Savers urged to be careful of tax on savings interest |

GB NEWS

Despite savings interest rates being high, inflation has eroded returns for bank customers over the years

Don't Miss

Most Read

British savers have suffered significant losses of nearly £3,000 as their money fails to keep pace with rising inflation-hiked prices, according to new research. Analysts are warning that at least £660billion is now languishing in accounts that cannot match the current 3.6 per cent inflation rate.

Experts are sounding the alarm that the typical saver has seen their wealth diminish by £2,991 in real terms over the past five years, as interest rates have consistently fallen short of inflation levels.

According to a Finder survey, the situation has worsened as underperforming account balances jumping by almost £200billion since January alone, representing a 36 per cent surge in just four months.

The erosion of the value attached to savings account has continued, with inflation exceeding typical variable cash ISA returns for 51 of the past 60 months, which is 85 per cent of the time.

Analysts are breaking down how savers are losing money to inflation

|GETTY

Research indicates that if interest rates had matched inflation since June 2020, the average British adult's £16,000 in savings would have grown to £20,287.

Instead, those funds placed in a standard variable cash ISA five years ago would be worth merely £17,296 today.

Notably, inflation climbed to 3.6 per cent in June, up from 3.4 per cent in May, whilst the total number of accounts earning 3.50 per cent or below has risen by nine million to reach 67.6 million.

Derek Sprawling, Spring's the head of Money, warned that the mounting total represents "a wake-up call for savers" as their money's real value steadily diminishes.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savers are losing money to interest rate cuts and inflation | GETTY

Savers are losing money to interest rate cuts and inflation | GETTY"It's time to review where your money is held and ensure it's working harder for you. Look for providers offering rates above 3.50 per cent - anything less means your savings are losing value in real terms," he said.

Kate Steere, personal finance expert at Finder, cautioned that continued inflationary pressures make immediate action essential.

"Loyalty doesn't pay, so make sure you're seeking out the best inflation-beating rates on the market," she advised.

Savers can find accounts paying above inflation, with some easy access options offering over 4 per cent returns and certain regular savings accounts reaching approximately seven per cent.

As it stands, the Bank of England has held the UK's base rate at 4.25 per cent but is expected to slash the cost of borrowing at least twice by the end of the year.

Savers are being urged to take advantage of competitive deals as soon as possible before these rate cuts are passed onto traditional savings accounts.

LATEST DEVELOPMENTS:

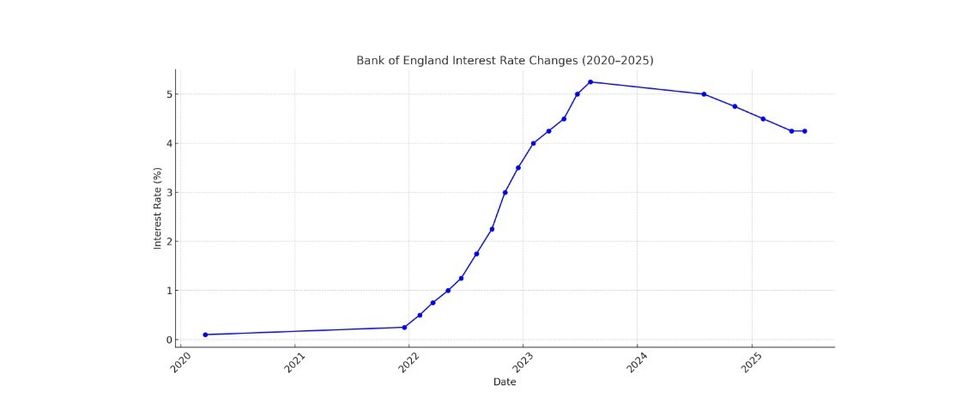

The Bank of England has made changes to interest rates in recent years | GETTY

The Bank of England has made changes to interest rates in recent years | GETTY Following the recent jump in inflation, Kevin Mountford, a personal finance expert and co-founder of Raisin UK, said: "The bigger issue is that too much money remains idle.

"Around £375billion of UK savings is in accounts earning zero interest, and more than £1trillion is earning less than the target inflation rate of two per cent. With prices rising faster than savings balances, many people are unknowingly losing money in real terms.

"And even with some current 'high-interest' accounts, not all deals are created equal. Some come with strings attached – rates that drop if you withdraw early, or only apply under specific conditions.

"Other low-paying accounts quietly rely on customer inertia, hoping savers won’t take the time to move their money."

More From GB News