Best savings interest rates of the week: Full list of the top accounts that 'trump inflation'

The rate of inflation for the 12 months to December 2023 rose to four per cent

Don't Miss

Most Read

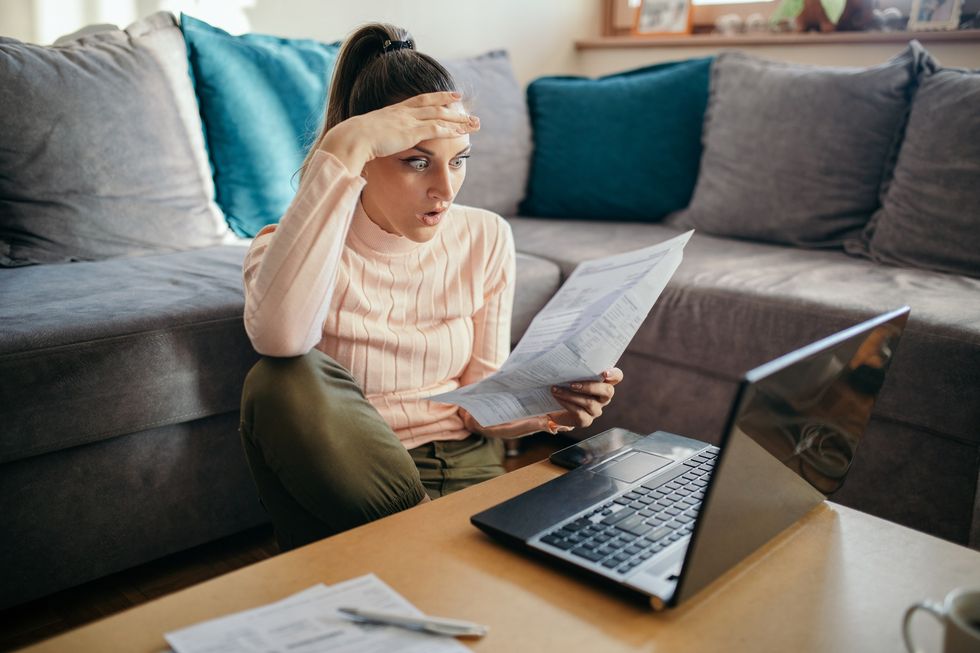

Savings interest rates in the UK are continuing to beat inflation but experts are warning that high street banks and building societies are beginning to “significantly” slash rates.

There are currently 967 savings accounts that are higher than the Consumer Price Index (CPI) rate, according to Moneyfactscompare.

Figures from the Office for National Statistics (ONS) confirmed the CPI rate increased to four percent last month which is higher than the Bank of England’s desired rate for inflation.

Compared to previous years, savings interest rates are exceeding inflation. In January 2023, there were no savings deals that could beat the previous month’s CPI inflation rate of 10.5 per cent.

Savings interest rates are beating inflation in most cases but high street banks and building society have begun cutting rates

Similarly, January 2022 saw no deals that could beat the CPI inflation rate of 5.4 per cent for December 2021.

Here is a breakdown of the top savings deals at £10,000 gross as of today, according to https://Moneyfactscompare.co.uk :

- Easy access account – Ulster Bank – 5.20 per cent

- Notice account – FirstSave – 5.40 per cent

- One-year fixed rate bond – SmartSave – 5.31 per cent

- Two-year fixed rate bond – Union Bank of India (UK) Ltd – 5.15 per cent

- Three-year fixed rate bond – Al-Rayan Bank 4.86 per cent

- Four-year fixed rate bond – Bank of Ceylon (UK) Ltd (Raisin UK) – 4.55 percent which is payable on interest.

However, experts are urging savers to consider challenger banks instead of high street institutions which have been “significantly cutting rates” in recent weeks.

GB News has previously reported on the recent wave of rate reductions to savings products by banks and building societies.

Interest rates have been boosted following the Bank of England’s decision to raise the country’s base rate 14 consecutive times to 5.25 per cent.However, analysts are betting on the base rate being cut in the later half of this year which high street banks and building societies appear to be pricing in.

James Hyde, a spokesperson at Moneyfactscompare.co.uk, highlighted there are just under 1,000 savings deals which currently “trump inflation” but noted certain rates have fallen.

LATEST DEVELOPMENTS:

Savers have benefited from the Bank of England's base rate hikes

| PAHe explained: “We recently saw the highest month-on-month drop to fixed savings rates in 15 years, but variable rates have remained fairly steady despite the fluctuation of other factors.

“With some no notice accounts still paying over five per cent interest, their instant accessibility may be a tempting factor for those not wishing to lock money away for a defined period.

“Despite many providers across the sector significantly cutting rates in recent weeks, challengers banks have continued to occupy the top positions in the charts.

“These providers are often able to offer very competitive deals, however their readiness to pull top rates once targets have been hit means it’s imperative to strike while the iron is hot to secure the best deal.”