Santander launches market-leading mortgage rate as price war heats up - but there's a catch

New fixed rate product triggers industry reaction as major lenders cut prices ahead of year end

Don't Miss

Most Read

Mortgage brokers have said a rate war is underway after Santander unveiled a 3.51 per cent fixed rate mortgage on Friday.

The announcement from the Spanish owned lender has prompted strong reactions across the industry, with experts suggesting the move indicates intensifying competition as the year ends.

The new residential home mover product, available as both two year and five year fixed deals, will launch on Tuesday.

Ranald Mitchell, director at Charwin Mortgages in Norwich, said: "Santander has just thrown a huge snowball into the mortgage market, and it's kicked off an all out winter rate fight".

TRENDING

Stories

Videos

Your Say

The pricing follows Nationwide's reductions announced yesterday.

However, the headline interest rate comes with restrictions that will exclude a significant portion of borrowers.

The deal has a £1,999 arrangement fee, although Santander is offering £250 cashback.

The product is also limited to loans between £500,000 and £2million.

Borrowers must have sizeable deposits or equity because the mortgage is restricted to 60 per cent and 75 per cent loan to value requirements.

Shaun Sturgess, director at Sturgess Mortgage Solutions in Swansea, said: "The catch? It comes with a £1,999 fee and only applies to loans between £500,000 and £2million, so it's hardly one for the average South Wales buyer".

Santander unveiled a 3.51 per cent fixed rate mortgage on Friday

|GETTY

He said opportunities to borrow at those levels in Swansea would be limited.

Mr Sturgess said the move could still have wider effects across the market.

He said: "On the surface, Santander's 3.51 per cent rate looks like a cracking move and a real show of confidence from lenders as we head into the festive season".

He said reductions from large lenders often influence pricing decisions elsewhere.

Mr Sturgess said: "Moves like this tend to ripple through the market and could spark some healthy festive competition among lenders great news for anyone looking to secure a deal before the year is out".

The comments reflect optimism among mortgage professionals that competitive pressure may push rates lower across a broader range of products, even if many borrowers cannot access Santander's headline deal.

LATEST DEVELOPMENTS

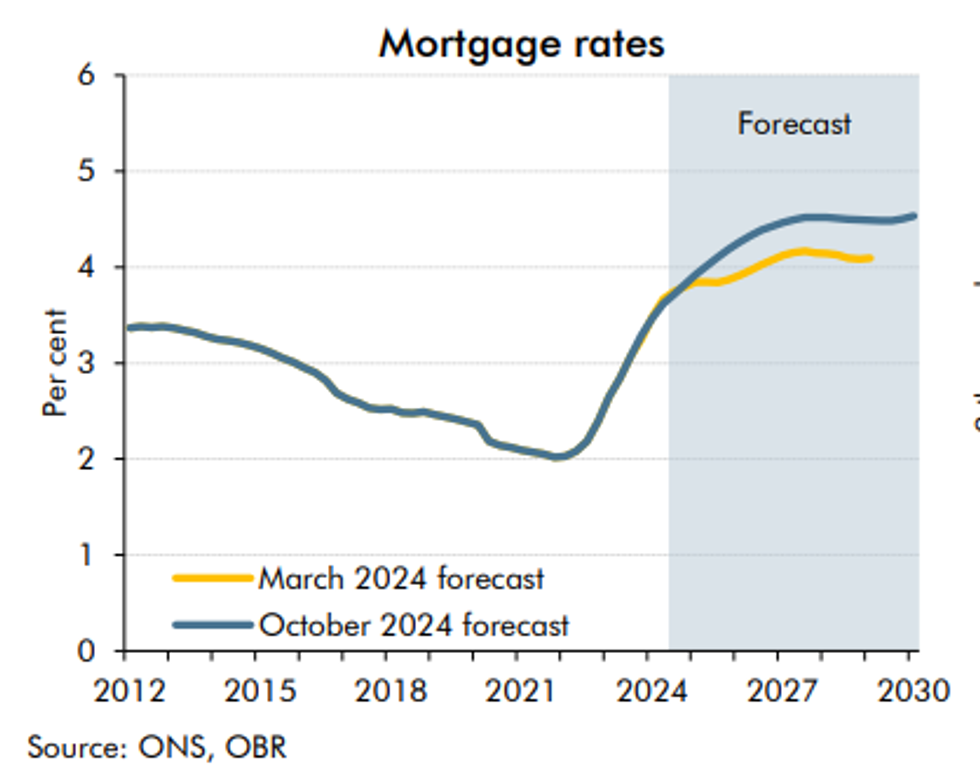

Mortgage rates are set to fall in a boost for holders | OBR

Mortgage rates are set to fall in a boost for holders | OBRJack Tutton, director at SJ Mortgages in Fareham, said the announcement arrives shortly after Nationwide lowered its prices.

Mr Tutton said: "Just as the UK temperature starts to dip, Santander are hot on the heels of Nationwide to bring some much needed heat to the mortgage market".

He noted that both lenders had made notable reductions over the previous 48 hours.

Mr Tutton said: "With the cost of borrowing continuing to fall, more lenders should start to reduce their offerings, which could make for a competitive rate war as the year ends".

Mr Mitchell said the latest cuts were not subtle adjustments.

He described them as "crowd pleasing cuts from a lender that clearly wants to dominate the home mover space".

Mr Mitchell said: "When a bank of this size starts slashing rates and adding cashback sweeteners, it tells you the mood of the market has flipped".

He added: "Lenders are hungry, borrowers suddenly have real power again, and 2026 is shaping up to explode out of the blocks. For anyone looking to move home, this is the best tailwind we've seen in months and it's only going to get better".

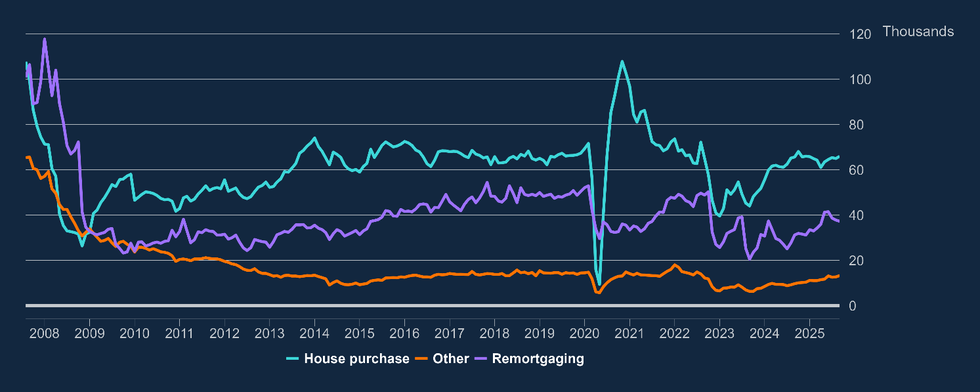

Net mortgage approvals increased by 1,000, to 65,900 in September | Bank of England report

Net mortgage approvals increased by 1,000, to 65,900 in September | Bank of England reportRiz Malik, director at R3 Wealth in Southend on Sea, said lenders appear to be preparing for next year.

Mr Malik said: "Mortgage lenders are getting ready for 2026 and Santander, on this evidence, wants to get in early. With next year being a big renewal year for many borrowers as they come off ultra low fixed rates, some have just been delivered an early Christmas present from Santander".

David Stirling, independent financial adviser at Mint Wealth Ltd in Belfast, said lenders may continue adjusting pricing in the coming weeks.

Mr Stirling said: "We may see lenders racing to meet their year end targets over the next few weeks. 2025 isn't quite finished yet, and 2026 is looking quietly optimistic".

More From GB News