Retirement age 'hopes' among British public wane amid pension savings 'uncertainty'

Finance expert discusses how Reeves should deal with rising pension costs.mp4 |

GB NEWS

Standard Life's research is shining light on the 'uncertainty' people have over their retirement future

Don't Miss

Most Read

Latest

The British public's retirement age "hopes" are warning as widespread "uncertainty" over the future of pension savings grow, according to damning new analysis from Standard Life.

Based on the firm's research, the typical employee dreams of leaving work at 62 but anticipates working until 67 which has been coined the "Retirement Expectation Gap"

According to Standard Life, more than a third of working-age adults anticipate their living standards will decline in retirement compared to their current situation.

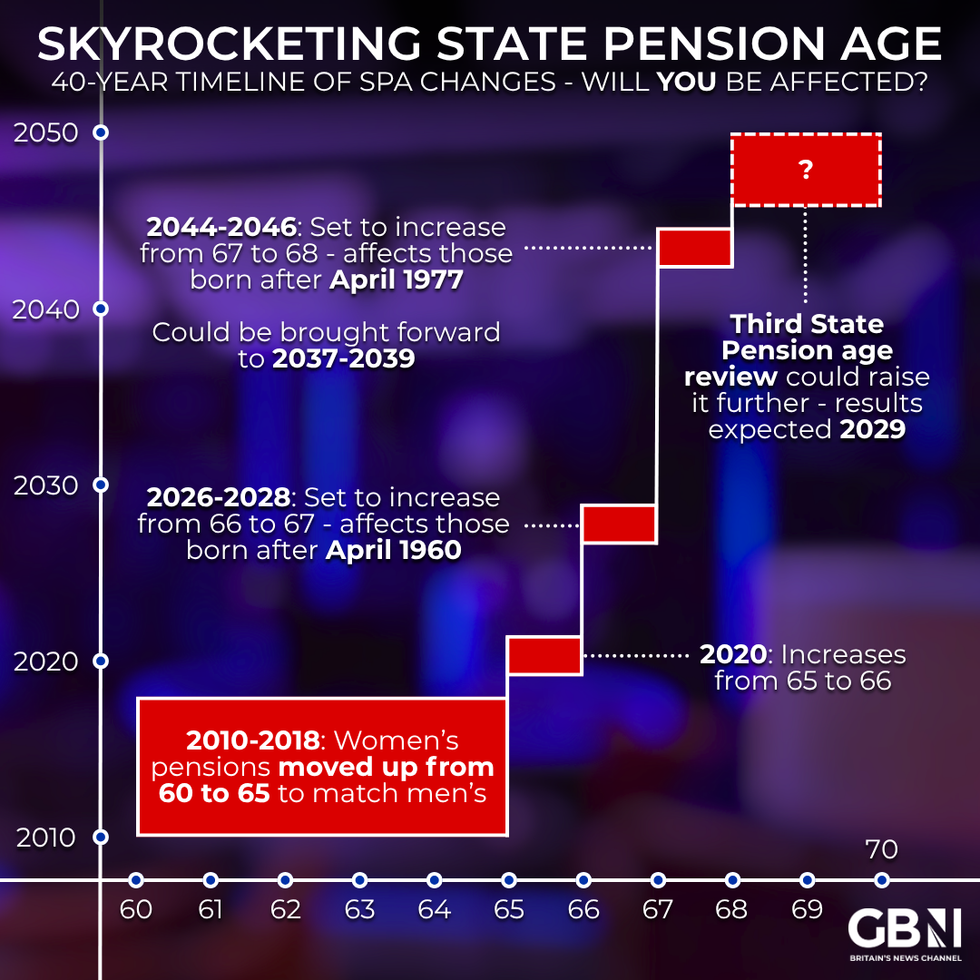

Additionally, fewer than half of workers feel confident they could maintain their current role or similar employment until age 70. These findings emerge as the state pension age prepares to increase from 66 to 67 between 2026 and 2028.

Research suggests peoples' retirement 'hopes' are different to their expectations

|GETTY

Geographic disparities paint a troubling picture across Britain. Workers in the North East confront the nation's widest retirement expectation gap at 5.9 years, whilst Yorkshire and Humber residents face a 5.3-year divide.

London workers experience the smallest disparity at 3.5 years, creating a 2.4-year regional variation. The East of England and South East both record 5.3-year gaps, while Scotland and Wales each show 4.9-year differences.

Housing circumstances dramatically influence retirement prospects. Tenants encounter a 6.1-year gap between hopes and expectations, compared with 5.2 years for mortgage holders and merely 2.4 years for those who own properties outright.

Income levels similarly shape retirement outlooks. Households earning below £30,000 annually face a 6.2-year gap, narrowing progressively to just two years for the highest earners.

Skyrocketing state pension age - will you be affected? | GB News

Skyrocketing state pension age - will you be affected? | GB NewsPension awareness remains alarmingly low amongst British workers. Fewer than one in five correctly identify the current state pension age as 66, while confidence in future provision has plummeted.

Only 29 per cent believe the triple lock protection will survive until their retirement. Just over half expect the state pension to remain universally available when they reach retirement age.

Workers without pension savings face a 6.5-year expectation gap, compared with 4.7 years for defined contribution scheme members and 2.5 years for those with defined benefit pensions.

Personal pension holders experience the smallest gap at 2.1 years. Financial planning significantly reduces the disparity. Lower-income households earning under £30,000 who engage extensively with retirement planning shrink their gap from 8.1 to 4.7 years.

Catherine Foot, Director of the Standard Life Centre for the Future of Retirement, emphasised the significance of the firm's latest report.

She explained: "Standard Life's Retirement Voice report is a vital barometer of public attitudes, giving us a sharp picture of how people are feeling about retirement, and where action is most urgently needed."

Ms Foot added: "Two decades ago, the independent Pensions Commission helped transform retirement saving by creating auto-enrolment.

"This has brought millions of people into regular workplace pension saving, but it’s clear that average rates of saving are too low to give most people a decent income in retirement.

LATEST DEVELOPMENTS:

DWP minister Liz Kendall has launched a new Pensions Commission | PA

DWP minister Liz Kendall has launched a new Pensions Commission | PA"With the Commission now revived, there is an opportunity to deliver even bolder action – building on the groundwork of auto-enrolment to tackle pension adequacy, in the context of longer working lives and the ongoing State Pension age review, to help people get one step closer to achieving their retirement aspirations."

She highlighted how the expectation gap varies significantly based on location, earnings, pension provisions and property ownership.

However, Ms Foot stressed that while individuals can take steps to narrow their personal gaps through planning and increased contributions, systemic changes remain essential.

"However it isn't only the pensions system that needs to adapt," Foot added. She called for workplace evolution embracing flexibility, enhanced carer support and non-linear career paths enabling retraining or re-entry in later life.

More From GB News