State pension triple lock 'questioned' as future payments may not be 'fit for the future'

Finance expert discusses how Reeves should deal with rising pension costs.mp4 |

GB NEWS

PensionBee's analysis indicates there is a generational divide in support for the state pension triple lock

Don't Miss

Most Read

Latest

The state pension triple lock is being "questioned" as future payments from the Department for Work and Pensions (DWP) may not be "fit for the future", according to alarming new analysis.

Fresh research from PensionBee is sounding the alarm over the dramatic generational split which has emerged in relation to the mechanism used for raising pension rates every year.

Four in five pensioners aged 65 and above back the triple lock, based on the latest polling, while merely a fifth of those aged 18 to 24 share the same view.

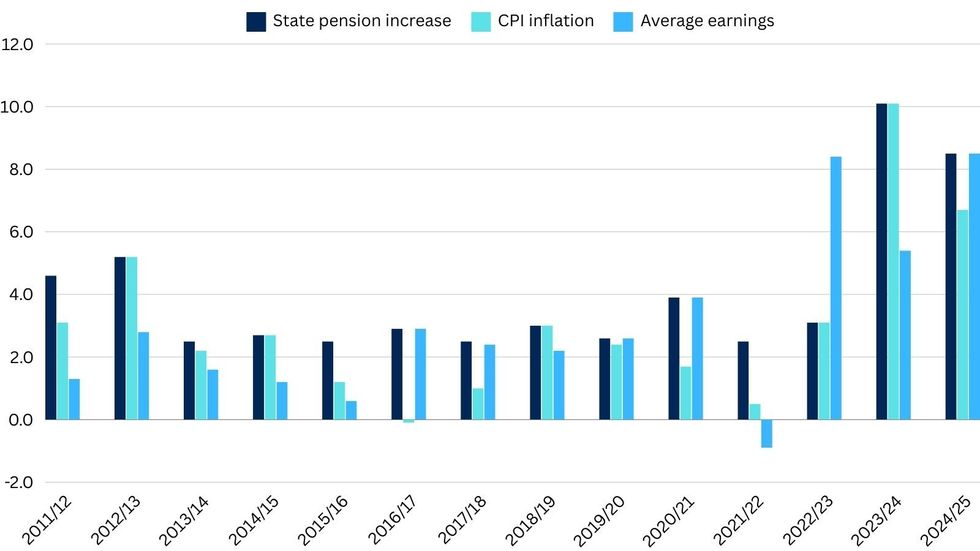

Thanks to the triple lock, state pension payment rates jump annually by either the rate of inflation, average wages or 2.5 per cent; whichever is highest.

The state pension may not be 'fit for the future', analysts claim

|GETTY

Analysts note this nearly fourfold gap between age groups underscores contrasting perspectives on financial security and differing life circumstances.

The findings arrive as ministers prepare their Autumn Budget amidst fiscal constraints, despite government pledges to preserve the triple lock throughout this parliamentary term.

The research indicates that while nearly half of all participants consider maintaining the triple lock important for pension policy, attitudes vary dramatically by age.

Public appetite for reforming the triple lock appears to be growing. More than a quarter of those surveyed favour limiting the policy to pensioners on lower incomes whilst reducing it for wealthier recipients.

House of Commons Library data shows how the state pension has increased since 2011/12 | GB NEWS | House of Commons Library data

House of Commons Library data shows how the state pension has increased since 2011/12 | GB NEWS | House of Commons Library dataYounger demographics particularly favour conditional approaches. Approximately a third of 25 to 34-year-olds support restricting the triple lock during inflationary periods.

A quarter of 18 to 24-year-olds believe it should apply solely when economic growth is robust, contrasting sharply with just two per cent of over-65s holding this view.

Additionally, a third of all participants would support abandoning the triple lock completely, preferring pension increases tied solely to inflation rates.

Lisa Picardo, Chief Business Officer UK at PensionBee, stated: "These figures expose a growing generational fault line around the triple lock.

"For many older savers, it is a lifeline that must be protected at all costs.While younger people may favour adjustments to how it is delivered, the reality is that in the short term, the triple lock is here to stay.

"What is clear is that the debate has moved beyond whether the triple lock should exist. The real question now is how it can be made sustainable, fair, and fit for the future.

"Policymakers must strike a careful balance: protecting the dignity of today's and tomorrow's retirees on one hand; and on the other, solving for sustainability and the weight of the tax burden borne by those contributing into the system now and in the future."

LATEST DEVELOPMENTS:

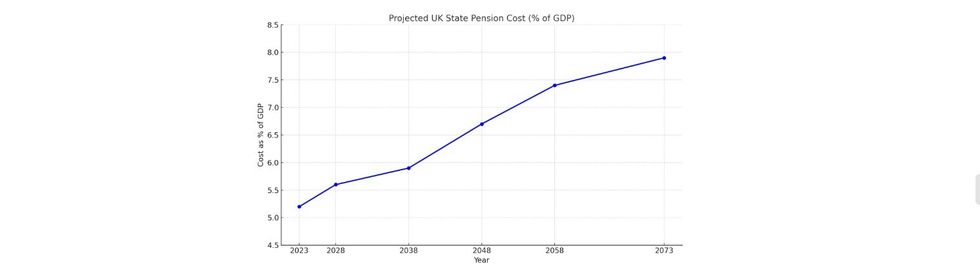

How much will the state pension cost as a percentage of gross domestic product (GDP) ? | ONS / CHAT GPT

How much will the state pension cost as a percentage of gross domestic product (GDP) ? | ONS / CHAT GPT They shared: "Every percentage rise costs billions, and with an ageing population, that bill is only getting bigger. Economists are clear: while the triple lock is politically popular, it risks becoming unsustainable by the 2030s when pension costs will take up an even greater share of public finances.”

"Pension rises look good on paper, but frozen personal allowances mean retirees don’t always feel the full benefit. This is called fiscal drag – where an increase in pension income simply pushes people into tax thresholds.

"Many pensioners who only rely on the state pension will soon find themselves paying tax for the first time, while those with workplace or private pensions are already there.”

"The Government has pledged to maintain the triple lock until the end of this parliament, but beyond that, nothing is guaranteed. No party wants the backlash of scrapping it outright, but behind the scenes, reform is a live discussion."

More From GB News