Rachel Reeves accused of turning UK economy into 'zombie apocalypse' as tax raids kick in

Economists are sounding the alarm over the Chancellor's tax reforms and the wider impact on the economy

Don't Miss

Most Read

Britain's economy is heading towards a "zombie apocalypse" this year as part of tax reforms introduced by Chancellor Rachel Reeves in previous Budgets, according to a leading think tank.

The Resolution Foundation, widely considered a left-of-centre public policy group, predicts thousands of underperforming businesses will fail under mounting financial strain.

The progressive think tank anticipates a "triple whammy" of sustained pressure from elevated borrowing costs, soaring energy expenses, and rising minimum wage requirements will force low-productivity companies out of business.

Ruth Curtice, the Resolution Foundation's chief executive, broke down the group's forecasts for the British economy going into 2026 and why a "zombie apocalypse" looks likely.

Rachel Reeves has been accused of turning the UK economy into a 'zombie apocalypse'

|GETTY / PA

She explained: "There are early and encouraging signs of a mild zombie apocalypse, where higher interest rates and minimum wages have combined to kill off struggling firms and leave the door open for new, more productive ones to replace them."

Job losses from company closures have reached their highest proportion since 2011, with corporate insolvencies climbing 17 per cent annually to reach 2,029 by October 2025.

The jobless rate exceeded five per cent last year as businesses struggled with mounting cost pressures, including the Chancellor's employer National Insurance increases and escalating wages.

From April 2025, the National Insurance levy paid by businesses jumped from 13.8 per cent to 15 per cent, while the National Living Wage jumped by 4.1 per cent for over-21s.

The Chancellor raised £40billion following her Budget in 2024, with her hike on National Insurance Contributions for employers increasing revenues £25billion

| PAMs Curtice cautioned that policymakers in Westminster must intensify their efforts to tackle these challenges as Prime Minister Keir Starmer signals the cost of living crisis will be the focus of his Government going into the New Year.

The foundation forecasts that British households will experience a "growth crawl" in their finances, with real disposable income per person expected to increase by a mere 0.2 per cent during 2026.

While the elimination of inefficient firms could eventually boost productivity, the foundation noted it has yet to observe new, higher-quality employment emerging to fill the gap.

Income growth is set to become a significant fault line, with pensioners and benefit recipients gaining from increased Government expenditure thanks to the state pension triple lock.

LATEST DEVELOPMENTS

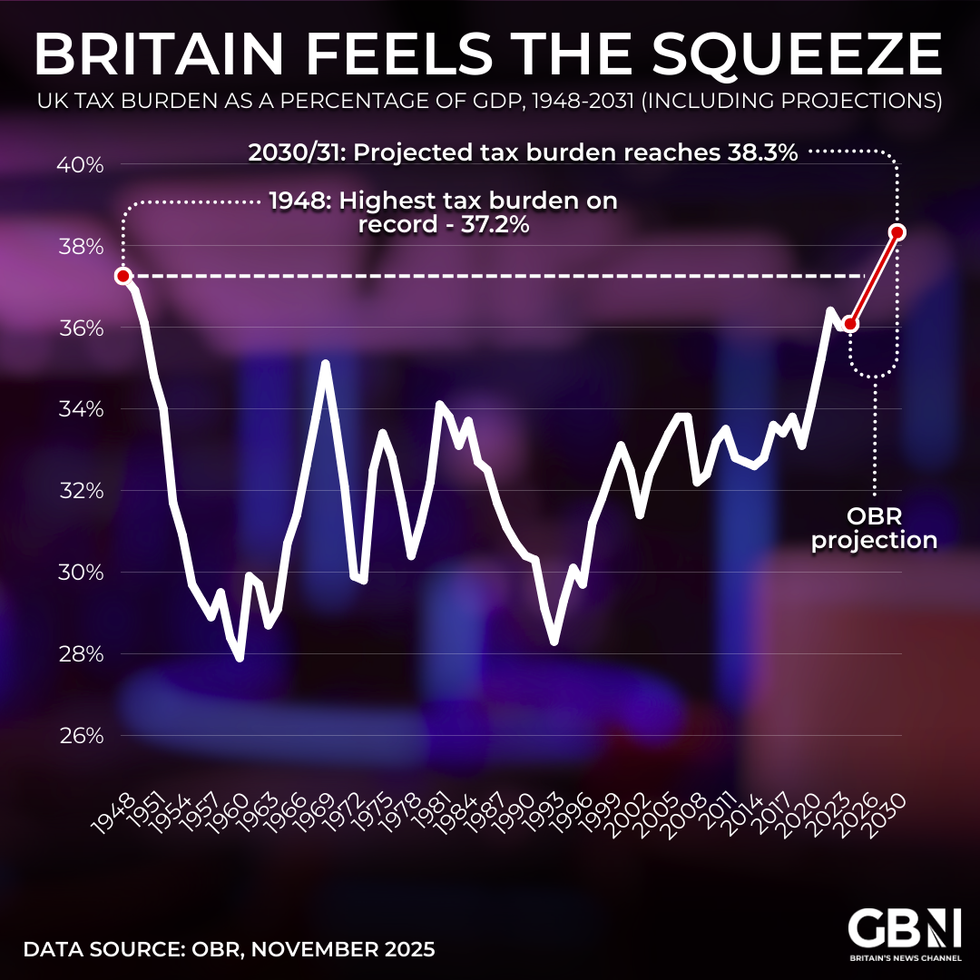

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBRThe Centre for Policy Studies accused the Labour Government of "quietly hammering" workers through taxation while state pensioners enjoy guaranteed rises of at least 2.5 per cent under the triple lock.

Last year, the Office for Budget Responsibility (OBR) projected that welfare spending would surge by £73.2billion over the coming five years, reaching £406.2billion by the decade's end.

Notably, some £34billion of this is expenditure is attributable to the triple lock commitment, which guarantees state pension payment rates rise in line with either inflation, average wage growth or 2.5 per cent.

In its latest forecast, the Resolution Foundation warned that Britain finds itself amid a gradual but significant transformation characterised by a shrinking working-age population.

The think tank also warned about volatile politics in 2026, heavier tax burdens, and an economy desperately requiring fresh enterprises to supplant those failing in the months ahead.

As well as this, the Resolution Foundation suggested this year could herald a "new era" in which mortality rates consistently outpace birth rates, placing additional strain on public finances to generate sufficient tax revenue for government spending.

"This should prompt us to ask hard questions about the future of our public services, and the tax revenues needed to fund them, in an ageing society," Ms Curtice added.

"Taken together, these trends point to a country in the middle of a slow but consequential transition: fewer people of working age; a more fragile politics; higher taxes; and an economy that urgently needs new firms and new jobs to replace the old.

"The story of 2026 is not one of crisis, but of drift finally giving way to change. Whether that change is managed or merely endured is the question that will define the years ahead."

More From GB News