Rachel Reeves must raise taxes or scrap state pension triple lock to save economy, warns IMF

The IMF is urging the Chancellor to create more fiscal headroom in the upcoming Budget

Don't Miss

Most Read

Latest

The International Monetary Fund (IMF) has cautioned that Chancellor Rachel Reeves risks failing to meet her fiscal rules and should consider raising taxes or axing the state pension triple lock later this year.

According to the think-tank, the UK would struggle to cope financially if the country encountered a global crisis, disappointing growth figures or unexpected interest rate movements.

The Washington-based institution's yearly assessment of Britain's economy highlighted that the Government's deficit reduction strategy could be derailed in the current unpredictable global climate.

With minimal financial flexibility available, the Fund warned that fiscal regulations might be violated if economic expansion falls short of expectations or if borrowing costs surge unexpectedly.

Rachel Reeves is being called to make tough decisions regarding the economy by the IMF

|GETTY / PA

As part of its Article IV Consultation with United Kingdom, the IMF stated: "Unless the authorities revisit their commitment not to increase taxes on ‘working people’, further spending prioritisation will be required to align better the scope of public services with available resources.

"The triple lock [guarantee on the state pension] could be replaced with a policy of indexing the state pension to the cost of living. Access to public services could also depend more on an individual’s capacity to pay, with charges levied on higher-income users, such as co-payments for health services, while shielding the vulnerable."

To address this dilemma, the IMF has emphasised that the Chancellor establish greater financial breathing room to ensure compliance with her fiscal framework.

"The first best (option) would be to maintain more headroom under the rules, so that small changes in the outlook do not compromise assessments of rule compliance," the IMF stated.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

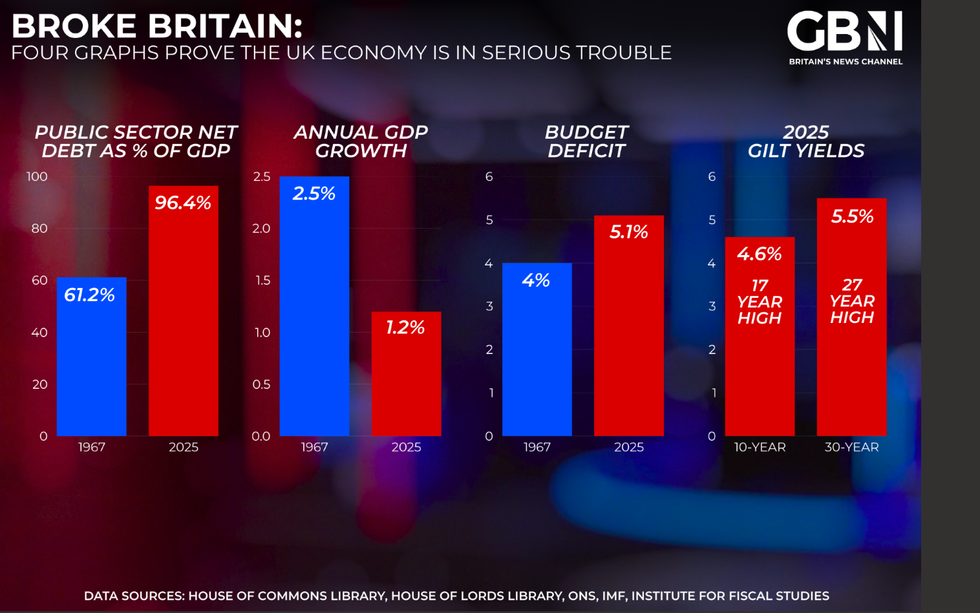

Four graphs prove the UK economy is in serious trouble | GB NEWS

Four graphs prove the UK economy is in serious trouble | GB NEWSFurthermore, the IMF's assessment recognised that modifications to the Government's approach to reducing the deficit have strengthened both the trustworthiness and efficiency of fiscal policy.

However, the Fund emphasised that executing the Chancellor's growth agenda presents considerable obstacles, particularly given constrained fiscal resources, the comprehensive nature of required reforms, and the turbulent international landscape.

The report specifically referenced complications arising from US President Donald Trump's trade conflict as an additional factor creating instability.

Earlier this year, the organisation advised that the Chancellor should adjust her fiscal framework to avoid the necessity for urgent expenditure reductions.

The Chancellor has welcomed the IMF's findings, asserting that the Fund has endorsed her economic recovery strategy and her approach to addressing inherited structural economic difficulties whilst navigating international challenges.

"The Fund had backed her choices for the UK economy to recover and her plans would tackle the deep-rooted economic challenges that we inherited in the face of global headwinds," Reeves said.

LATEST DEVELOPMENTS:

Chancellor Rachel Reeves is attempting to grow the economy and balance the books | GB News

Chancellor Rachel Reeves is attempting to grow the economy and balance the books | GB News In recent months, Rachel Reeves has been under pressure over her fiscal policy decisions in light of stagnant gross domestic product (GDP) growth.

Reeves has already raised employer National Insurance contributions to 15 per cent and pledged to make pensions liable for inheritance tax from next year.

Both the Chancellor and Business Secretary Jonathan Reynolds have refused to introduce a wealth tax as part of the Autumn Budget later this year.

However, recent rversals on welfare policy have intensified strain on government finances, fuelling speculation about substantial tax rises ahead.

More From GB News