State pension triple lock 'must go' as DWP payment accused of 'delivering to those who are well-off'

The state pension triple lock is under scrutiny after a recent report from the Office for Budget Responsibility (OBR)

Don't Miss

Most Read

The state pension triple lock "must go" and be replaced with an alternative payment uprate mechanism, economic analysts are telling the Labour Government ahead of this year's Autumn Budget.

Under the triple lock, the retirement benefit's payment is raised every year by either the rate of consumer price index (CPI) inflation, average wages or 2.5 per cent; whichever is the highest.

Conor Nakkan, an economic researcher for the Intergenerational Foundation, is sounding the alarm that the state pension status quo is not fiscally viable in the long-term.

He highlighted three main risks to the pension system posed by the triple lock, which has led to the Department for Work and Pensions (DWP) payment being "unsustainable, unpredictable and unfair".

Experts are claiming the state pension "must go"

|GETTY

These concerns included there being a significant increase in the direct fiscal cost of the state pension, which has been primarily driven by demographic change and the triple lock.

Nakkan also highlighted that inadequate private pension saving among some demographics has resulted in specific groups being increasingly reliant on the state in retirement.

Finally, the economic researcher cited the structural decline of defined benefit (DB) pensions, which is weakening demand for Government debt and could lead to higher borrowing costs.

In lieu of the triple lock, Nakkan is proposing a "double lock" model for future payment rate increases in order to ensure the state pension becomes intergenerationally fair.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

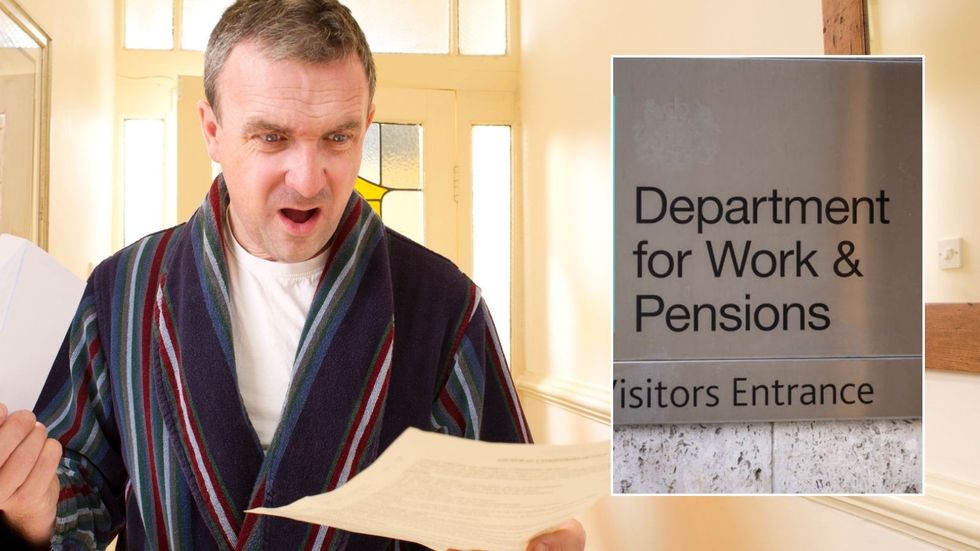

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR He explained: "The triple lock raises serious concerns about intergenerational fairness. While it has helped reduce pensioner poverty, it now delivers large, untargeted gains to all pensioners, including those who are already well-off.

"In other words, given that the state pension is not means-tested, every pensioner receives the same uplift, regardless of income, assets, or broader financial circumstances. This includes those with substantial private pension incomes or significant housing wealth, who are often among the wealthiest households in the country.

"Meanwhile, younger generations face a very different set of economic circumstances. As recent research by IF has demonstrated, young people in the UK are falling further behind older generations. Despite becoming more educated, young people today face higher levels of unemployment, greater job insecurity, and relatively stagnant wages.

"They are less likely to own a home and more likely to spend the majority of their income on essentials. At the same time, they are saddled with rising student debt burdens and face high marginal tax rates. Moreover, three in ten children in the UK currently live in poverty, while government spending is increasingly skewed towards the old."

If a double lock payment mechanism was introduced for the state pension, analysts have differing ideas of what that would look like for the state pension going forward.

Some suggest basing future increases on either just earnings or inflation-based uprating, or uprating by the average of the two. Alternatively, some have floated removing the 2.5 per cent minimum rate hike or introducing a "smoothed earnings link".

LATEST DEVELOPMENTS:

Rachel Reeves is under more pressure as borrowing costs surge and benefits expenditure rises

| GETTYNakkan added: "Each option comes with trade-offs, and future IF research will examine these in detail. But what is clear from the OBR’s latest report is that the status quo cannot hold.

"Reforming the triple lock is no longer just a matter of balancing the fiscal books, it is one of the most urgent challenges in restoring intergenerational fairness to the UK’s public finances."

In reaction to the Office for Budget Responsibility's (OBR) assessment of the rising state pension triple lock, a Government spokesperson said: "What we recognise is that the public finances need to be brought back under control.

"We've had a decade of the UK being exposed to global risks more and more and to interest rate fluctuations, and that is why we have non-negotiable fiscal rules, and that is our focus."

More From GB News