Rachel Reeves's pension reforms SLAMMED as Lords warn 'damage is already happening'

The Chancellor's Pension Schemes Bill is facing scrutiny from members of the House of Lords

Don't Miss

Most Read

Members of the House of Lords have voiced alarm this week that pension providers are already modifying their approach in anticipation of the draft Pension Schemes bill, despite the legislation not yet being enacted.

The bill is presently undergoing its committee stage, with peers examining proposed amendments and new clauses across five sessions throughout January.

During Monday's debate, Baroness Bowles of Berkhamsted highlighted her concerns about the exclusion of listed investment companies from the legislation, while long-term asset funds remain permitted.

She argued that the mere prospect of investment companies being left out is already influencing market behaviour.

Members of the House of Lords are taking aim at Rachel Reeves's pension reforms

|GETTY

"Even if regulations are never made, the damage is already happening. The reserved power has a signalling effect," Baroness Bowles told the chamber.

She warned that providers are shifting their strategies based on signals from the bill about which investment structures the government favours and which assets will qualify for authorisation.

"That is how markets are distorted, long before the law is even used," she added.

Baroness Altmann backed the proposed amendment, stating that the preference for open-ended structures over closed-ended alternatives "makes no sense to many in the industry".

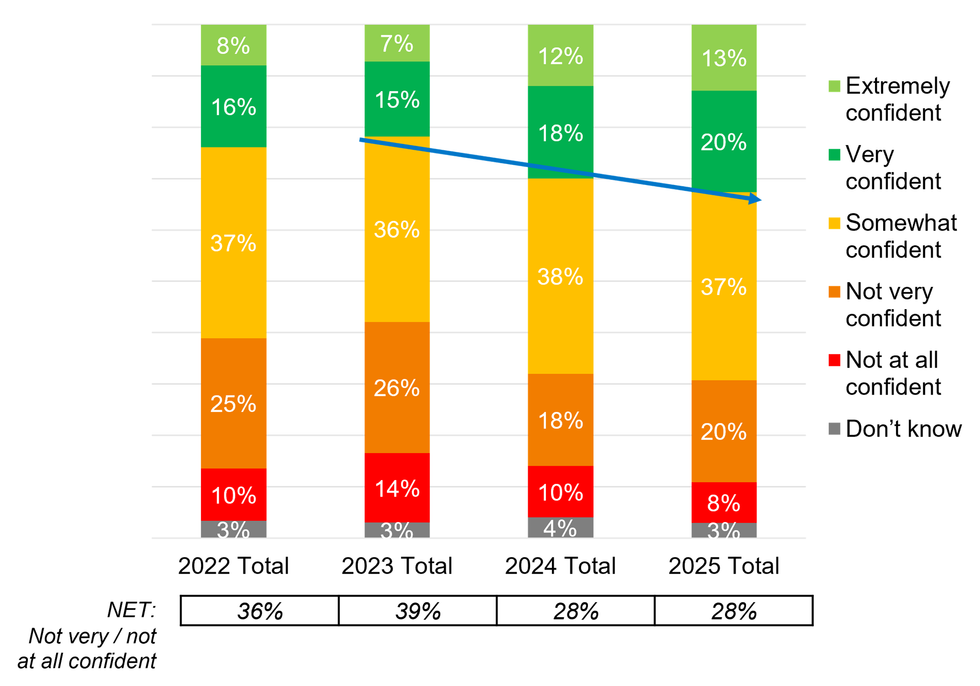

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON Despite this support, Baroness Bowles ultimately withdrew her amendment following the government's response.

Lord Fuller described the legislation as "overly complicated" and expressed concern it could deter people from putting money aside for their later years.

He suggested the bill appeared to contain provisions that would allow established operators to block new market entrants, warning this could "reduce choice, stifle innovation and damage the reputation of the city".

"I do not think that was purposeful, but this is what happens when you get a bill that is so overly complicated and takes people away from saving for their long-term retirement," Lord Fuller said.

The House of Lords is scrutininsing the Government's Pensions Bill

| GettyLATEST DEVELOPMENTS

He indicated growing unease about what he perceived as a guiding influence within the legislation. Government whip Lord Katz acknowledged the concerns raised but indicated his response would "disappoint" those seeking immediate action.

He confirmed awareness of the issues surrounding the treatment of listed investment funds, particularly investment companies and trusts, under the reserve asset allocation powers affecting defined contribution pension schemes.

Lord Katz assured peers they would have an opportunity to debate these matters when the committee reaches a later clause dealing specifically with asset allocation for defined contribution pensions.

The committee stage continues with four further sessions scheduled in the House of Lords, with the next sitting taking place earlier this afternoon.

How will the Pensions Bill impact your retirement savings?

| GETTYTowards the end of last year, Glyn Bradley, chair of the IFoA Pensions Board, said: "The Pension Schemes Bill is a significant step in improving the UK pensions system. The IFoA supports the Government’s efforts to better support pension savers and stimulate growth in the economy.

"As the Bill progresses, there is a valuable opportunity to refine it further and deliver the strongest possible outcomes for pension savers across the UK. It is encouraging to see provisions in the Bill to promote better value for members from their pension plans.

"This will help to simplify the experience for savers, help them to plan their retirement and cut down on the complexity of drawing down pension income. There is still work to do.

"The Government must strike a careful balance between encouraging investment in growth assets and managing the associated risks and costs, while addressing ongoing concerns about any form of mandated investment for pension schemes."

More From GB News