Pension hack could boost YOUR retirement savings by £173,000 - but only if you ditch going to the pub

Research conducted by Standard Life is sounding the alarm over the impact of 'friendflation' on pension savings

Don't Miss

Most Read

Latest

Britons are being urged to make a sacrifice in their personal lives to ensure a pension savings boost of up to £173,000 in retirement, following the publication of shocking new figures.

The phenomenon known as "friendflation" is increasingly squeezing British wallets as the costs associated with maintaining social lives, including regular pub visits, continuing to climb.

Research from Standard Life has found that adults across the UK are parting with an average of £375 each month on social activities, which amounts to around £4,500 annually.

The rising expense of everything from restaurant meals and evenings at the pub to hen parties and group holidays is taking its toll.

A pension hack could boost your retirement savings but Britons will have to sacrifice going to the pub

|GETTY

According to the findings, one in six people are now spending more on their social calendars compared to twelve months ago, placing additional pressure on household budgets following the festive period.

Despite the importance of social connections for wellbeing, the financial consequences are causing widespread concern among Britons, according to retirement analysts.

The Standard Life study revealed that 46 per cent of UK adults have experienced regret over money spent on socialising.

Costly nights out topped the list of regretted expenditures at 32 per cent, followed closely by dining at restaurants at 29 per cent and spending on alcoholic drinks at 25 per cent.

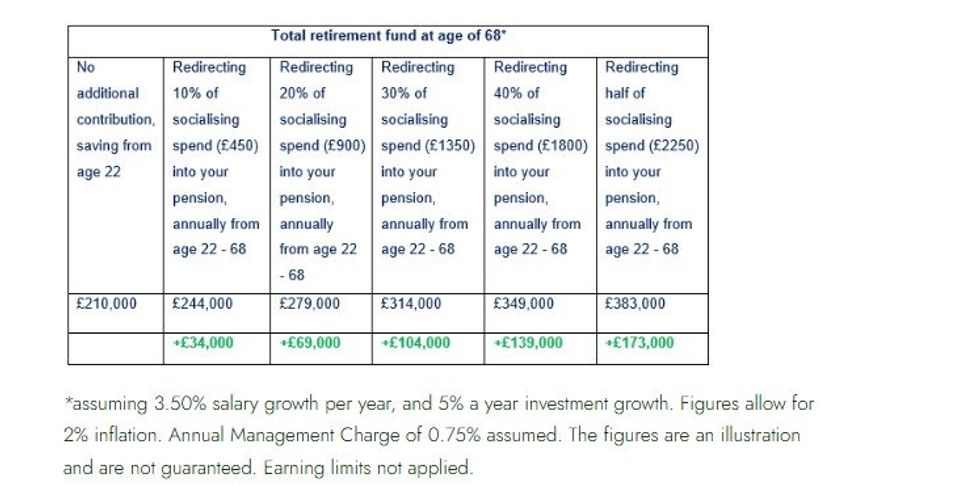

How much could you save for retirement by tackling 'friendflation'?

|STANDARD LIFE

The cumulative effect of these social expenses is proving significant for long-term financial planning.

Nearly a third of those surveyed, some 31 per cent, acknowledged that their spending on social activities was preventing them from putting money aside for the future. Standard Life's analysis demonstrates the substantial long-term benefits of diverting even a portion of social spending into retirement savings.

The calculations show that an individual starting work at 22 on a £25,000 salary, making minimum auto-enrolment contributions, would accumulate approximately £210,000 by age 68.

However, channelling half of their annual socialising budget into their pension throughout their career could boost that figure to £383,000, representing an additional £173,000 at retirement.

LATEST DEVELOPMENTS

Pubs are a staple of British culture but are costing your retirement

| GETTYEven more modest adjustments yield meaningful results, with redirecting just 10 per cent of social spending adding £34,000 to the final pot, while 30 per cent would contribute an extra £104,000.

Mike Ambery, the retirement savings director at Standard Life, part of Phoenix Group, commented: "January is often when people take stock and set new goals, so it's a great time to think about balance.

"Spending time with friends is one of life's great joys, and it's not something people should feel pressured to give up.

"But as our research shows, many people do looks back and regret certain socialising costs whether it's an overpriced dinner or a night out that didn't feel worth it."

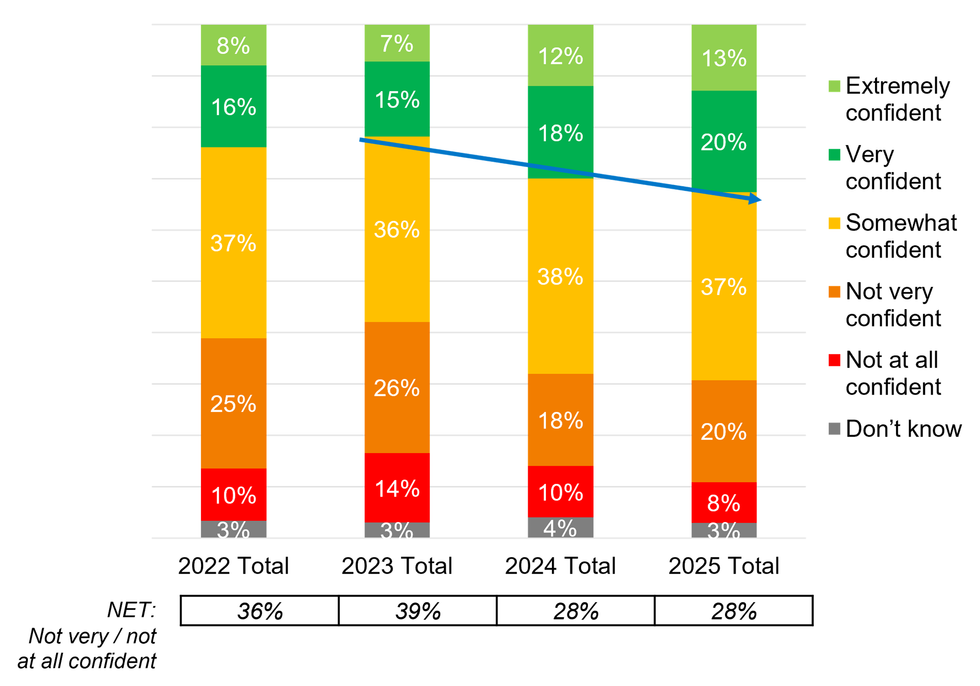

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON He emphasised that friendship and connection provide enormous emotional value, keeping people grounded and happy.

The key, according to Mr Ambery, lies in prioritising meaningful experiences while considering small diversions to long-term savings, particularly given that most UK adults are currently under-saving for retirement.

"Prioritising spending on the things you really want to do, and considering redirecting even a small amount of the money you would have spent on the rest into your long-term savings, can have a powerful impact over time," he shared.

"With most UK adults currently under-saving for retirement, it’s worth considering where small changes could help build a more secure financial future."

More From GB News