Tax rises 'primary lever' to balance the books as Rachel Reeves sees backlash after Winter Fuel Payment cut reforms

Sue Ashcombe-Hurt rages at Labour after having winter fuel payment reinstated |

GB NEWS

The Chancellor is under pressure as gilt yields surpass Italy and Greece amid weak growth and political unrest

Don't Miss

Most Read

Tax rises from Cancellor Rachel Reeves will be the "primary lever" to balance the books as Britain’s borrowing costs rise above those of nations once considered fiscal basket cases, according to new analysis.

Economists are warning that the Treasury has little fiscal headroom left after the Labour Government was forced to U-turn on tightening Winter Fuel Payment eligibility and cutting benefit expenditure.

Daniel Casali, the chief investment strategist at at wealth management firm Evelyn Partners, explained: "Efforts to find further savings are complicated by internal Labour Party divisions, with MPs rebelling against measures such as means-testing the Winter Fuel Allowance and cutting welfare spending.

"This leaves tax increases as the primary lever to balance the books. However, the Labour manifesto pledged not to raise any of the 'big three' taxes - National Insurance, VAT, or income tax - which together account for nearly 75% of total tax revenues."

TRENDING

Stories

Videos

Your Say

"There will be scrutiny on how the Chancellor can credibly raise additional revenue. Potential options could include closing tax loopholes, reforming capital gains and inheritance tax. However, each option comes with political and economic trade-offs."

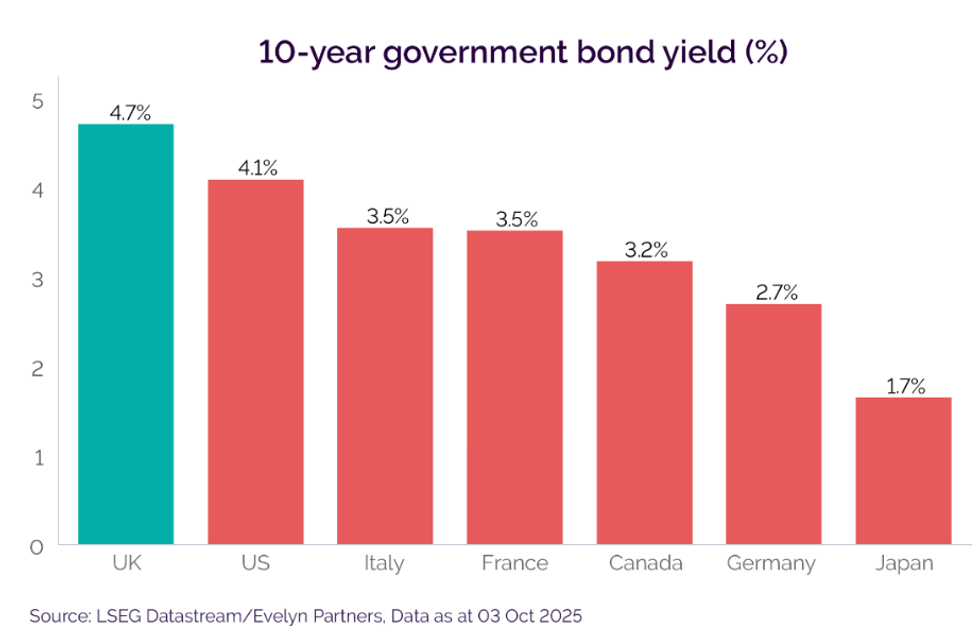

UK 10-year gilt yields have climbed to 4.7 per cent, surpassing both Italy and Greece, countries carrying substantially larger debt burdens relative to their economies.

This trend comes despite the Chancellor’s October 2024 overhaul of fiscal rules. The reforms were designed to enhance investor confidence and reduce borrowing costs. The new framework mandates balancing day-to-day spending by the end of Parliament, while targeting lower public sector net financial liabilities.

Yet these reforms have not delivered their promised benefits with economists highlighting that the Britain now carries the unwanted distinction of maintaining the steepest Government bond yields among developed nations.

Rachel Reeves faces a fiscal credibility test as UK borrowing costs surpass those of Italy and Greece, fuelling market concerns over Labour’s economic plans

|GETTY

Multiple forces are pushing Britain’s borrowing costs beyond those of other G7 nations with Mr Casali asserting that the UK finds itself trapped in a stagflationary environment, where weak growth undermines fiscal sustainability.

The Organisation for Economic Co-operation and Development (OECD) projects that Britain will experience the highest inflation among major economies this year. The Bank of England’s perceived restrictive monetary stance, combined with stubborn price pressures, has pushed yields higher.

Political uncertainty compounds these economic headwinds, with polling data revealing widespread public discontent that unsettles bond investors.

Mr Casali added: "Gilt yields reflect more than fiscal policy alone. They also capture expectations around short-term interest rates, inflation and broader monetary conditions."

LATEST DEVELOPMENTS:

Yields have climbed as the Bank of England maintains tight monetary policy amid persistent inflation, fuelling investor concerns over long-term borrowing costs.

| GETTYHe highlighted parallels with US markets, where fiscal sustainability concerns are also intensifying. Britain’s fiscal arithmetic presents major obstacles ahead of the Budget on November 26.

The National Institute of Economic and Social Research (NIESR) calculates that securing just £10billion of fiscal headroom by 2029 would require finding £50billion in savings.

Furthermore, the Office for Budget Responsibility (OBR) appears poised to downgrade medium-term growth projections. It has already flagged declining productivity forecasts in its Spring 2025 commentary.

JPMorgan Chase & Co. warns that GDP growth downgrades of just 0.1–0.2 per cent could create budget shortfalls between £9billion and £18billion.

As such, this leaves the Chancellor exploring politically sensitive alternatives such as capital gains and inheritance tax reforms.

Political turbulence threatens to deepen the Chancellor’s fiscal predicament.

Labour’s standing has fallen sharply, with Electoral Calculus projecting that Reform UK could secure 301 seats if current polling trends persist.

That would fall just short of a parliamentary majority. Labour would drop to 153 seats from its current 412, while the Conservatives could fall to 51 seats.

Immigration has emerged as the electorate’s top concern, according to YouGov. It now slightly eclipses economic worries.

The Government’s recent ‘one in, one out’ agreement with France on illegal migration faces legal challenges and has shown little evidence of effectiveness.

Internal Labour dissent further destabilises the Government’s position. A survey by Survation revealed two-thirds of Labour MPs oppose the Chancellor’s fiscal rules.

Andy Burnham, the mayor of Greater Manchester, has signalled potential leadership ambitions. Mr Burnham has advocated £40billion in housing borrowing, a proposal that could unsettle bond markets.

10-year government bond yield (%)

|LSEG Datastream/Evelyn Partners

According to Mr Casali, there are possible paths are emerging for the November Budget, each carrying major implications for gilt markets.

The most likely scenario involves modest revenue adjustments while maintaining a cautious stance which assumes the OBR avoids significant growth downgrades.

Such an approach might preserve roughly £10billion of fiscal headroom through targeted wealth taxation. However, he notes that the limited breathing room may disappoint bond investors.

An alternative scenario could involve abandoning manifesto pledges and introducing comprehensive tax increases to secure £20billion of headroom. Such measures could dampen business confidence and prove inflationary if firms pass costs on to consumers.

The least probable option would involve loosening fiscal constraints alongside spending reductions, Mr Casali claims. This could ultimately benefit gilt performance by enabling growth-supportive policies and showing pragmatic governance over rigid adherence to fiscal rules.

More From GB News