Rachel Reeves implored to hike 'alcohol tax' as UK faces 'productivity crisis' due to workplace drinking

'Appalling!' Pensioners blast Rachel Reeves for 'fiddling' with taxes - 'We get the brunt of it' |

GB NEWS

The IPPR is calling on the Chancellor to tackle economic inactivity resulting from job-related drinking

Don't Miss

Most Read

A leading think tank has urged the Government to raise alcohol taxes as new research exposes how workplace drinking is fuelling a national productivity crisis.

Research from the Institute for Public Policy Research (IPPR) has found that almost a third of UK workers have taken sick days following work-related drinking events within the past year.

The IPPR's survey of over 2,000 employees uncovered alarming patterns of alcohol-related workplace absence. More than a fifth of workers admitted to performing their duties while hungover, with 29 per cent observing colleagues appearing fatigued or lethargic following drinking.

These findings emerge as Chancellor Rachel Reeves prepares to unveil her Autumn Budget next month, with the think tank arguing that addressing workplace alcohol harm is essential for tackling productivity challenges across all economic sectors.

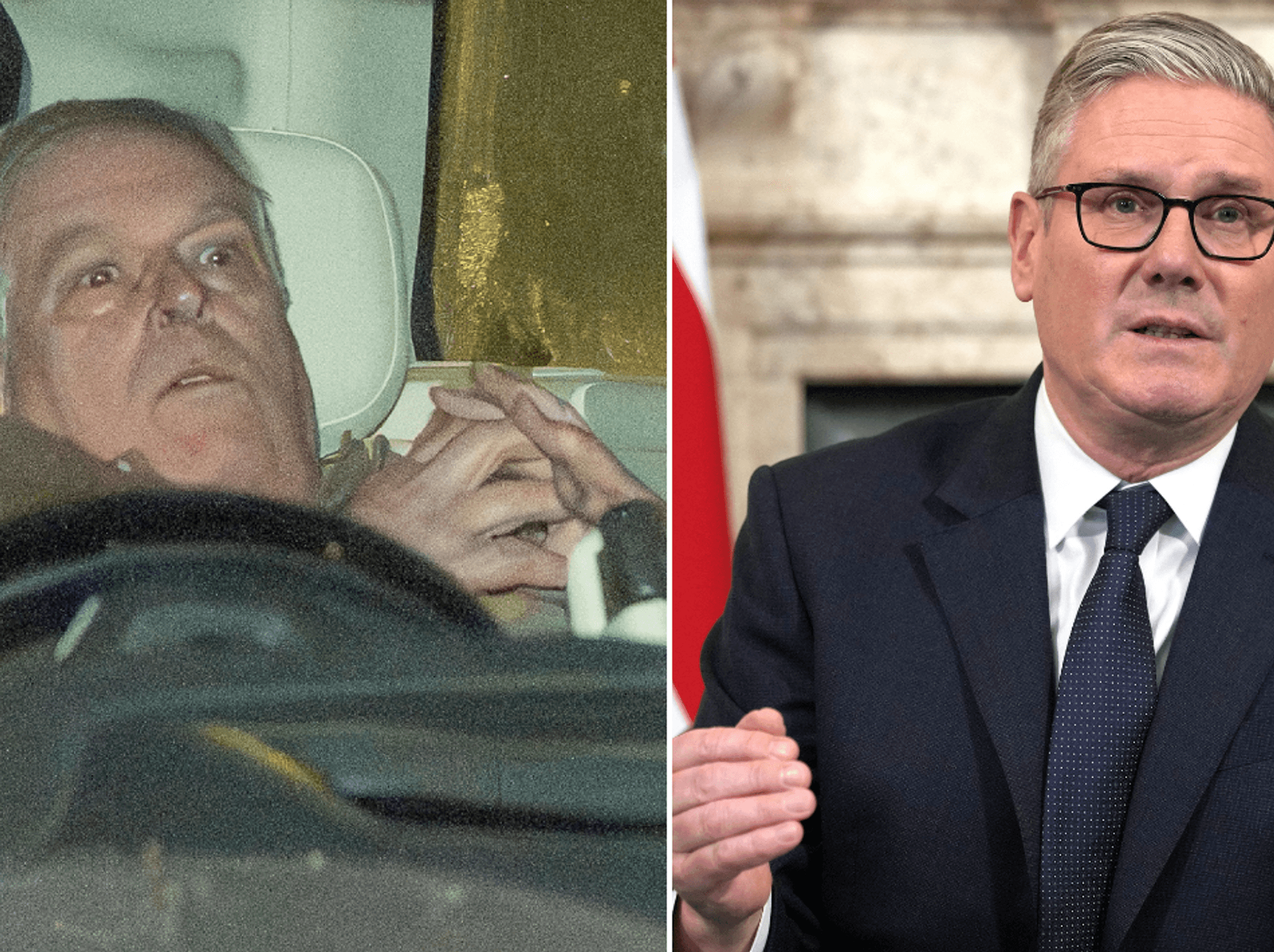

The Chancellor is being urged to tackle Britain's 'productivity crisis' which analysts claim is caused by drinking

|PA / GETTY

Young workers face the most severe impact from workplace drinking culture, with 43 per cent of those aged 18 to 24 reporting absences after work drinking events.

The IPPR's research highlights particular vulnerability among Generation Z employees, who experience significant pressure to participate in alcohol-related activities. More than a third of young professionals reported feeling compelled to drink to integrate with colleagues or advance their careers.

Jamie O'Halloran, the senior research fellow at IPPR, emphasised the scale of the issue: "When nearly half of young professionals are calling in sick after workplace drinking, it's not just a hangover, it's a productivity crisis."

He added: "We often think of alcohol harm as a public health issue, but this research shows it's a national economic problem. If the Government is serious about growth, it needs to take alcohol harm seriously too."

The IPPR has outlined several specific measures for government action on alcohol taxation. The think tank wants ministers to restore the alcohol duty escalator, a mechanism introduced by Labour in 2008 that automatically raised all alcohol duties by 2 per cent above inflation annually before being abolished by the Conservatives in 2014.

Furthermore, the organisation also recommends standardising duty rates based on alcohol content across all beverages, targeting what they describe as the most harmful products - those that are both cheap and high in strength.

Additionally, the IPPR suggests England should follow Scotland and Wales by implementing minimum unit pricing for alcohol. These proposals come after the government raised alcohol duties in February, following a two-year freeze under the previous Conservative administration.T

Notably, the research reveals a significant disconnect between worker expectations and employer action on alcohol-related harm. Over half of employees reported receiving no guidance, training or alcohol-free alternatives from their organisations, despite 73 per cent believing employers bear responsibility for reducing alcohol's negative impact.

Sebastian Rees, IPPR's head of health, highlighted the opportunity for businesses: "Employers have a huge opportunity here. By shifting away from alcohol-centric cultures and offering real support, they can boost wellbeing, improve performance, and build more inclusive workplaces."

He stressed: "This isn't about banning drinks it's about giving people the choice to thrive without pressure. The evidence is clear: doing nothing is costing us all.

"The IPPR acknowledged potential political risks in raising alcohol prices, noting the industry's extensive lobbying efforts that emphasise the sector's economic contribution of tens of billions annually.

The British Beer & Pub Association has strongly opposed any duty increases, with chief executive Emma McClarkin warning that higher taxes would be "catastrophic" for breweries and pubs.

LATEST DEVELOPMENTS:

Alcohol could be taxed more

| TAYBEH BEER / FACEBOOKShe highlighted that UK beer duty already stands at three times the EU average and ten times the rates in Spain and Germany.

A Government spokesperson outlined existing health initiatives, including plans for mandatory nutritional labelling and health warnings on alcoholic drinks. The government has allocated £310 million for drug and alcohol treatment services, emphasising prevention within their 10 Year Health Plan.

Ms McClarkin argued that the current duty system has encouraged lower-strength product development and expanded consumer choice in low and no-alcohol beers.

She called for duty cuts and business rates reform in the upcoming Budget.

More From GB News