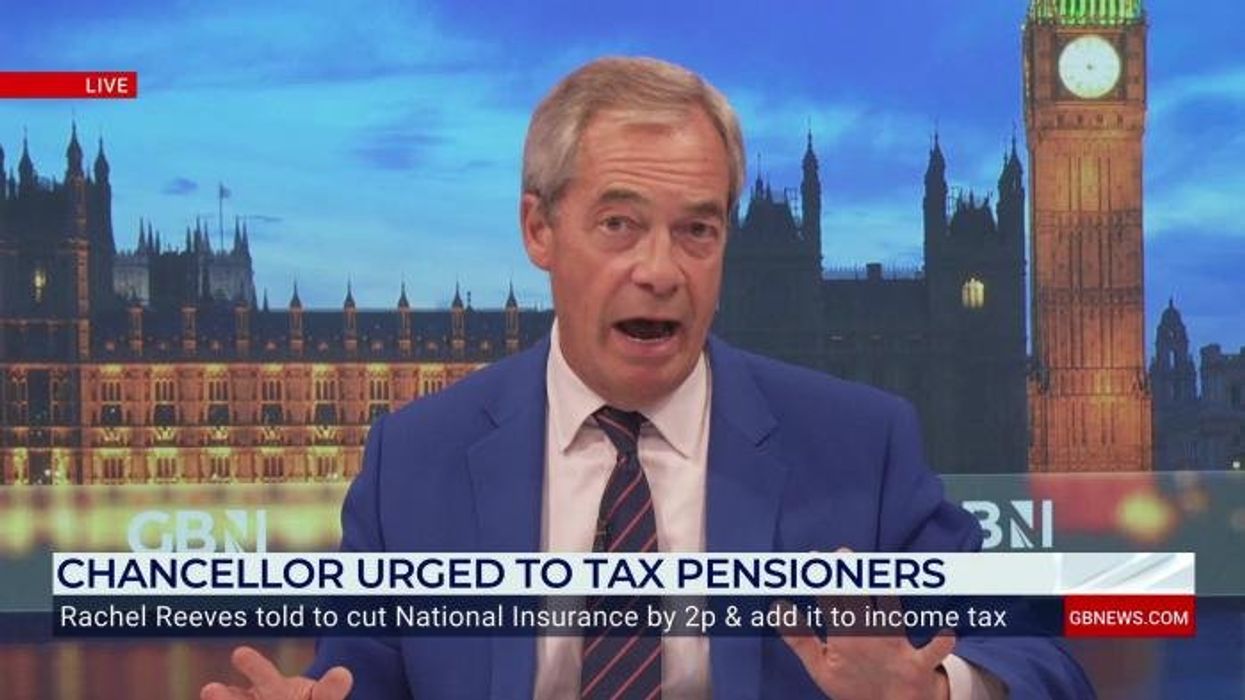

Rachel Reeves urged to hit pensioners with new tax raid in Budget as over 60s now hold half of UK's wealth

GBNEWS

The proposed tax could raise around £6billion for the Treasury

Don't Miss

Most Read

Latest

Rachel Reeves is under pressure to hit pensioners with higher taxes in her next Budget as new figures have revealed over-60s now hold nearly half of the UK’s wealth.

Older generations have tightened their grip on assets, controlling 49 per cent of the nation’s total, up from 39 per cent in 2008, according to new research.

The analysis by the Resolution Foundation highlights how financial power has shifted towards pensioners over the past decade and a half, largely thanks to soaring house prices rather than investment gains.

The findings come as the government faces growing calls to rethink how wealth is taxed, with some experts suggesting future budgets could target property owners and retirees in a move that could raise £6billion.

It also shines a light on the growing wealth gap between generations. The typical difference in assets between someone in their early thirties and someone in their early sixties has more than doubled over the past 14 years.

The Resolution Foundation's research reveals that property values and pension holdings now constitute 80 per cent of household wealth in Britain.

This concentration of assets amongst older demographics has prompted debate about potential policy responses to address the growing disparity.

The Foundation has urged the Chancellor to take the tax burden away from younger workers and onto pensioners.

The stark reality of this wealth accumulation becomes clearer when examining specific figures. Individuals in their early thirties saw their wealth increase by merely £8,000 over the 14-year period, whilst the average pensioner experienced gains of £150,000 in real terms.

The Resolution Foundation's research reveals that property values and pension holdings now constitute 80 per cent of household wealth in Britain

| GETTYThe Resolution Foundation's analysis reveals that reaching the threshold for Britain's wealthiest 10 per cent now requires £1.3million in assets.

Back in 2008, the gap was around £135,000. By 2022, it had grown to £310,000 once adjusted for inflation. For younger workers and millennials, slow wage growth and high housing costs have held back wealth, while older generations have seen their property and pensions climb sharply in value.

A worker would need to save their entire salary for 52 years to achieve this level, making it mathematically impossible for someone beginning employment at 16 and retiring at state pension age.

This compares to just 38 years of savings required in 2006-2008, when the inflation-adjusted target was £1million.

Older generations have seen their property and pensions climb sharply in value

The Resolution Foundation has proposed raising income tax by two per cent while cutting National Insurance by the same amount.

Because pensioners and the self-employed do not pay NI, they would shoulder more of the extra cost, while employees on salaries would see their higher income tax bill offset by the NI reduction.

The plan, which could raise around £6billion for the Treasury, carries weight given the think tank’s close ties with senior figures in government.

The foundation argues higher wealth taxes are likely to fall on pensioners

| GettyMolly Broome, from the Resolution Foundation, acknowledged the implications: "With property and pensions now representing 80 per cent of household wealth, we need to be honest that higher wealth taxes are likely to fall on pensioners, Southern homeowners or their families, rather than just being paid by the super-rich."

She also highlighted concerns about wealth mobility, stating: "These gaps are doubly concerning as wealth mobility in Britain is low people that start life wealthy tend to stay wealthy and vice versa."