Rachel Reeves's mansion tax could force vicars out of parishes, bishop warns

Ministers urged to exempt vicarages as London property values push homes over £2million threshold

Don't Miss

Most Read

Labour's mansion tax could force clergy out of their parishes across London and the South East, the Bishop of Manchester has warned.

The Right Rev David Walker issued the alert during a Budget debate in the House of Lords, cautioning that vicarages in even modest areas of the capital surpass the £2million threshold that triggers the new levy.

He told peers these homes were not grand or luxurious properties, but their location alone pushed valuations beyond the taxable limit.

The senior cleric, who serves as Convenor of the Lords Spiritual and oversees the work of 26 bishops in the Upper Chamber, urged ministers to introduce an exemption for clergy housing.

TRENDING

Stories

Videos

Your Say

His remarks reflect growing concern about the disproportionate effect of Chancellor Rachel Reeves's surcharge on London and its surrounding counties.

The new council tax supplement, which begins in April 2028, comprises four price bands starting at £2,500 a year for homes valued between £2million and £2.5million, rising to £7,500 for properties above £5million.

While vicars would not receive the bill personally, the cost would fall on the property owners, typically parish bodies or dioceses.

The Bishop told the Lords: "Few parishes will be able to pay this additional tax, nor can dioceses simply absorb the costs."

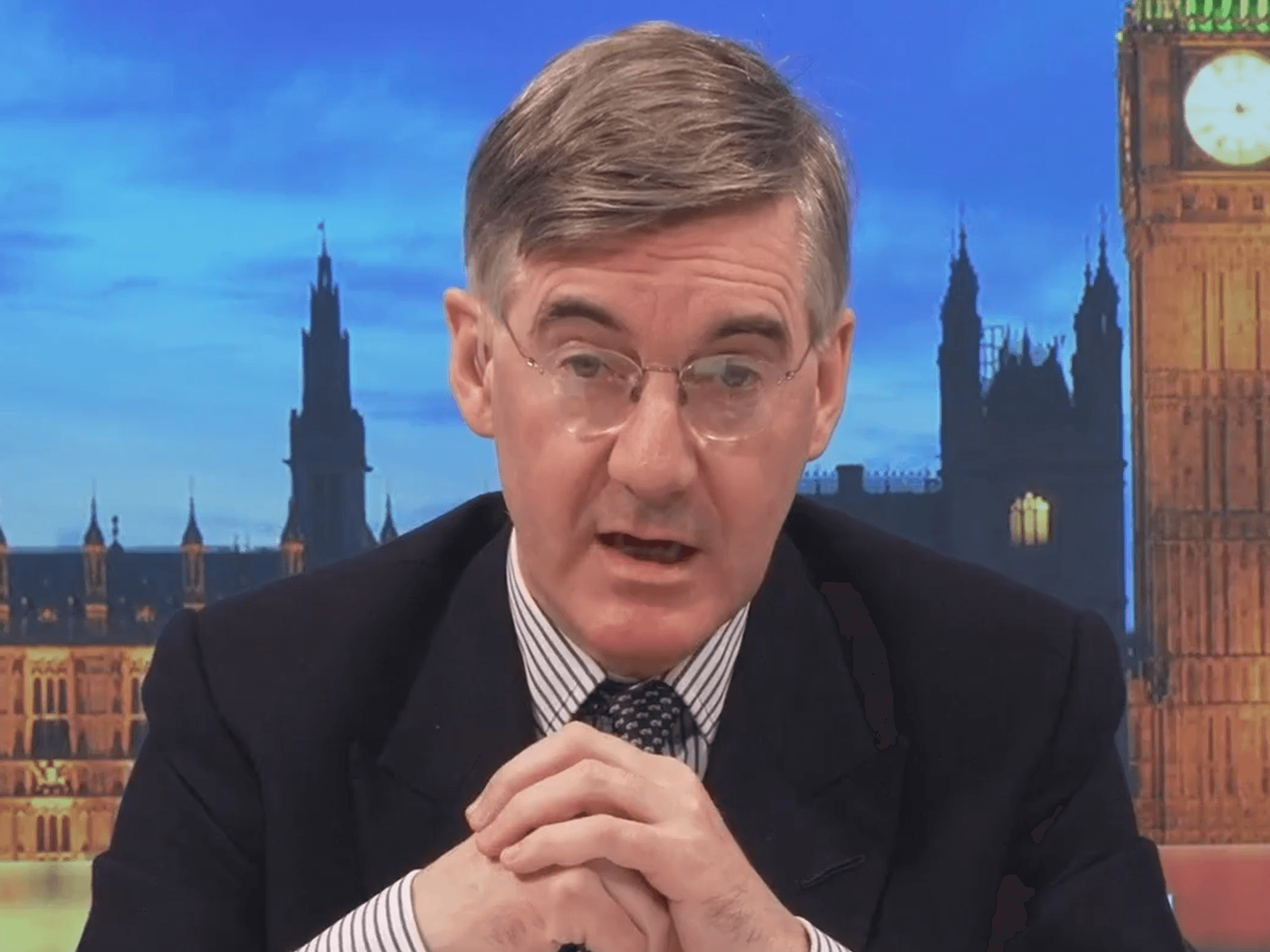

Bishop of Manchester warns Labour’s mansion tax could force clergy from parishes

|GETTY/Parliament

In an interview with The Telegraph, he said: "There is no way that people in an East End parish would be able to pay this mansion tax on top of everything else they're paying."

The Church of England oversees around 12,500 parishes, most of which provide accommodation for their vicar.

The requirement for clergy to live within their parish dates back to the 1898 Benefices Act, which established that vicars must reside in the benefice they serve.

Bishop Walker told peers that this rule "ensures that parishioners have easy access to them and that the vicar is a visible face on the streets of the parish, not merely another middle-class commuter".

LATEST DEVELOPMENTS:

Such functional demands make many vicarages large, and in London their value can easily top £2million

|GETTY

He said that modern vicarages are "rarely as large and luxurious as some of former times".

These properties must, however, meet a range of practical needs beyond providing a home for the priest and their family.

They are used for parish meetings, for gatherings of parishioners and for the study and office space required for clerical duties.

Such functional demands mean vicarages are often sizeable, and when combined with London property values, they can easily exceed the £2million threshold.

Bishop Walker warned that clergy could be forced to relocate to more affordable areas if the levy remains unchanged.

He said that dioceses and parishes may face "a range of tough decisions" that could leave vicars commuting from the outer suburbs rather than living among their congregations.

He told the Lords: "If we ended up with significant parts of London and the South East where we could no longer sustain that pattern, it would be a hugely detrimental change to how clergy have ministered to parishioners for centuries."

The Bishop noted that he has the authority to permit vicars to live outside parish boundaries in exceptional cases, but such permissions are issued sparingly.

"The whole point of the residence law is they should know their own people walking the streets, going to the shops and they should know their community.

"If they end up commuting from the suburbs, you lose that."

Ministers expect the surcharge to raise £400–£450million a year

|GETTY

The Treasury has confirmed it will launch a consultation in early 2026 on exemptions and reliefs, including measures for people who are required to live in a property as part of their employment.

The Government has also said that those unable to pay the annual charge may defer the bill until they sell their home or after their death.

Ministers expect the surcharge to raise between £400million and £450million each year.

Research by the Institute for Fiscal Studies (IFS) shows that nearly a quarter of affected homes are concentrated in three London boroughs: Kensington and Chelsea, Westminster and Camden.

The analysis indicates that 69 per cent of properties subject to the surcharge are located in London and the South East, demonstrating the regional concentration of the policy.

Our Standards: The GB News Editorial Charter

More From GB News