Tax alert: Inside Rachel Reeves's £15bn raid on savers and investors - how to 'get your house in order'

The Chancellor unveiled multiple reforms to the tax regime in last month's Budget

Don't Miss

Most Read

Savers and investors are set to be slapped with a £15.5billion tax bill from HM Revenue and Customs (HMRC) thanks to Chancellor Rachel Reeves's Budget reforms. analysts warn.

The largest revenue generators include restrictions on pension salary sacrifice arrangements and a significant increase to dividend taxation, which are set to be implemented in the years to come.

Laith Khalaf, the head of investment analysis at AJ Bell, noted that while the overall tax burden is substantial, "the bulk of the tax take isn't hitting right away, giving savers and investors time to get their houses in order".

The phased implementation means most of the financial impact falls in later years, providing individuals with an opportunity to reorganise their affairs before the measures take full effect.

Ms Reeves has launched a £15billion tax raid on savers and investors

|GETTY / PA

The cap on salary sacrifice pension arrangements is projected to generate £7.3billion for the Treasury over the five-year forecast period. While employers will bear much of this burden directly, Khalaf warned they "may choose to pass some of that, if not all of it, onto employees by depressing pension contributions and wages".

Furthermore, the two per cent increase to dividend taxation is expected to yield £5.1billion from business owners and investors during the same timeframe. These core measures are reinforced by additional levies on property and savings income.

Notably, the two per cent rise in tax rates on these income sources will contribute approximately £3billion to government coffers over the forecast period, effectively closing off alternative routes for those seeking to shelter their wealth.

As well as this, the cash ISA allowance will be slashed to £12,000 for savers under 65 from April 2027, further compounding the impact on those seeking tax-efficient returns.

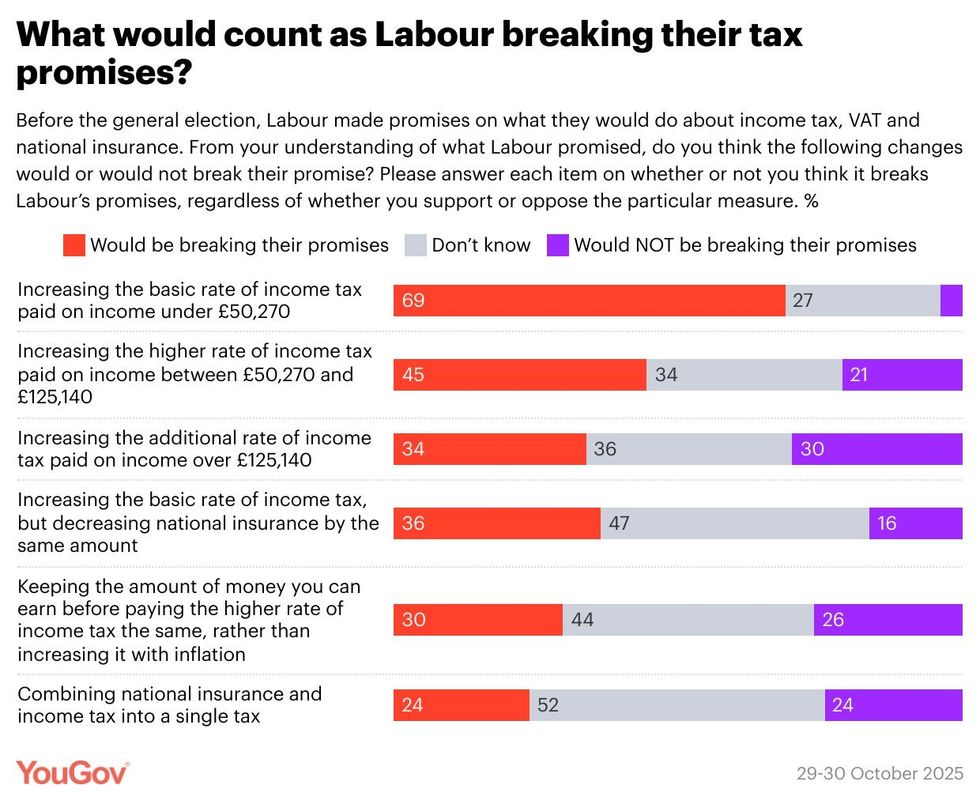

The poll showed a majority of people thought increasing the basic rate of income tax would be seen as Labour breaking their tax promises | YOU GOV/X

The poll showed a majority of people thought increasing the basic rate of income tax would be seen as Labour breaking their tax promises | YOU GOV/XThe precise revenue this measure will generate remains unclear, as Treasury documents have bundled it together with the extension of the Help to Save scheme under what Mr Khalaf described as "the somewhat ironic heading 'Supporting Savers'".

While the combined package is presented as beneficial overall, the reality for cash ISA holders is rather different.

"Taken together these measures are net positive for savers, but the devil will be in the detail as to how this is split, and cash ISA savers will find themselves on the negative side of the ledger," Mr Khalaf observed.

The decision to raise dividend taxation directly contradicts the Government's stated ambition of encouraging investment in British equities, according to AJ Bell's analysis.

UK shares offer considerably more attractive income returns than overseas alternatives, with the FTSE 100 yielding 3.2 per cent compared to just 1.2 per cent from the S&P 500 and 1.3 per cent from the MSCI World Index.

Higher dividend taxes therefore penalise domestic investment more severely than international holdings.

From April 2026, higher and additional rate taxpayers will face dividend tax rates of 35.75 per cent and 39.35 per cent respectively, compared to 24 per cent on capital gains.

"The dividend tax system is actually tilting the table to encourage investors to buy US and global stocks instead of UK ones," Mr Khalaf warned, adding that while ISAs offer protection, "we shouldn't ignore the behavioural effect it might have."

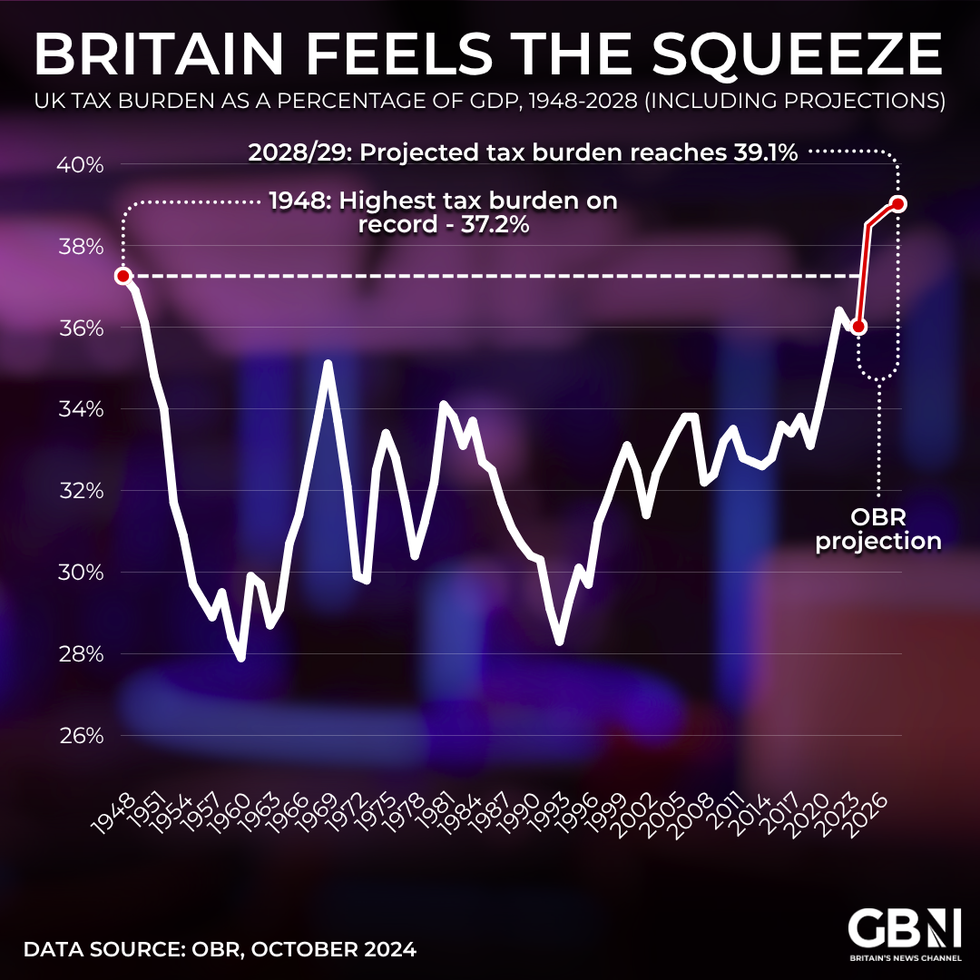

Tax Burden as a percentage of GDP | GETTY

Tax Burden as a percentage of GDP | GETTYHowever, the Budget did offer a concession to stock market investors by abolishing stamp duty on newly listed shares for their first three years of trading.

Despite this development, scepticism remains about whether this will stimulate UK flotation activity.

Mr Khalaf said: "The people who decide where to float their company are the owners of the business and their advisers, and one suspects the fact a bunch of strangers won't have to pay 0.5 per cent stamp duty to buy shares plays second fiddle to the millions of extra pounds that could fill their pockets simply by listing in the US."

Meanwhile, restrictions on Venture Capital Trust tax relief could trigger a short-term rush of investment before April, as savers scramble to secure the current 30% upfront relief before it is reduced.

More From GB News